당사 팬 페이지에 가입하십시오

- 조회수:

- 8618

- 평가:

- 게시됨:

- 업데이트됨:

-

이 코드를 기반으로 한 로봇이나 지표가 필요하신가요? 프리랜스로 주문하세요 프리랜스로 이동

The real author:

Xrust & Vinin

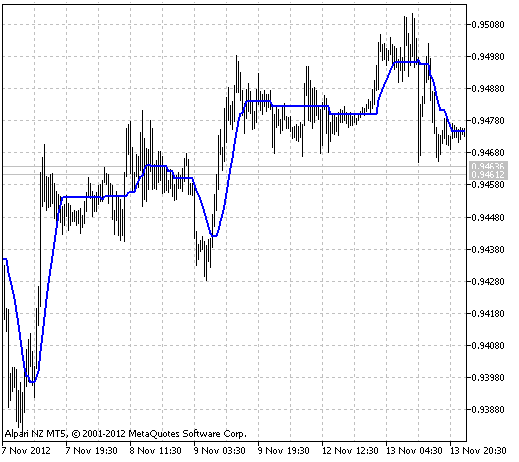

A digital adaptive Moving Average XXMA represents subtype of Moving Averages with a digital flat-trend filter and is made to separate the angular direction of price movement (trend) from the horizontal (flat) direction for effective trend trading.

As you can see on the figure, during the trend movement of the price XXMA line stays over or under the price chart constantly changing its meaning and drawing bounding line, and during the horizontal movement (flat) it stays in a fixed position. The signal to enter into the deal is closing bar above or below the indicator line on the slant, while the signal to close the position is crossing or closing of the indicator line into the opposite side on the horizontal position.

This indicator was first implemented in MQL4 and published in Code Base on 17.08.2009.

The indicator uses SmoothAlgorithms.mqh library classes (must be copied to the terminal_data_folder\MQL5\Include). The use of the classes was thoroughly described in the article "Averaging price series for intermediate calculations without using additional buffers".

Fig.1 The XXMA indicator

MetaQuotes Ltd에서 러시아어로 번역함.

원본 코드: https://www.mql5.com/ru/code/1271

HeikinAshi_SepWnd

HeikinAshi_SepWnd

The Heikin Ashi indicator drawn in a separate subwindow with the ability to choose a period

Gaus_MA

Gaus_MA

The indicator calculates the Moving Average using a modified algorithm of the linearly weighed Moving Average.

XATRStopLevel

XATRStopLevel

The indicator gives Stop Loss value for open position on the basis of the XATR indicator.

Trend Continuation Factor

Trend Continuation Factor

The indicator to determine the trend and its directions.