Adam Van Wyk / プロファイル

- 情報

|

8+ 年

経験

|

0

製品

|

0

デモバージョン

|

|

0

ジョブ

|

0

シグナル

|

0

購読者

|

Private

において

Private

私は物事について不思議に思って、狂気の中でその方法を見ようとしているだけで、ロードランナーを捕まえようとする人です

Adam Van Wyk

In result of the previous trading session, traders with bullish outlook pushed the pair simultaneously from larger descending and minor ascending channels. The surge was based on increasing tensions between the US and North Korea.

Link: https://www.fxstreet.com/analysis/xauusd-analysis-awaits-fed-decision-201710110838

Link: https://www.fxstreet.com/analysis/xauusd-analysis-awaits-fed-decision-201710110838

Adam Van Wyk

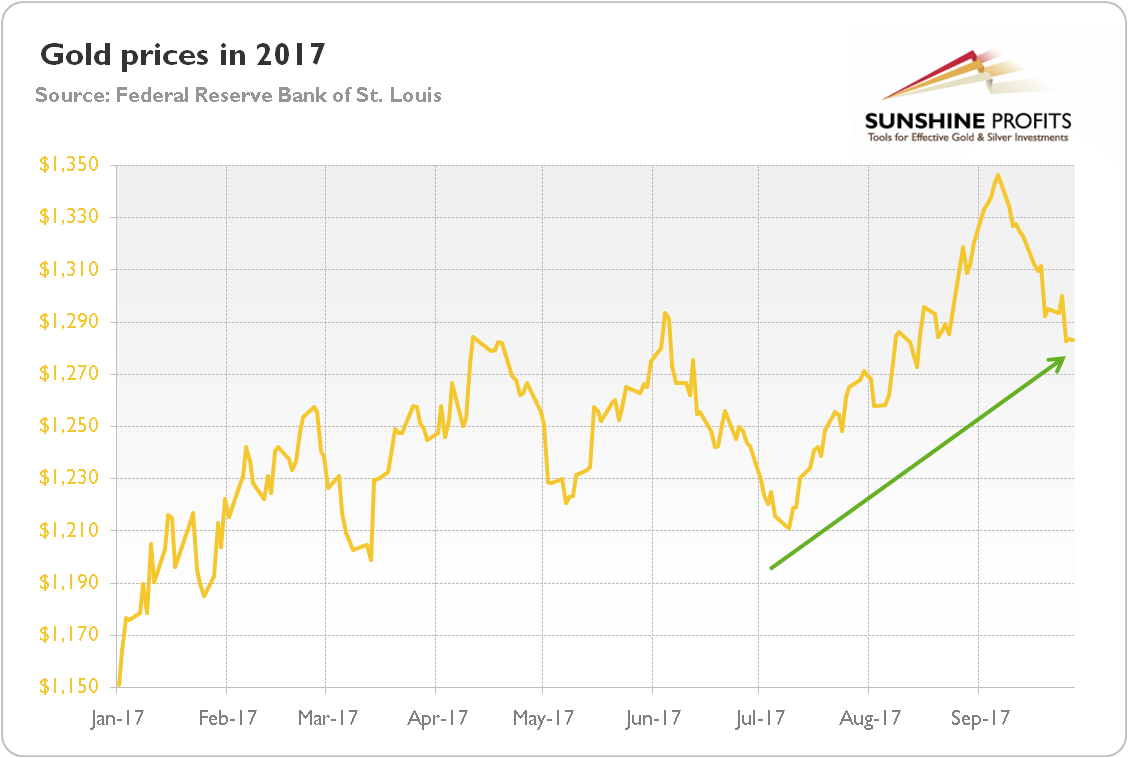

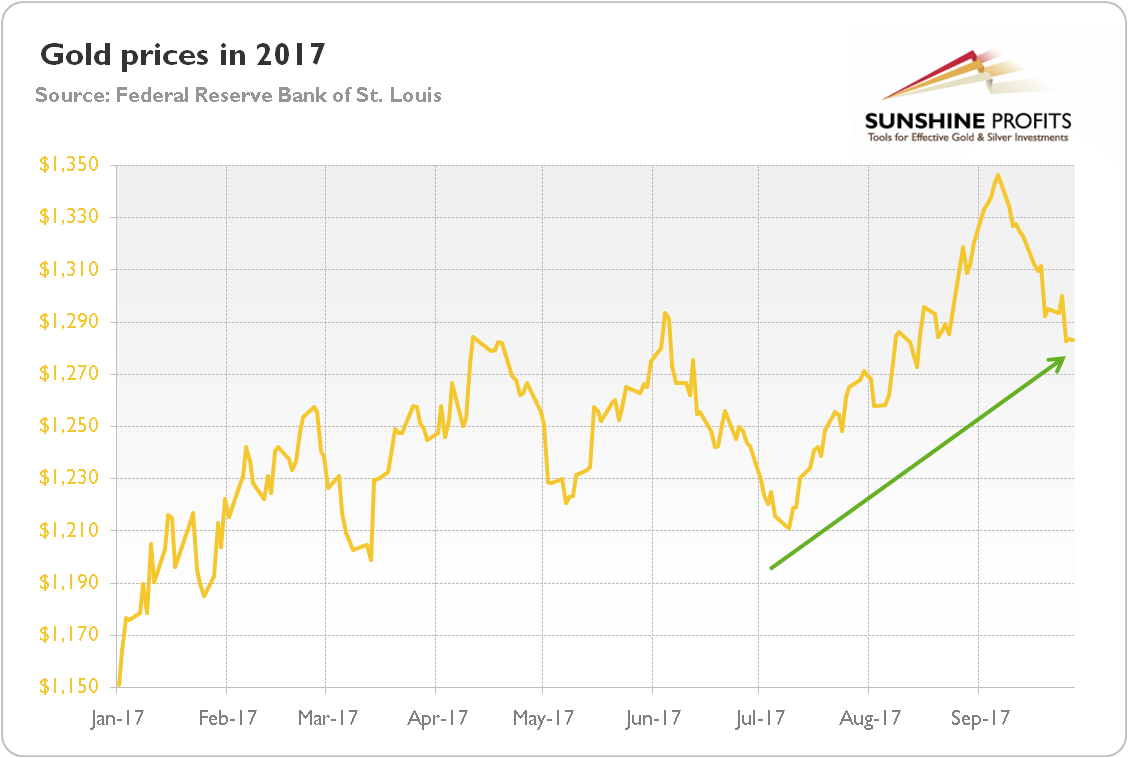

"What were the reasons behind that impressive upward move? The popular story says that worries about North Korea triggered a rally in gold prices. However, as we showed in the September edition of the Market Overview, “gold’s reactions to geopolitical developments, including these about the country ruled by the Kim dynasty, are usually merely short-lived and limited.” Indeed, for example, although North Korea uttered new threats and launched another missile in the penultimate week of September, gold prices retreated."

Interesting read: https://www.fxstreet.com/analysis/gold-in-q3-2017-201710061303

Interesting read: https://www.fxstreet.com/analysis/gold-in-q3-2017-201710061303

Adam Van Wyk

North Korea, Iran and Trump walk into a bar, and that's always good for some action...

"...[on Friday] news emerged that North Korea may be about to test a new missile capable of reaching the United States. The rally has continued this morning with gold moving to 1284.50 as China returns from holiday. Iranian sabre rattling, Trump remarks on North Korea and further details of the proposed missile test have injected a geopolitical risk premium back into the yellow metal."

