당사 팬 페이지에 가입하십시오

- 조회수:

- 3899

- 평가:

- 게시됨:

- 업데이트됨:

-

이 코드를 기반으로 한 로봇이나 지표가 필요하신가요? 프리랜스로 주문하세요 프리랜스로 이동

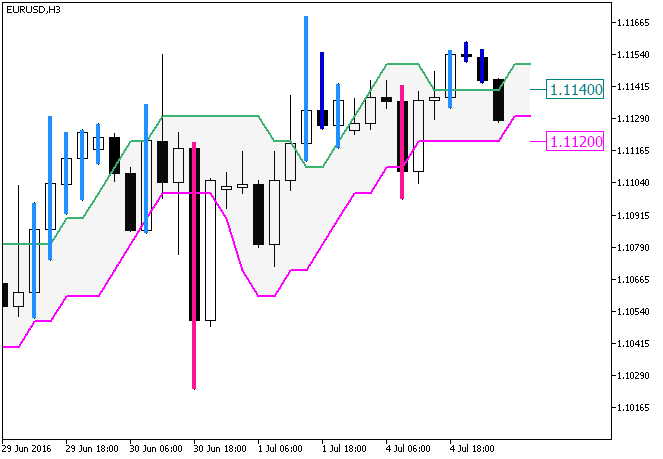

The indicator implements a breakout system using a channel based on the High and Low price series processed by the algorithm of JFatl_Digit.

When price exits the gray channel, the bar color changes to the color corresponding to trend direction. Blue for the growth of a financial asset, red color - fall. Bright colors denote coincidence of trend direction and direction of a candlestick. Dark colors correspond to the situation when the direction of a candlestick is opposite to trend.

The price labels indicate the most recent values of the channel, used as the breakout levels.

The indicator uses SmoothAlgorithms.mqh library classes (copy it to <terminal_data_folder>\MQL5\Include). The use of the classes was thoroughly described in the article "Averaging Price Series for Intermediate Calculations Without Using Additional Buffers".

Fig.1. The JFatl_Digit_System indicator

MetaQuotes Ltd에서 러시아어로 번역함.

원본 코드: https://www.mql5.com/ru/code/15878

Volume_Weighted_MACandle

Volume_Weighted_MACandle

The Volume_Weighted_MA indicator implemented as a sequence of candlesticks.

Fisher_org_v1_Sign

Fisher_org_v1_Sign

Semaphore arrow signal indicator based on the Fisher_org_v1 oscillator leaving the overbought and oversold areas.

Volume_Weighted_MA_Digit_System

Volume_Weighted_MA_Digit_System

The indicator implements a breakout system using a channel based on the High and Low price series processed by the algorithm of Volume_Weighted_MA_Digit.

Fisher_org_v1_Sign_Alert

Fisher_org_v1_Sign_Alert

Semaphore arrow signal indicator based on the Fisher_org_v1 oscillator leaving the overbought and oversold areas, which features alerts, sending emails and push-notifications to mobile devices.