Zhuo Kai Chen / プロファイル

- 情報

|

no

経験

|

0

製品

|

0

デモバージョン

|

|

1

ジョブ

|

0

シグナル

|

0

購読者

|

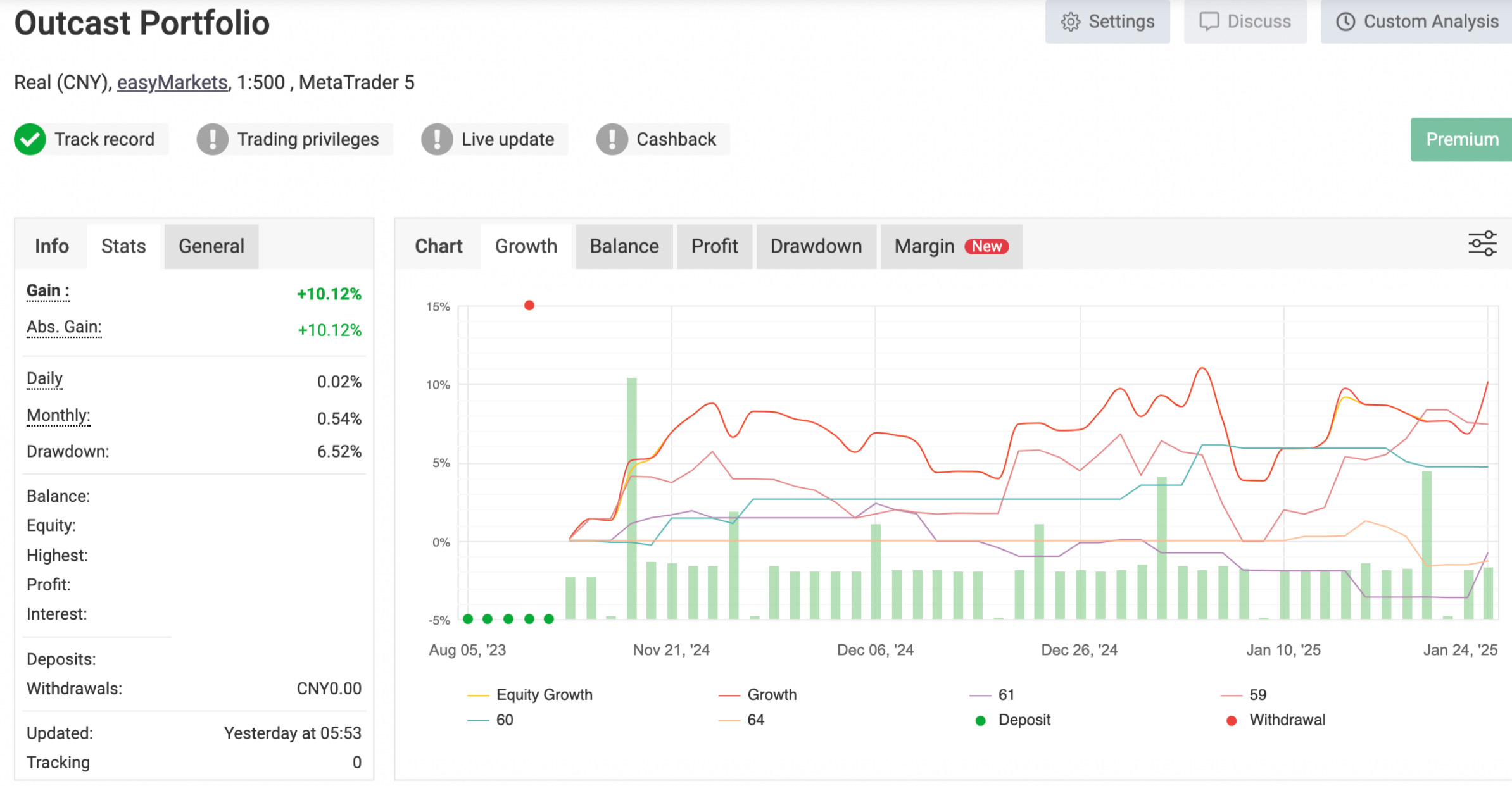

Quant Researcher with 3+ years of trading experience

Currently managing 5+ trading systems

Specializes in CTA strategy development

Github: https://github.com/CodyOutcast

Partnering with: https://www.mql5.com/en/users/metasignalspro

| 仕様品質 | 5.0 | |

| 結果チェックの品質 | 5.0 | |

| 可用性とコミュニケーションスキル | 5.0 |

Opening Range Breakout (ORB) strategies are built on the idea that the initial trading range established shortly after the market opens reflects significant price levels where buyers and sellers agree on value. By identifying breakouts above or below a certain range, traders can capitalize on the momentum that often follows as the market direction becomes clearer. In this article, we will explore three ORB strategies adapted from the Concretum Group.

Larry Connors is a renowned trader and author, best known for his work in quantitative trading and strategies like the 2-period RSI (RSI2), which helps identify short-term overbought and oversold market conditions. In this article, we’ll first explain the motivation behind our research, then recreate three of Connors’ most famous strategies in MQL5 and apply them to intraday trading of the S&P 500 index CFD.

The Darvas Box Breakout Strategy, created by Nicolas Darvas, is a technical trading approach that spots potential buy signals when a stock’s price rises above a set "box" range, suggesting strong upward momentum. In this article, we will apply this strategy concept as an example to explore three advanced machine learning techniques. These include using a machine learning model to generate signals rather than to filter trades, employing continuous signals rather than discrete ones, and using models trained on different timeframes to confirm trades.