Link: https://www.fxstreet.com/analysis/gold-follows-the-silver-bullet-higher-201710090349

"...[on Friday] news emerged that North Korea may be about to test a new missile capable of reaching the United States. The rally has continued this morning with gold moving to 1284.50 as China returns from holiday. Iranian sabre rattling, Trump remarks on North Korea and further details of the proposed missile test have injected a geopolitical risk premium back into the yellow metal."

Link: https://www.fxstreet.com/analysis/gold-follows-the-silver-bullet-higher-201710090349

Adam Van Wyk

"Hurricane disruption dragged US payrolls negative, but a big fall in unemployment and significant wage increases make a December rate hike look probable, according to James Knightley, Chief International Economist at ING."

Link: https://www.fxstreet.com/news/us-payrolls-distorted-but-strong-wages-boosts-case-for-dec-rate-hike-ing-201710061256

Link: https://www.fxstreet.com/news/us-payrolls-distorted-but-strong-wages-boosts-case-for-dec-rate-hike-ing-201710061256

Adam Van Wyk

NFP Day! Lets see where this goes!

"The precious metal halted its recent slump and has now recovered back above 100-day SMA as the dollar failed to strengthen despite strong data. The dollar should actually be trading much higher given the unexpected strength of the non-manufacturing ISM report. Service sector activity grew at its fastest pace in 13 years as Hurricane Harvey caused a sudden slowdown in supplier delivery times. Most importantly, the employment component of the report increased which indicates that instead of losing jobs, the services sector, which is the largest part of the labor market added jobs at a faster pace in the month of September. According to ADP, corporate payrolls rose by only 135K compared to 228K the previous month but while job growth slowed, investors had braced for an even softer report. So the fact that it was in line is good news for the dollar."

Link: https://www.fxstreet.com/markets/commodities/metals/gold

Link: https://www.fxstreet.com/news/gold-to-take-a-trip-to-1251-on-strong-dollar-201710060011

"The precious metal halted its recent slump and has now recovered back above 100-day SMA as the dollar failed to strengthen despite strong data. The dollar should actually be trading much higher given the unexpected strength of the non-manufacturing ISM report. Service sector activity grew at its fastest pace in 13 years as Hurricane Harvey caused a sudden slowdown in supplier delivery times. Most importantly, the employment component of the report increased which indicates that instead of losing jobs, the services sector, which is the largest part of the labor market added jobs at a faster pace in the month of September. According to ADP, corporate payrolls rose by only 135K compared to 228K the previous month but while job growth slowed, investors had braced for an even softer report. So the fact that it was in line is good news for the dollar."

Link: https://www.fxstreet.com/markets/commodities/metals/gold

Link: https://www.fxstreet.com/news/gold-to-take-a-trip-to-1251-on-strong-dollar-201710060011

Adam Van Wyk

JPMorgan has already coined a nickname for the next financial meltdown.

And while the firm isn't sure exactly when the so-called Great Liquidity Crisis will strike, it figures that tensions will start to ratchet up in 2018, once the Federal Reserve starts to unwind its massive balance sheet.

Link: http://www.businessinsider.com/stock-market-news-jpmorgan-explains-next-financial-crisis-2017-10

And while the firm isn't sure exactly when the so-called Great Liquidity Crisis will strike, it figures that tensions will start to ratchet up in 2018, once the Federal Reserve starts to unwind its massive balance sheet.

Link: http://www.businessinsider.com/stock-market-news-jpmorgan-explains-next-financial-crisis-2017-10

Adam Van Wyk

Another Gold Bull...would not think it reading the headline :-D

"Our view is that we definitely believe that markets are too optimistic regarding the ability of central banks to tighten their monetary policy. Debts are way too important and increasing the cost of the debt would create major markets turmoil. We then continue to consider that central banks will likely let inflation run in order to kill it. This will definitely result in a gold appreciation within the medium-term. We maintain our bullish view on gold and reload longs as we should hit new highs soon."

