Dinesh Biswas / プロファイル

- 情報

|

8+ 年

経験

|

0

製品

|

0

デモバージョン

|

|

0

ジョブ

|

2

シグナル

|

0

購読者

|

Trader

において

fx

Dinesh Biswas

パブリッシュされたMetaTrader 5シグナル

My strategy is suitable for smart people. Read economic & fundamental news, FOMC member speach, Chart analysis etc. Trade is always risky So Wait and see Then Copy...... WhatsApp: +8801632299796

Dinesh Biswas

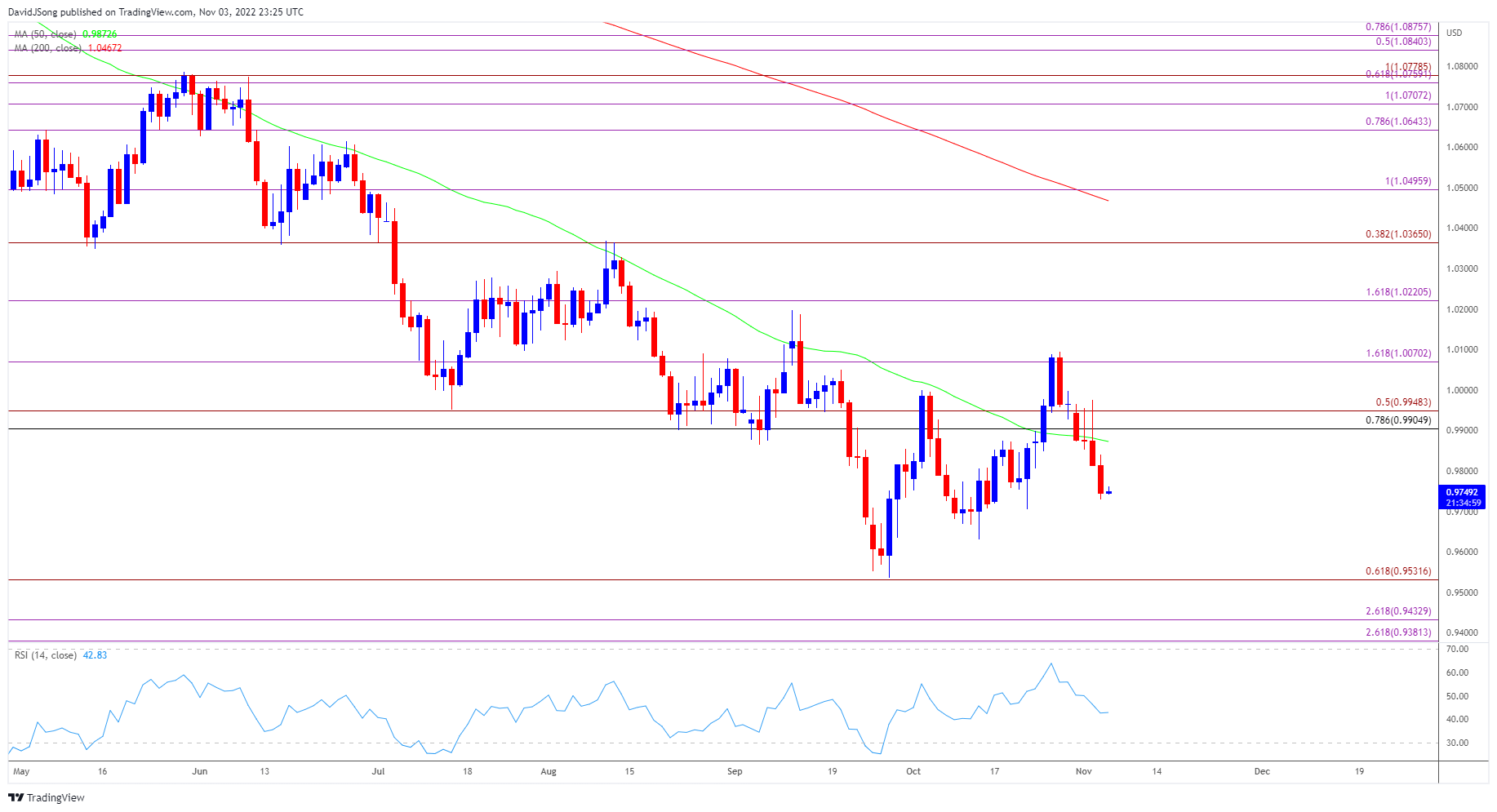

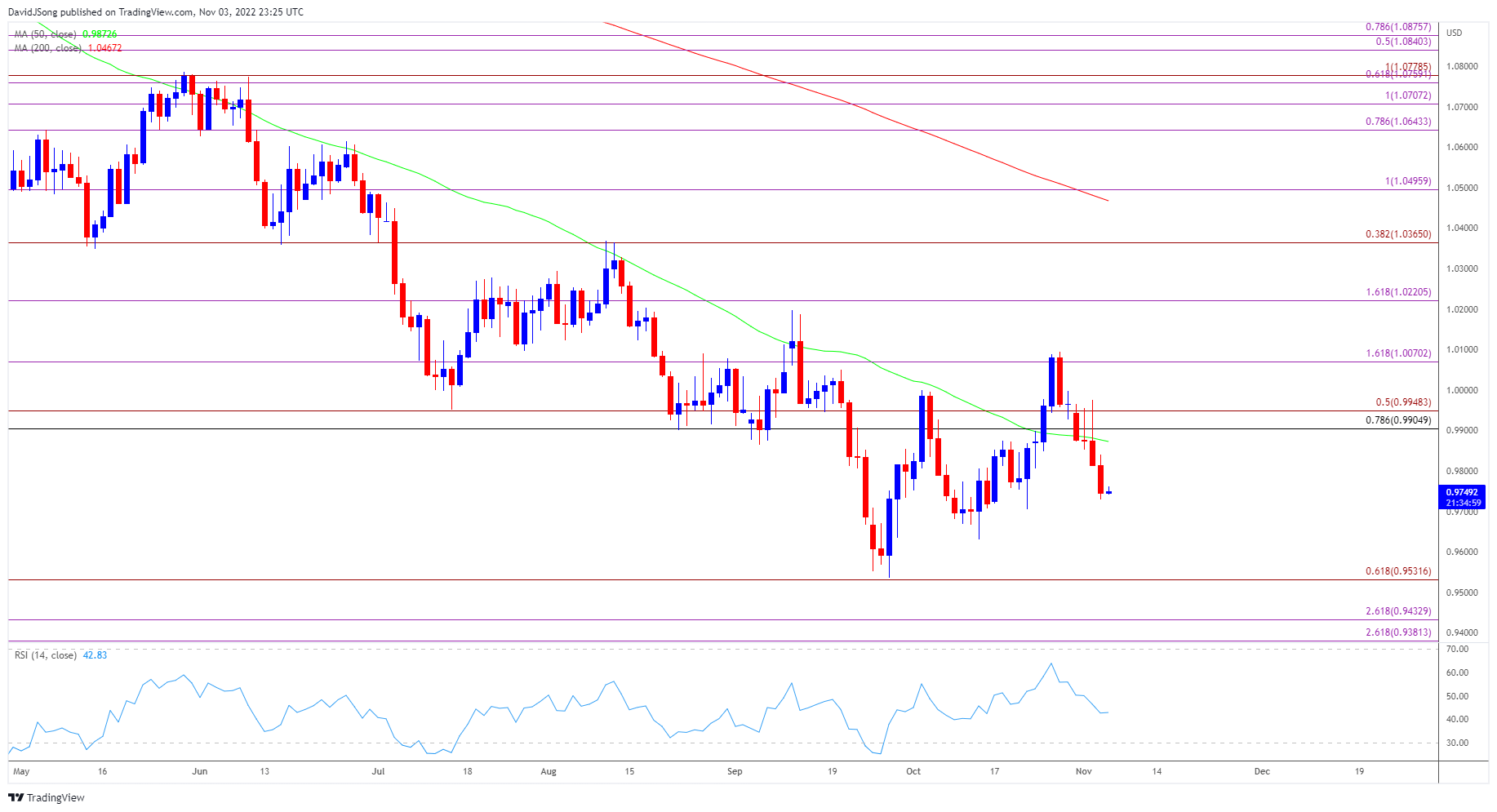

TODAY: EUR/USD RATE SUSCEPTIBLE TO STRONG US NFP REPORT

EUR/USD trades back below the 50-Day SMA (0.9873) after failing to test the September high (1.0198), and the exchange rate may struggle to retain the advance from the yearly low (0.9536) as it appears to be tracking the negative slope in the moving average.

At the same time, the NFP report may drag on EUR/USD as the US economy is anticipated to add 200K jobs in October, and signs of a resilient labor market may provide the Federal Open Market Committee (FOMC) with greater scope to pursue a highly restrictive policy as Chairman Jerome Powell emphasizes that “it is very premature” to pause the hiking-cycle.

As a result, the FOMC may maintain its existing approach to achieve price stability as Chairman Powell acknowledges that “we haven't seen inflation coming down,” and it remains to be seen if Fed officials will project a steeper path for US interest rates as the central bank is slated to release the updated Summary of Economic Projections (SEP) at the next rate decision on December 14.

Until then, EUR/USD may face headwinds as the European Central Bank (ECB) shows little interest in pursuing a restrictive policy, while the tilt in retail sentiment looks poised to persist as traders have been net-long the pair for most of the year.

