당사 팬 페이지에 가입하십시오

- 조회수:

- 103786

- 평가:

- 게시됨:

- 2015.12.24 09:25

- 업데이트됨:

- 2016.11.22 07:32

-

이 코드를 기반으로 한 로봇이나 지표가 필요하신가요? 프리랜스로 주문하세요 프리랜스로 이동

Updates:

- 2016-02-04; v1.47: Performance upgrade.

- 2016-01-15; v1.46: Performance upgrade.

- 2015-12-31; v1.45: Performance upgrade.

- 2015-12-31; v1.44: Performance upgrade.

- 2015-12-31; v1.43: Performance upgrade.

- 2015-12-26; v1.42: Performance upgrade.

- 2015-12-26; v1.41: Minor changes for performance upgrade.

- 2015-12-24; v1.40: Initial public version.

VWAP is an intra-day calculation used primarily by algorithms and institutional traders to assess where a stock is trading relative to its volume weighted average for the day. Day traders also use VWAP for assessing market direction and filtering trade signals. Before using VWAP, understand how it is calculated, how to interpret it and use it, as well the drawbacks of the indicator (http://traderhq.com/trading-strategies/understanding-volume-weight-average-price/).

This is a VWAP indicator based on the Investopedia description (http://www.investopedia.com/articles/trading/11/trading-with-vwap-mvwap.asp).

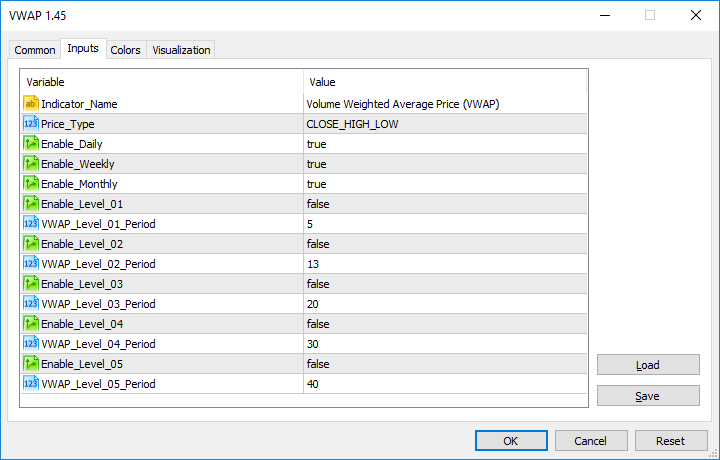

I've added six lines to this indicator. The principal is the VWAP Daily which is the calculation based on the intra-day values. All the other five lines you can set the period of the calculation, so it can be less or greater than the intra-day period.

All six lines are independent. As default only the intra-day comes enabled, but you can enable the others in the properties panel.

Thanks for downloading this code. I will be waiting for your comments, vote and rating.

RJT Matches

RJT Matches

This indicator helps determine the end and the beginning of trends based on the inclination of the matches.

PA_Oscillator

PA_Oscillator

A simple oscillator that shows the speed of the MACD indicator change implemented as a two-colored histogram.

ManualTradeOnStrategyTester

ManualTradeOnStrategyTester

A simple way on how EA can link a manual order command from outside to use it in MetaTrader 5 Strategy Tester.

VWAP Lite - Volume Weighted Average Price

VWAP Lite - Volume Weighted Average Price

VWAP is an intra-day calculation used primarily by algorithms and institutional traders to assess where a stock is trading relative to its volume weighted average for the day.