Link: https://www.fxstreet.com/analysis/gold-tumbles-as-geopolitical-risks-fade-201710041204

"Our view is that we definitely believe that markets are too optimistic regarding the ability of central banks to tighten their monetary policy. Debts are way too important and increasing the cost of the debt would create major markets turmoil. We then continue to consider that central banks will likely let inflation run in order to kill it. This will definitely result in a gold appreciation within the medium-term. We maintain our bullish view on gold and reload longs as we should hit new highs soon."

Link: https://www.fxstreet.com/analysis/gold-tumbles-as-geopolitical-risks-fade-201710041204

Adam Van Wyk

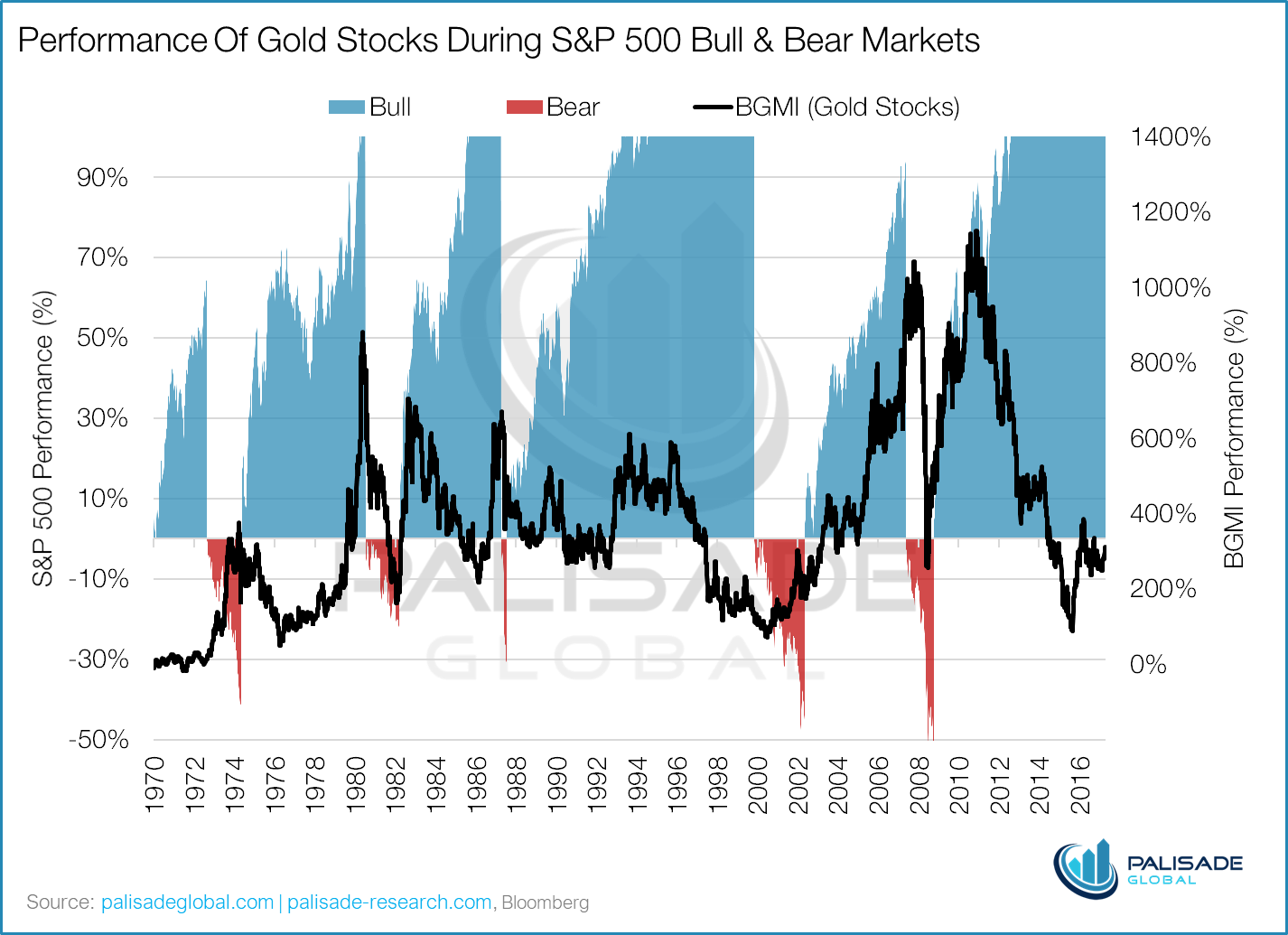

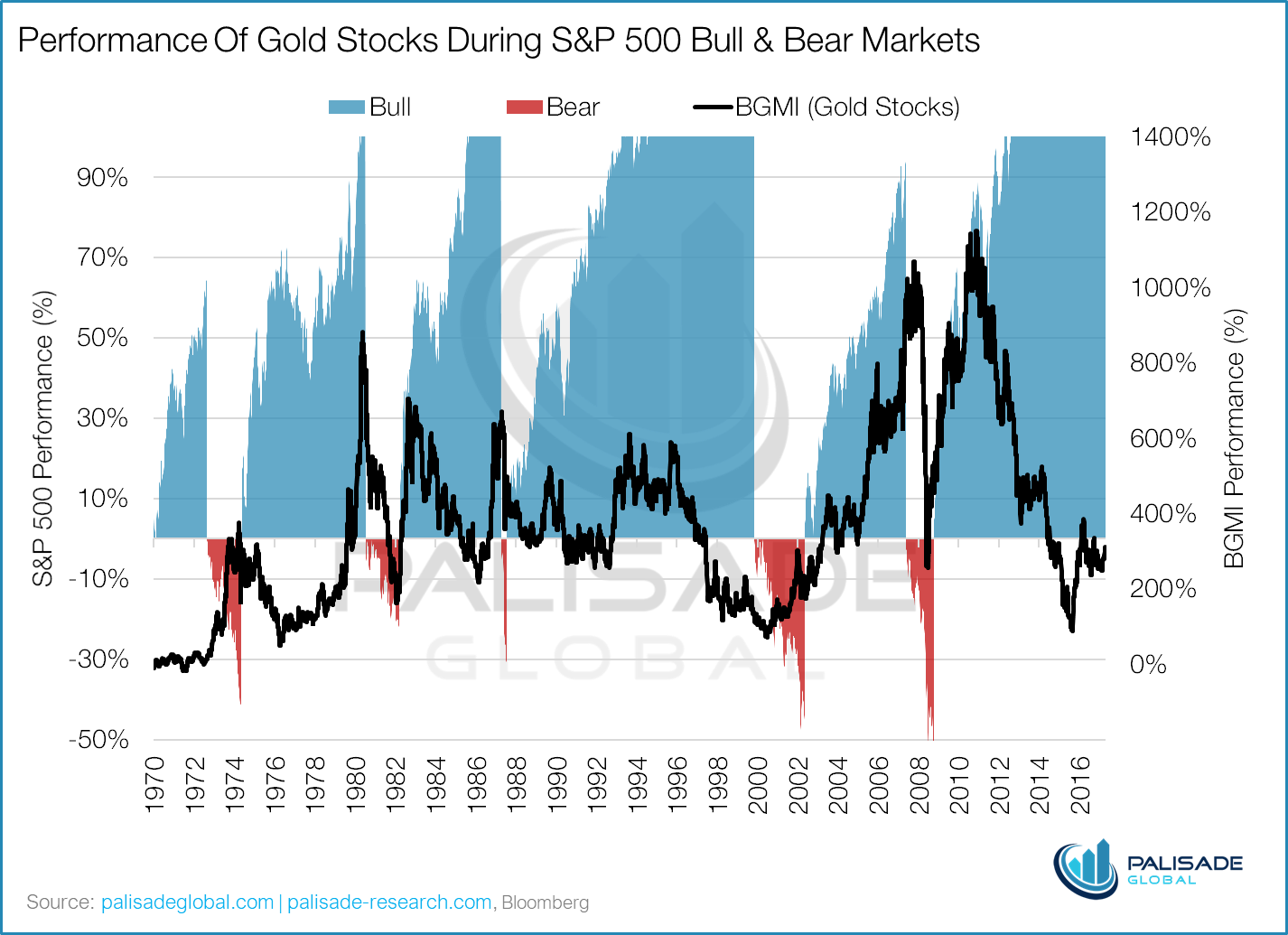

"...When the S&P inevitably corrects or crashes, what will happen to gold stocks? With 2008 in close memory, most gold investors foresee a stock market crash that will also drag down the gold stocks.

The above chart dispels such a theory. In fact, the number one determining factor as to whether a stock market crash will take the gold stocks up or down, is the performance of the gold stocks in the years leading up to the market crash.

It is actually the performance of gold stocks during a bull market that dictates the performance of gold stocks during a bear."

More here on gold stocks and their performance during bull/bear market: http://palisade-research.com/gold-stocks-to-explode-when-the-sp-implodes/

The above chart dispels such a theory. In fact, the number one determining factor as to whether a stock market crash will take the gold stocks up or down, is the performance of the gold stocks in the years leading up to the market crash.

It is actually the performance of gold stocks during a bull market that dictates the performance of gold stocks during a bear."

More here on gold stocks and their performance during bull/bear market: http://palisade-research.com/gold-stocks-to-explode-when-the-sp-implodes/