EUR/USD trades back below the 50-Day SMA (0.9873) after failing to test the September high (1.0198), and the exchange rate may struggle to retain the advance from the yearly low (0.9536) as it appears to be tracking the negative slope in the moving average.

At the same time, the NFP report may drag on EUR/USD as the US economy is anticipated to add 200K jobs in October, and signs of a resilient labor market may provide the Federal Open Market Committee (FOMC) with greater scope to pursue a highly restrictive policy as Chairman Jerome Powell emphasizes that “it is very premature” to pause the hiking-cycle.

As a result, the FOMC may maintain its existing approach to achieve price stability as Chairman Powell acknowledges that “we haven't seen inflation coming down,” and it remains to be seen if Fed officials will project a steeper path for US interest rates as the central bank is slated to release the updated Summary of Economic Projections (SEP) at the next rate decision on December 14.

Until then, EUR/USD may face headwinds as the European Central Bank (ECB) shows little interest in pursuing a restrictive policy, while the tilt in retail sentiment looks poised to persist as traders have been net-long the pair for most of the year.

Dinesh Biswas

Hi to all trader, very good evening on Friday, hopefully everyone is good and making nice profit these week. Since today is the last day of trading, lets hope all is good and getting good profit pay...

ソーシャルネットワーク上でシェアする · 4

118

Dinesh Biswas

Different men uses different indicator, Some of them are gain or fail. I can tell, you never fall at fail. If you follow me. I have used three indicators combination, And its results is best. So you can apply it. They are 1. Moving Average (100,simple, close. 2.Parabolin SR(Step: 0.02, maximum: 0...

ソーシャルネットワーク上でシェアする · 9

320

2

: