Soraya Bahlekeh / プロファイル

- 情報

|

1 年

経験

|

3

製品

|

1286

デモバージョン

|

|

0

ジョブ

|

0

シグナル

|

0

購読者

|

If you require guidance and advice, please feel free to send me a private message, and I will respond as soon as possible.

Soraya Bahlekeh

パブリッシュされたプロダクト

Prop Hunter Pro EAは、 HFTおよびスキャルピング を含む6つの精密に作成された戦略を備えた高度なエキスパートアドバイザー(EA)です。これらの戦略のうち3つはプロップファームによって課せられる課題を克服するために設計されており、残りの3つは個人の取引口座で使用するために設計されています。 元の価格 399$ —> 60%割引のみ $169 (4コピー 利用可能 ) ライブでの動作を見るには、以下の口座詳細でMT4にサインインして確認できます: 口座番号: 12634479 | パスワード: PropHunterPro | サーバー: ICmarketsSC-Demo01 | 戦略: PassProp1-HFT 主な特徴 HFTの課題に対応するために設計された3つの戦略: プロップファームの課題を効果的に通過するために設計された3つの戦略で、低ドローダウンとストップロスを備えています。 個人および資金提供口座用の3つの戦略:

Soraya Bahlekeh

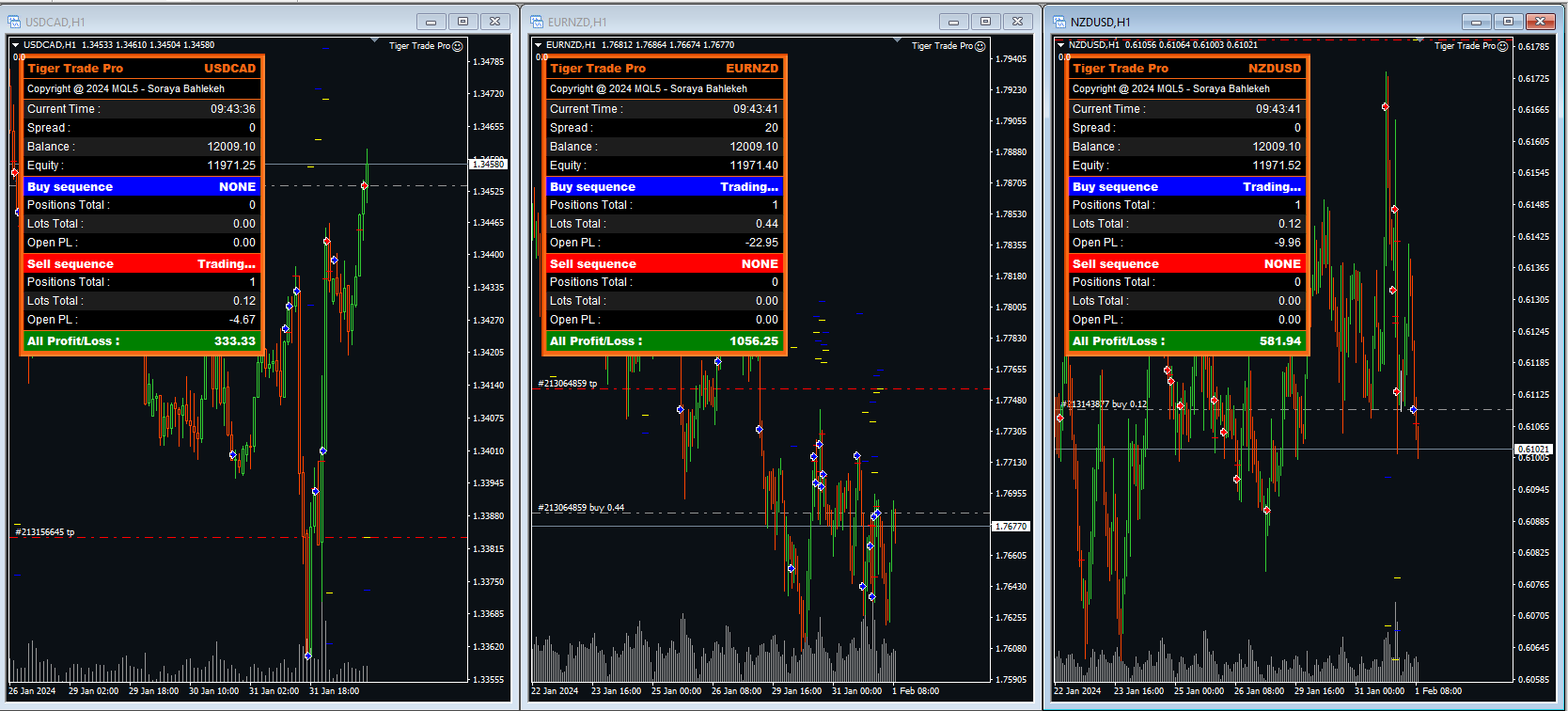

Performance of Tiger Trade Pro in the last 12 days.

profit : 20%

As you can see, it has performed best on the EURNZD currency pair.

Live Signals : https://bit.ly/tigertradepro

profit : 20%

As you can see, it has performed best on the EURNZD currency pair.

Live Signals : https://bit.ly/tigertradepro

Soraya Bahlekeh

In the last 7 days, there has been a 12% profit.

Tiger Trade Pro is designed to facilitate easy profit generation. You can keep the EA active 24 hours a day or set specific trading times according to your preferences

Tiger Trade Pro is designed to facilitate easy profit generation. You can keep the EA active 24 hours a day or set specific trading times according to your preferences

Kevin Maher

2024.01.26

Nice EA with impressive results vs. price. However, I only use the MT5 platform. Please make a MT5 version!

Soraya Bahlekeh

I am a passionate programmer who has been immersed in the exciting world of financial markets and programming for over a decade. From my early days as a student, I was captivated by the dynamic intersection of these two realms. Now, with more than 10 years of experience under my belt, I take great pride in being a seasoned specialist in the field of financial markets.

Throughout my journey, I have assembled a formidable team of experts who share my enthusiasm and drive. Together, we have delved into the realm of automated trading robots specifically tailored for the Forex market. These robots are the culmination of relentless effort, extensive research, and a fusion of cutting-edge technology with the intricacies of financial trading.

Today, I am thrilled to showcase our exceptional robots as a symbol of precision, power, and top-notch performance in the realm of financial markets. Our robots have been meticulously designed to excel in optimizing time efficiency while executing intelligent and profitable trades. By harnessing the power of advanced data analysis and intricate mathematical equations, our robots make informed decisions with unwavering accuracy.

We firmly believe that the marriage of specialized financial knowledge and programming expertise is the key to crafting autonomous robots that effortlessly navigate the complexities of the market. Our ultimate aim is to empower traders and investors with a powerful tool that enhances their trading capabilities, maximizes profitability, and ushers them into a new era of success in the financial landscape.

Join us on this thrilling journey as we continue to push the boundaries of innovation, refining our robots, and revolutionizing the way trading is conducted in the dynamic world of financial markets. Together, let us unlock the immense potential that lies at the intersection of technology and finance.

Throughout my journey, I have assembled a formidable team of experts who share my enthusiasm and drive. Together, we have delved into the realm of automated trading robots specifically tailored for the Forex market. These robots are the culmination of relentless effort, extensive research, and a fusion of cutting-edge technology with the intricacies of financial trading.

Today, I am thrilled to showcase our exceptional robots as a symbol of precision, power, and top-notch performance in the realm of financial markets. Our robots have been meticulously designed to excel in optimizing time efficiency while executing intelligent and profitable trades. By harnessing the power of advanced data analysis and intricate mathematical equations, our robots make informed decisions with unwavering accuracy.

We firmly believe that the marriage of specialized financial knowledge and programming expertise is the key to crafting autonomous robots that effortlessly navigate the complexities of the market. Our ultimate aim is to empower traders and investors with a powerful tool that enhances their trading capabilities, maximizes profitability, and ushers them into a new era of success in the financial landscape.

Join us on this thrilling journey as we continue to push the boundaries of innovation, refining our robots, and revolutionizing the way trading is conducted in the dynamic world of financial markets. Together, let us unlock the immense potential that lies at the intersection of technology and finance.

Soraya Bahlekeh

Using Technical Indicators in Forex Trading:

Technical indicators can help traders analyze price patterns and trends, identify entry and exit points, and make informed trading decisions. Let's discuss some popular technical indicators and how to use them effectively:

Moving Average:

Simple Moving Average (SMA): SMA calculates the average price over a specified period of time. Using SMA can help identify price trends and confirm entry and exit signals.

Exponential Moving Average (EMA): EMA is similar to SMA but gives more weight to recent prices. EMA, being a dynamic indicator, can reflect the speed of price changes.

Relative Strength Index (RSI):

RSI is a popular indicator that measures the strength and direction of a price trend. It ranges from 0 to 100, and when RSI approaches the upper range (above 70), the market may be overbought, and when it approaches the lower range (below 30), the market may be oversold.

Moving Average Convergence Divergence (MACD):

MACD is a lagging indicator used to identify changes in trend direction and potential continuation or reversal of price trends. Its main components include the MACD line, signal line, and histogram.

Bollinger Bands:

Bollinger Bands consist of a middle band (SMA or EMA), an upper band (standard deviation multiplied by a factor), and a lower band (standard deviation multiplied by a factor). They help identify periods of high or low volatility and potential price breakouts.

Fibonacci Retracement:

Fibonacci retracement is based on the Fibonacci sequence and is used to identify potential support and resistance levels. Traders use these levels to determine entry and exit points in a trending market.

Remember, technical indicators should not be used in isolation but as part of a comprehensive trading strategy. It's crucial to combine technical analysis with fundamental analysis, risk management techniques, and market understanding for successful trading.

Technical indicators can help traders analyze price patterns and trends, identify entry and exit points, and make informed trading decisions. Let's discuss some popular technical indicators and how to use them effectively:

Moving Average:

Simple Moving Average (SMA): SMA calculates the average price over a specified period of time. Using SMA can help identify price trends and confirm entry and exit signals.

Exponential Moving Average (EMA): EMA is similar to SMA but gives more weight to recent prices. EMA, being a dynamic indicator, can reflect the speed of price changes.

Relative Strength Index (RSI):

RSI is a popular indicator that measures the strength and direction of a price trend. It ranges from 0 to 100, and when RSI approaches the upper range (above 70), the market may be overbought, and when it approaches the lower range (below 30), the market may be oversold.

Moving Average Convergence Divergence (MACD):

MACD is a lagging indicator used to identify changes in trend direction and potential continuation or reversal of price trends. Its main components include the MACD line, signal line, and histogram.

Bollinger Bands:

Bollinger Bands consist of a middle band (SMA or EMA), an upper band (standard deviation multiplied by a factor), and a lower band (standard deviation multiplied by a factor). They help identify periods of high or low volatility and potential price breakouts.

Fibonacci Retracement:

Fibonacci retracement is based on the Fibonacci sequence and is used to identify potential support and resistance levels. Traders use these levels to determine entry and exit points in a trending market.

Remember, technical indicators should not be used in isolation but as part of a comprehensive trading strategy. It's crucial to combine technical analysis with fundamental analysis, risk management techniques, and market understanding for successful trading.

Soraya Bahlekeh

The hedging strategy is a method used to reduce risks in trading and financial investments. Essentially, hedging is employed to protect financial positions against price fluctuations, exchange rates, and other market factors. This approach is commonly used by companies, investors, and traders in financial markets.

One common method of hedging is through the use of futures contracts. By buying or selling futures contracts, individuals can lock in the price of a desired product or asset. This enables them to benefit from price increases or decreases in the future.

Another hedging method is engaging in offsetting transactions (e.g., trading in the spot market or in the options market). By executing offsetting trades, individuals can reduce risk while still taking advantage of profitable opportunities.

Implementing a hedging strategy requires careful market analysis, risk assessment, and precise portfolio management. Its main objective is to mitigate price volatility, preserve capital, and maintain profitability in turbulent market conditions.

One common method of hedging is through the use of futures contracts. By buying or selling futures contracts, individuals can lock in the price of a desired product or asset. This enables them to benefit from price increases or decreases in the future.

Another hedging method is engaging in offsetting transactions (e.g., trading in the spot market or in the options market). By executing offsetting trades, individuals can reduce risk while still taking advantage of profitable opportunities.

Implementing a hedging strategy requires careful market analysis, risk assessment, and precise portfolio management. Its main objective is to mitigate price volatility, preserve capital, and maintain profitability in turbulent market conditions.

: