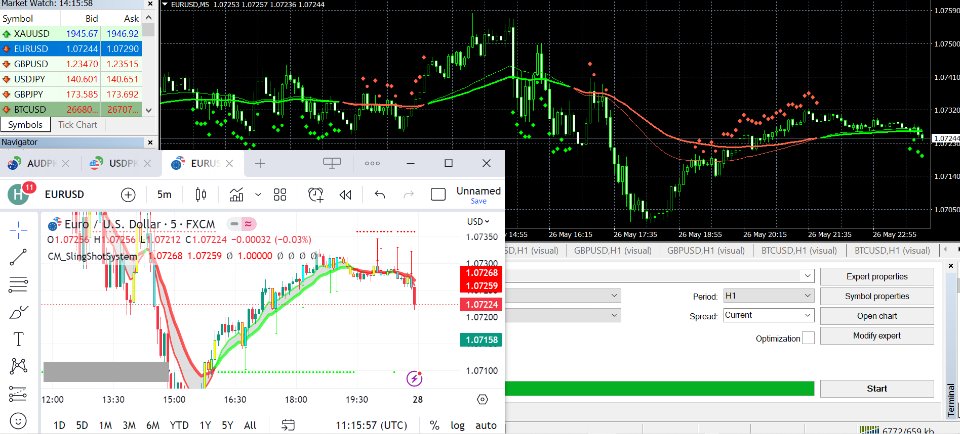

CM SlingShot System

- インディケータ

- Muhammad Hassaan

- バージョン: 1.0

The CM Slingshot System Indicator is a trading tool that aims to identify potential trade setups based on market volatility and price action. It is designed to help traders spot entry and exit points in trending markets.

The CM Slingshot System Indicator combines multiple indicators and techniques to generate trading signals. Here are the key features and components of the indicator:

-

Bollinger Bands: The indicator incorporates Bollinger Bands, which consist of a middle moving average line (typically a simple moving average) and two outer bands representing a specified number of standard deviations from the middle line. Bollinger Bands are often used to gauge volatility and identify potential price reversal points.

-

Momentum and Volatility Filters: The CM Slingshot System Indicator utilizes momentum and volatility filters to identify trade setups. These filters help to confirm the strength of the trend and filter out potential false signals. The specific calculations and parameters used may vary depending on the version of the indicator.

-

Entry and Exit Signals: The indicator generates entry and exit signals based on the interaction between price action and the Bollinger Bands. For example, a typical entry signal could occur when the price breaks above the upper Bollinger Band and a momentum filter confirms the strength of the upward move. Conversely, an exit signal might be triggered when the price crosses below the lower Bollinger Band and the momentum weakens.

-

Customization Options: The CM Slingshot System Indicator often provides customization options, allowing traders to adjust parameters such as the period of the moving average, the number of standard deviations for the Bollinger Bands, and the sensitivity of the momentum and volatility filters. These options enable traders to adapt the indicator to different timeframes and trading preferences.

It's important to note that the effectiveness of the CM Slingshot System Indicator depends on various factors, including market conditions, the timeframe being analyzed, and the trader's overall trading strategy. Traders should use the indicator as part of a comprehensive trading approach, incorporating other technical analysis tools, risk management techniques, and fundamental analysis to make well-informed trading decisions.