RMA Signal Indicator MT5

- インディケータ

- Noman Rasheed

- バージョン: 1.0

- アクティベーション: 5

The "RMA Signal Indicator MT5" refers to an indicator called "RMA" (Running Moving Average) Signal Indicator designed specifically for the MetaTrader 5 (MT5) trading platform. The RMA is a variation of the Moving Average indicator that emphasizes recent price data.

The specific details and functionality of the "RMA Signal Indicator MT5" may depend on the developer or the version you are using. However, in general, here is a general approach to using a signal indicator like RMA on the MT5 platform:

-

Install the indicator: Download and install the "RMA Signal Indicator MT5" into your MT5 platform by following the installation instructions provided by the developer or the indicator's documentation.

-

Apply the indicator to the chart: Once installed, apply the "RMA Signal Indicator MT5" to the desired currency pair or financial instrument's chart. You can typically find the indicator in the "Custom Indicators" section within the MT5 platform.

-

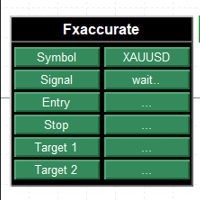

Interpret the signals: Monitor the indicator's signals to identify potential trade opportunities. The "RMA Signal Indicator MT5" might generate signals based on the crossover of the RMA line(s) or other predefined criteria. A bullish signal could indicate a potential buying opportunity, while a bearish signal could suggest a potential selling opportunity.

-

Confirm with additional analysis: Utilize the signals generated by the "RMA Signal Indicator MT5" as initial guidance and complement them with other technical analysis tools or indicators. This may include trend lines, support and resistance levels, or other indicators to validate the strength of the signal and increase the probability of success.

-

Trade execution: Once you receive a signal from the "RMA Signal Indicator MT5" and confirm it with additional analysis, you can consider entering a trade. For example, if the indicator generates a bullish signal and other factors align, you might consider entering a long position or buying the asset. Conversely, if it generates a bearish signal, you might consider entering a short position or selling the asset.

-

Risk management: Implement appropriate risk management strategies to protect your capital. Set stop-loss orders to limit potential losses and determine position sizing based on your risk tolerance and overall trading plan.