당사 팬 페이지에 가입하십시오

- 조회수:

- 64307

- 평가:

- 게시됨:

- 2017.03.15 11:20

-

이 코드를 기반으로 한 로봇이나 지표가 필요하신가요? 프리랜스로 주문하세요 프리랜스로 이동

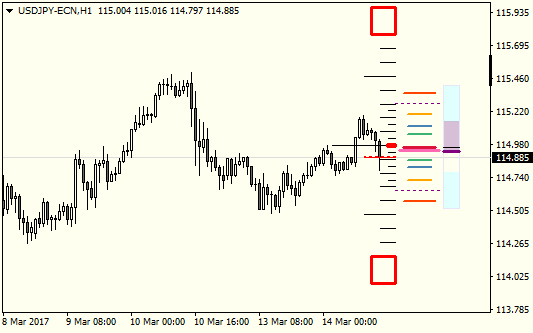

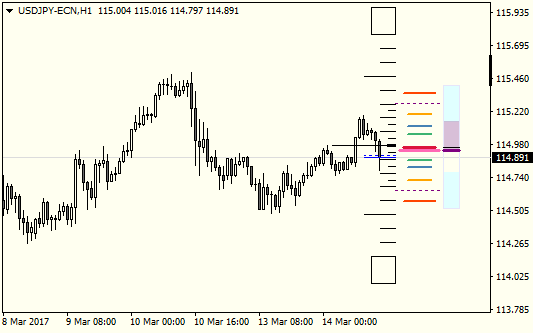

Experimental indicator I wrote for myself. It's made to show some reference (it's more like a rifle scope, than a rifle). Main components are pip scale, ATR/pivot, MA level, RSI, and spread alert. Can be used on any timeframe, but since it's made for scalping it is somewhat adjusted for M1-M15.

Pips Scale

Settings: Scale Zero Level Shift.

This is simple scale. Middle (zero level) is placed at the middle of the body of chosen candle. This can be adjusted so that you can differentiate reversal from pullbacks.

Rule of thumb is: Trend is up when price is above Zero Level, trend is down when price is below.

ATR/Pivots

Settings: Mode(Standard,Fibonacci), Period (No of M5 Bars), Lines - Style, Color, Width.

There's some math behind this one. Weighted average of chosen number of M5 bars (for open/close/high/low price)

for(int i=1;i<N_Bars;i++) { mod=(double)(N_Bars-i); mod*=(double)(iVolume(NULL,inpTimeFrame,PivotBar+i)); xOpen+=mod*iOpen(NULL,inpTimeFrame,PivotBar+i); xClose+=mod*iClose(NULL,inpTimeFrame,PivotBar+i); xHigh+=mod*iHigh(NULL,inpTimeFrame,PivotBar+i); xLow+=mod*iLow(NULL,inpTimeFrame,PivotBar+i); div+=mod; }

Range is adjusted with ATR from this range,

double xATR=iHigh(NULL,ATRTimeFrame,iHighest(NULL,ATRTimeFrame,MODE_HIGH,5*N_Bars,0)) -iLow(NULL,ATRTimeFrame,iLowest(NULL,ATRTimeFrame,MODE_LOW,5*N_Bars,0)); double xRange=(xHigh-xLow)+xATR;

and all these are used to calculate pivot levels.

Because of that these levels will be dynamic, depending on ATR value, so chosen Period makes big difference here. The lower number the more dynamic levels (they will expand and contract). For intraday trading/scalping Period 12 - 288 is reasonable (1-24 hours).

Rule of thumb just like other pivot tools.

MA Level

Settings: Period, Method, Applied price, Timeframe, Line Color/Style/Width.

This is additional line that shows latest price of Moving Average from a chosen time-frame. If the level is "outside" the chart the line is drawn at the top/bottom of the chart (longer and thicker). I use EMA(16) of typical price on H1, that shows the trend pretty well.

Rule of thumb: trend is up then price is above the MA level, trend is down when price is below.

RSI indicator

Settings: Period

This one may seem confusing at first. (it's more like looking at RSI from the side, like a plan view). Line shows current RSI, color fill shows plan view of last n bars (min/max value) (n is the same as RSI period).

Rule of thumb: RSI > 50 trend is up, RSI < 50 trend is down. Also when trending sideways the color fill is tight around 50.

Spread Alert

Settings: Ratio, Color.

Set the ratio of spread and ATR to trigger alert. When it's triggered it changes color of Bid/Ask line, and some scale lines to draw your attention. Enable debug mode to show some internal numbers, also spread, ATR and %ratio to help you adjust this level.

Messages Helpers

Messages Helpers

Various helper functions for sending messages of different types to different sources.

Zig Zag & Fibonacci

Zig Zag & Fibonacci

One of the best indicators about with a slight tweak to make it less noisy. Shows ZigZag lines to help spot cycles and draws Fibonacci lines to indicate support and resistance levels.

Detrended Synthetic Price (histo)

Detrended Synthetic Price (histo)

Detrended Synthetic Price (histogram form)

Detrended Synthetic Price (bars)

Detrended Synthetic Price (bars)

Detrended Synthetic Price (bars form).