당사 팬 페이지에 가입하십시오

- 조회수:

- 9376

- 평가:

- 게시됨:

-

이 코드를 기반으로 한 로봇이나 지표가 필요하신가요? 프리랜스로 주문하세요 프리랜스로 이동

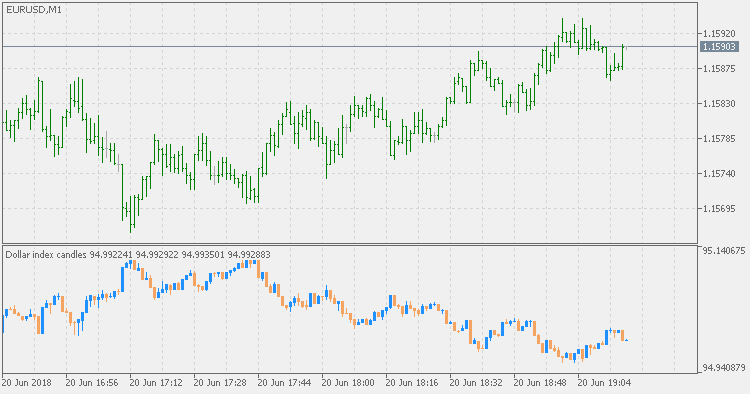

The U.S. Dollar Index (USDX, DXY, DX) is an index (or measure) of the value of the United States dollar relative to a basket of foreign currencies, often referred to as a basket of U.S. trade partners' currencies. The Index goes up when the U.S. dollar gains "strength" (value) when compared to other currencies.

The index is maintained and published by ICE (Intercontinental Exchange, Inc.), with the name "U.S. Dollar Index" a registered trademark.

It is a weighted geometric mean of the dollar's value relative to following select currencies:

- Euro (EUR), 57.6% weight.

- Japanese yen (JPY) 13.6% weight.

- Pound sterling (GBP), 11.9% weight.

- Canadian dollar (CAD), 9.1% weight.

- Swedish krona (SEK), 4.2% weight.

- Swiss franc (CHF) 3.6% weight.

Compared to the Dollar Index indicator, this version is a bit different: instead of showing just one value, it is displaying the "open", "close", "high" and "low" of dollar index as candles in a separate window. That way you can see the volatility of the dollar index intra bar change too and it displays values closer to our normal assumption how the index is formed.

Dollar Index

Dollar Index

The U.S. Dollar Index (USDX, DXY, DX) is an index (or measure) of the value of the United States dollar relative to a basket of foreign currencies, often referred to as a basket of U.S. trade partners' currencies. The Index goes up when the U.S. dollar gains "strength" (value) when compared to other currencies.

Repulse Multi Timeframe

Repulse Multi Timeframe

The Repulse Multi Timeframe indicator measures and displays the bullish or bearish pressure associated with each price candlestick in the form of a curve.

Volatility Pivot

Volatility Pivot

Volatility Pivot indicator calculates "pivots" (support/resistance lines) based on current symbol/timeframe Average True Range calculated volatility.

Step Chart

Step Chart

Step Chart indicator monitors the price change (in pips) and according to that, determines if a new "step" has been made or not.