Adam Van Wyk

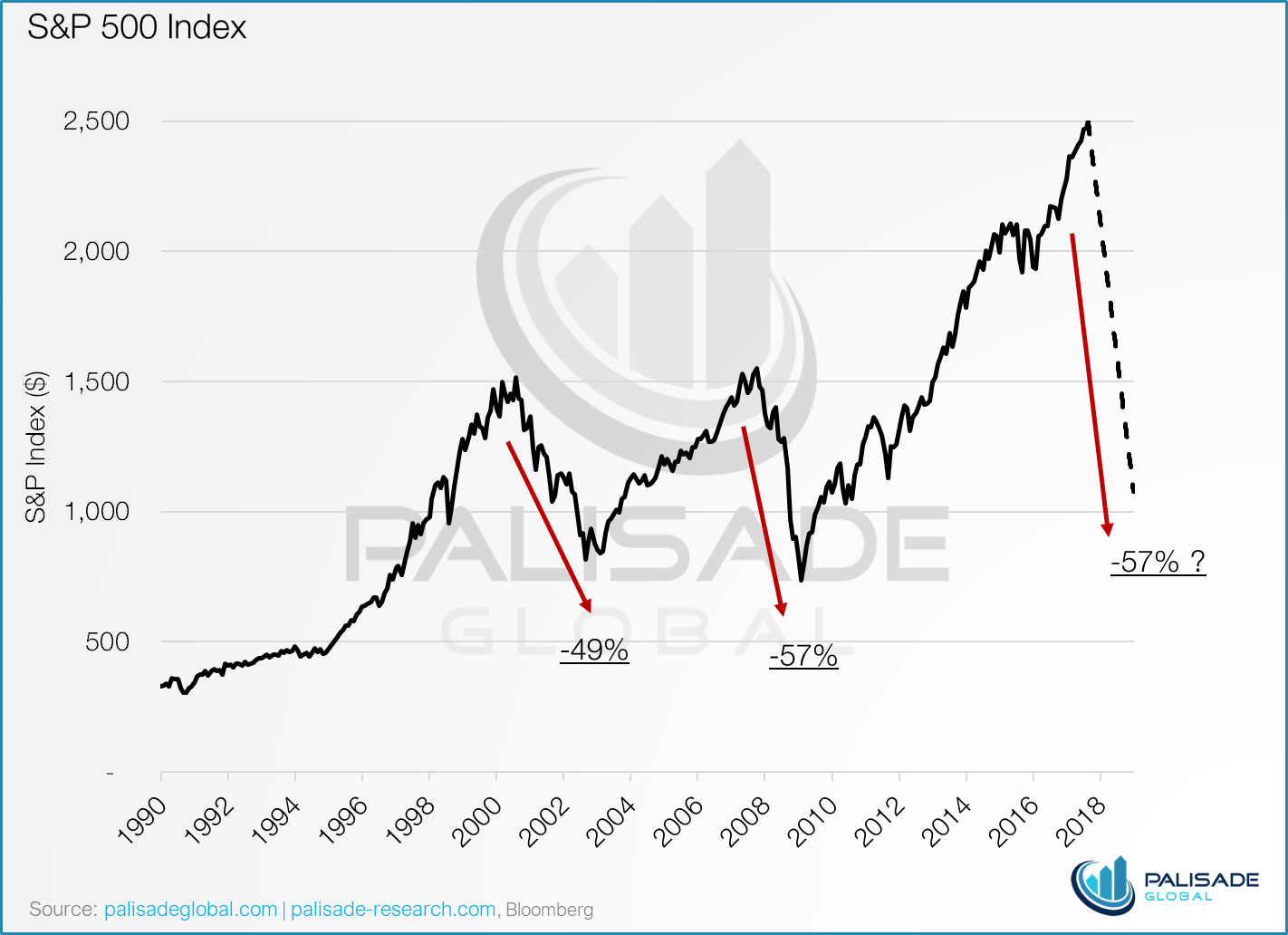

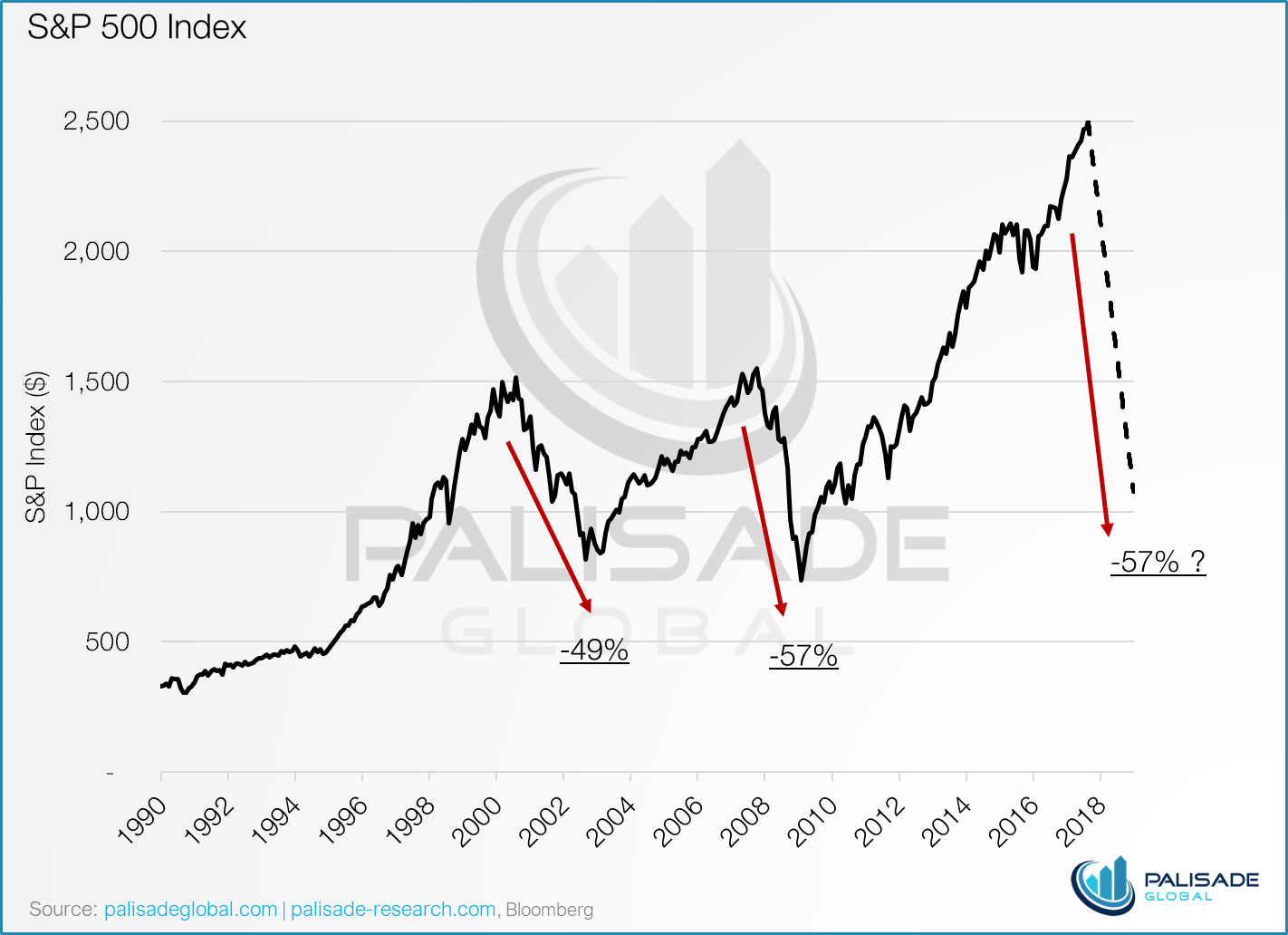

The S&P 500 Poised To Lose $10 Trillion In Value... I am not sure about the 57%, but the reasoning on gold makes sense

"...As we noted in our previous write-up, Gold Stocks To Explode When The S&P Implodes, in the current bull market, the S&P is up 247%, while gold stocks are down -30%. If the pattern holds, the succeeding bear market in the S&P will trigger a major gold rally, which we predict will continue into the next S&P bull."

Some food for thought by Palisade Research. Link: http://www.zerohedge.com/news/2017-10-03/sp-500-poised-lose-10-trillion-value

