당사 팬 페이지에 가입하십시오

- 조회수:

- 11355

- 평가:

- 게시됨:

-

이 코드를 기반으로 한 로봇이나 지표가 필요하신가요? 프리랜스로 주문하세요 프리랜스로 이동

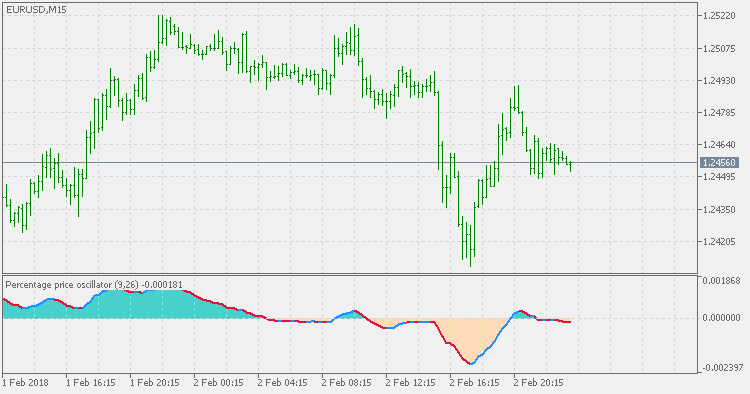

The Percentage Price Oscillator (PPO) is a technical Momentum indicator showing the relationship between two Moving Averages. To calculate the PPO, subtract the 26-day Exponential Moving Average (EMA) from the nine-day EMA, and then divide this difference by the 26-day EMA. The end result is a percentage that tells the trader where the short-term average is relative to the longer-term average.

Calculated as:

![]()

The PPO and the moving average convergence divergence (MACD) are both momentum indicators that measure the difference between the 26-day and the nine-day Exponential Moving Averages. The main difference between these indicators is that the MACD reports the simple difference between the Exponential Moving Averages, whereas the PPO expresses this difference as a percentage. This allows a trader to use the PPO indicator to compare stocks with different prices more easily. For example, regardless of the stock's price, a PPO result of 10 means the short-term average is 10% above the long-term average.

Woodies CCI

Woodies CCI

Woodies CCI is a momentum indicator that was developed by Ken Woods. It's based on a 14 period Commodity Channel Index (CCI).

ATR Probability Levels

ATR Probability Levels

Probability levels based on ATR. "Probability" is calculated based on the projected Average True Range and previous period Close.

Percentage Price Oscillator Extended

Percentage Price Oscillator Extended

The Percentage Price Oscillator Extended (PPO) is a technical Momentum indicator showing the relationship between two Moving Averages. To calculate the PPO, subtract the 26-day Exponential Moving Average (EMA) from the nine-day EMA, and then divide this difference by the 26-day EMA. The end result is a percentage that tells the trader where the short-term average is relative to the longer-term average.

Smoothed Rate of Change

Smoothed Rate of Change

Smoothed Rate of Change (Smoothed-RoC) is a refinement of Rate of Change (RoC) indicator that was developed by Fred G Schutzman. It differs from the RoC in that it based on Exponential Moving Averages (EMAs) rather than on price closes. Like the RoC, Smoothed RoC is a leading Momentum indicator that can be used to determine the strength of a trend by determining if the trend is accelerating or decelerating. The Smoothed RoC does this by comparing the current EMA to value that the EMA was a specified periods ago. The use of EMAs rather than the price close eliminates the erratic tendencies of the RoC.