The Kalman filter is a recursive algorithm used in algorithmic trading to estimate the true state of a financial time series by filtering out noise from price movements. It dynamically updates predictions based on new market data, making it valuable for adaptive strategies like mean reversion. This article first introduces the Kalman filter, covering its calculation and implementation. Next, we apply the filter to a classic mean-reversion forex strategy as an example. Finally, we conduct various statistical analyses by comparing the filter with a moving average across different forex pairs.

In strategy development, there are many intricate details to consider, many of which are not highlighted for beginner traders. As a result, many traders, myself included, have had to learn these lessons the hard way. This article is based on my observations of common pitfalls that most beginner traders encounter when developing strategies on MQL5. It will offer a range of tips, tricks, and examples to help identify the disqualification of an EA and test the robustness of our own EAs in an easy-to-implement way. The goal is to educate readers, helping them avoid future scams when purchasing EAs as well as preventing mistakes in their own strategy development.

Long Short-Term Memory (LSTM) is a type of recurrent neural network (RNN) designed to model sequential data by effectively capturing long-term dependencies and addressing the vanishing gradient problem. In this article, we will explore how to utilize LSTM to predict future trends, enhancing the performance of trend-following strategies. The article will cover the introduction of key concepts and the motivation behind development, fetching data from MetaTrader 5, using that data to train the model in Python, integrating the machine learning model into MQL5, and reflecting on the results and future aspirations based on statistical backtesting.

An inverse fair value gap(IFVG) occurs when price returns to a previously identified fair value gap and, instead of showing the expected supportive or resistive reaction, fails to respect it. This failure can signal a potential shift in market direction and offer a contrarian trading edge. In this article, I'm going to introduce my self-developed approach to quantifying and utilizing inverse fair value gap as a strategy for MetaTrader 5 expert advisors.

Volatility tends to peak around high-impact news events, creating significant breakout opportunities. In this article, we will outline the implementation process of a calendar-based breakout strategy. We'll cover everything from creating a class to interpret and store calendar data, developing realistic backtests using this data, and finally, implementing execution code for live trading.

The liquidity grab trading strategy is a key component of Smart Money Concepts (SMC), which seeks to identify and exploit the actions of institutional players in the market. It involves targeting areas of high liquidity, such as support or resistance zones, where large orders can trigger price movements before the market resumes its trend. This article explains the concept of liquidity grab in detail and outlines the development process of the liquidity grab trading strategy Expert Advisor in MQL5.

Hidden Markov Models (HMMs) are powerful statistical tools that identify underlying market states by analyzing observable price movements. In trading, HMMs enhance volatility prediction and inform trend-following strategies by modeling and anticipating shifts in market regimes. In this article, we will present the complete procedure for developing a trend-following strategy that utilizes HMMs to predict volatility as a filter.

数十年にわたり、トレーダーは破産リスクを最小限に抑えつつ長期的な資産成長を最大化する手法として、ケリー基準の公式を活用してきました。しかし、単一のバックテスト結果に基づいてケリー基準を盲目的に適用することは、個人トレーダーにとって非常に危険です。というのも、実際の取引では時間の経過とともに取引優位性が薄れ、過去の実績は将来の結果を保証するものではないからです。本記事では、Pythonによるモンテカルロシミュレーションの結果を取り入れ、MetaTrader 5上で1つ以上のエキスパートアドバイザー(EA)にケリー基準を現実的に適用するためのリスク配分アプローチを紹介します。

Recently, a fund manager from Man Group gave a lecture about CTAs (Commodity Trading Advisors) at my university. He mentioned that they rarely use machine learning in their CTA bots, which baffled me. Literally, one of the most successful firms in the world prefers simple rules and intuitive algorithms over sophisticated methods. I asked him why, and he explained:

1. They tried using machine learning to mine alphas but failed miserably.

2. They attempted to use it as a filter, similar to what we discussed in this article, but it barely worked, achieving only 80% correlation. This means it provided almost no additional edge compared to the original strategy.

3. They found success in using machine learning to select the best strategy for a given market.

Regarding the third point, I wondered why they didn’t simply test each strategy for every market and compare the results. However, I assume they find it more efficient to cluster markets for certain strategies, especially since they trade over 6,000 assets. They believe the aforementioned theory explains their obstacles, as they primarily use trend-following strategies for their CTA bots.

CatBoostは、定常的な特徴量に基づいて意思決定をおこなうことに特化した、強力なツリーベースの機械学習モデルです。XGBoostやRandom Forestといった他のツリーベースモデルも、堅牢性、複雑なパターンへの対応力、そして高い解釈性といった点で共通した特長を備えています。これらのモデルは、特徴量分析からリスク管理に至るまで、幅広い分野で活用されています。本記事では、学習済みのCatBoostモデルを、従来型の移動平均クロスを用いたトレンドフォロー戦略のフィルターとして活用する手順を解説します。戦略構築の過程で直面しうる課題を取り上げながら、具体的な開発プロセスへの理解を深めることを目的としています。MetaTrader 5からのデータ取得、Pythonによる機械学習モデルの学習、そしてそれをMetaTrader 5のエキスパートアドバイザー(EA)へ統合するまでのワークフローをご紹介します。記事の終盤では、統計的検証を通じて戦略の有効性を確認し、現在のアプローチをもとにした今後の展望についても考察していきます。