"...As we noted in our previous write-up, Gold Stocks To Explode When The S&P Implodes, in the current bull market, the S&P is up 247%, while gold stocks are down -30%. If the pattern holds, the succeeding bear market in the S&P will trigger a major gold rally, which we predict will continue into the next S&P bull."

Some food for thought by Palisade Research. Link: http://www.zerohedge.com/news/2017-10-03/sp-500-poised-lose-10-trillion-value

Adam Van Wyk

"...investors are continuing to ignore geopolitical risks, as their insatiable appetite for risk continues: US index futures have hit new record high levels, while European equities – except in Spain – have also risen. Dollar-denominated and safe haven gold has consequently fallen out of favour. But are risk-seeking investors being a bit… reckless?"

Link: https://www.fxstreet.com/analysis/rising-dollar-stocks-exert-pressure-on-goldfor-now-201710021239

Link: https://www.fxstreet.com/analysis/rising-dollar-stocks-exert-pressure-on-goldfor-now-201710021239

Adam Van Wyk

Cryptocurrencies are being billed as a new and improved form of money that has been offered to us courtesy of technological evolution. There is a big problem with this conclusion. That is, digital money is not money at all. And proving this truth serves to underscore why gold has been utilized as the best form of money for thousands of years.

Link: https://www.fxstreet.com/analysis/bitcoin-is-not-new-and-improved-money-201710021442

Interesting read.

Link: https://www.fxstreet.com/analysis/bitcoin-is-not-new-and-improved-money-201710021442

Interesting read.

: