Market Structure Patterns

- インディケータ

- Samuel Manoel De Souza

- バージョン: 3.34

- アップデート済み: 9 4月 2025

- アクティベーション: 20

Related posts:

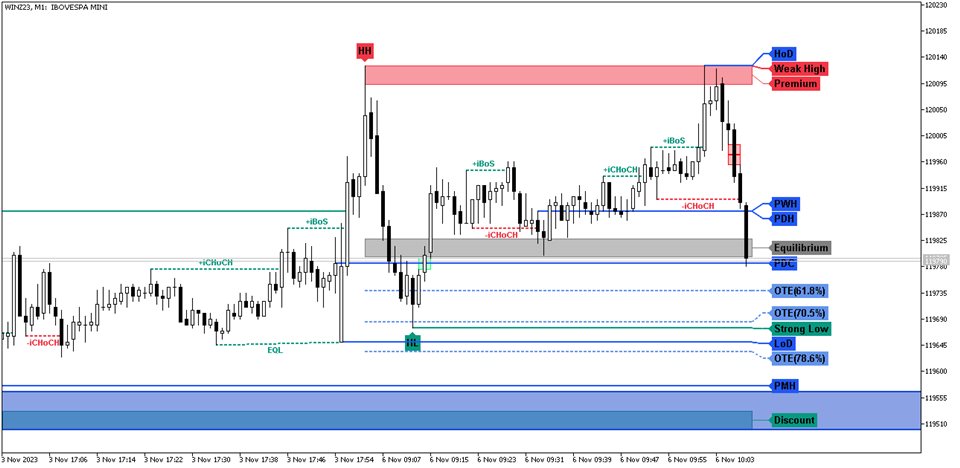

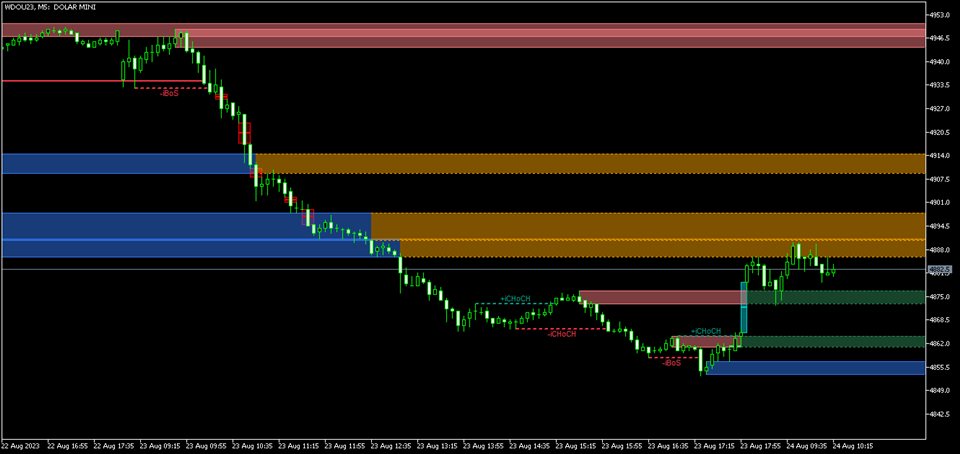

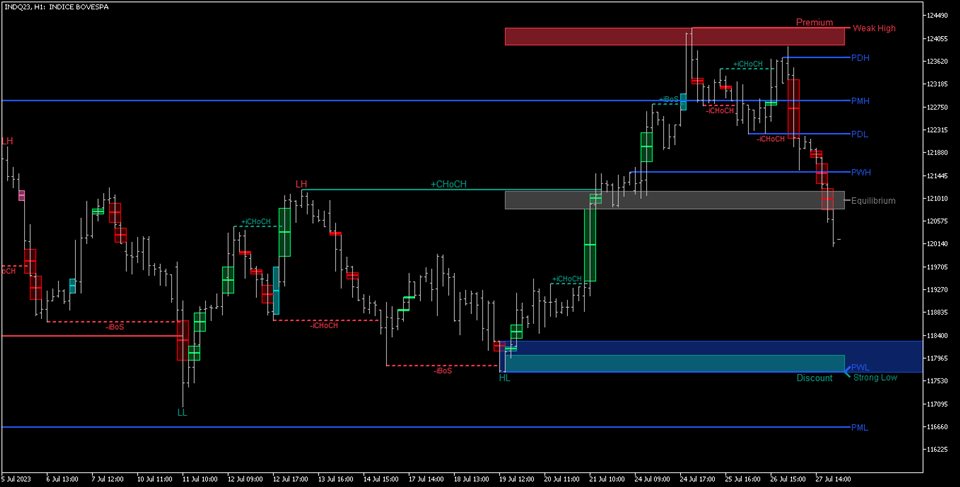

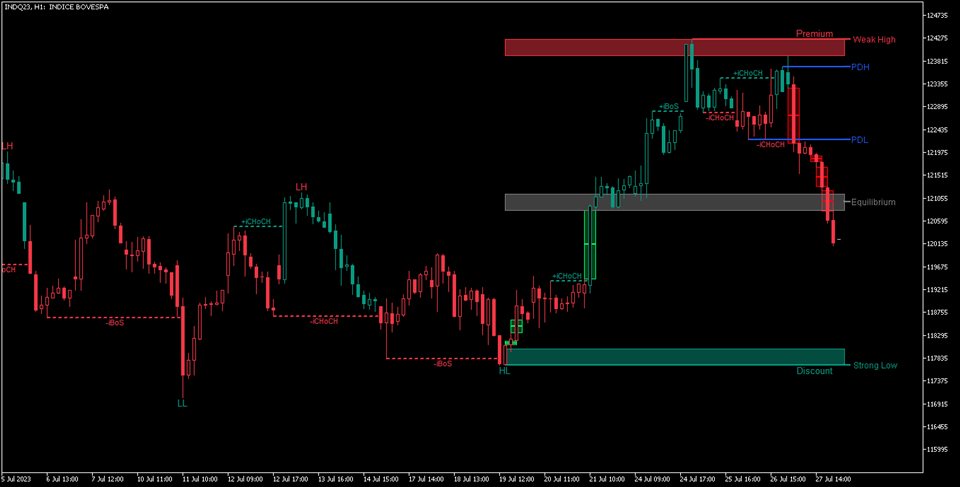

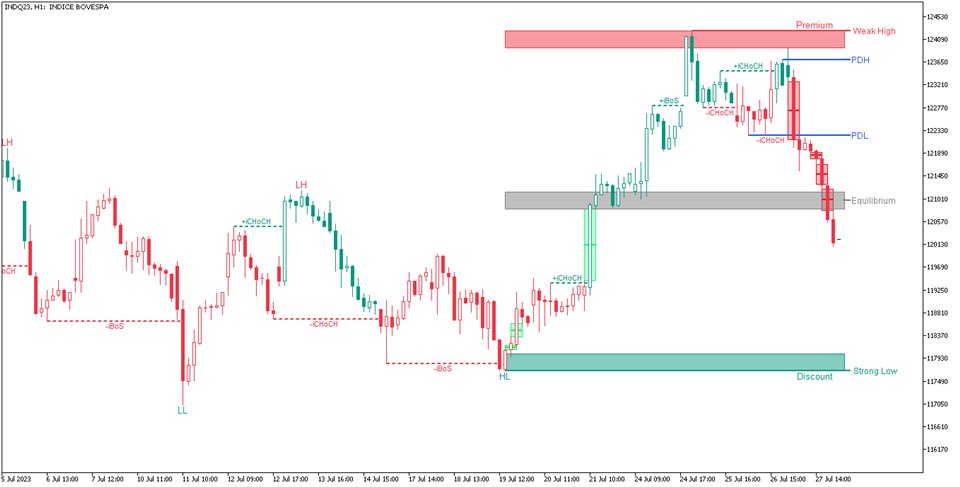

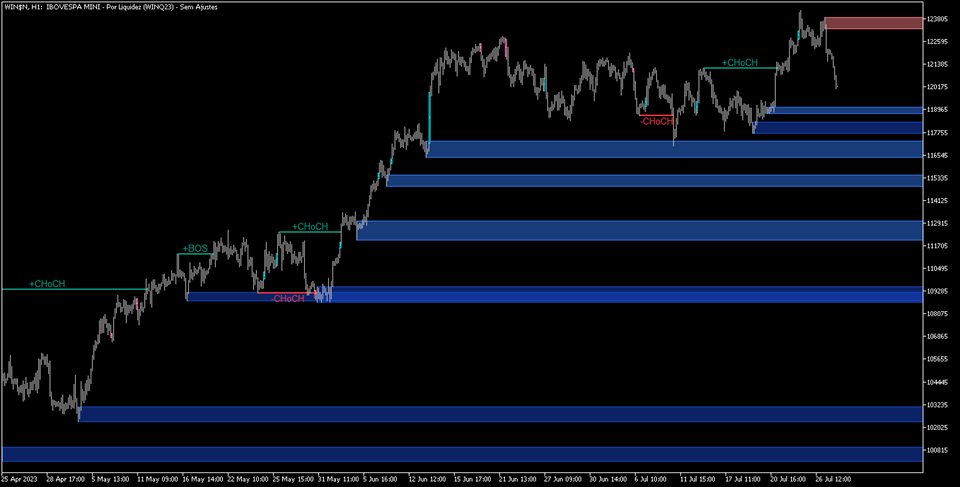

Market Structure Patterns is an indicator based on smart money concepts that displays SMC/ICT elements that can take your trading decisions to the next level. Take advantage of the alerts, push notifications and email messages to keep informed from when an element is formed on the chart, the price crosses a level and/or enters in a box/zone. Developers can access the values of the elements of the indicator using the global variables what allows the automation of trading decisions based on SMC/ICT strategies.

Thinking on high level of customization, the indicator allows to customaze the color and transparency of the element, display the labels using bubble style, display the sessions/trading windows in the bottom of the chart or over the price chart, has an exclusive algorithm to avoid labels/text overlapping, paints the candlesticks depending on the trend and/or internal and swing trend alignment. This feature can be enabled in the parameter "Color Candles". By default the trend is show as green for bullish trend and red for bearish trend. Among with the trend the candlesticks can be filled or not giving the hability to recognize bullish and bearish candlesticks.

Elements and/or Abreviations:

The elements present in the indicator are listed down with their abreviations when applied:

- Premium, Equilibrium and Discount zones

- Strong/Weak High/Low

- Automatic Fibonacci

- OTE - Optimal Trade Entry

- HH, HL, LH, LL- Higher highs, higher lows, lower highs and lower lows

- EQH, EQL - Equal highs and Equal lows

- BSL, SSL - Buy Stops Liquidity and Sell Stops Liquidity

- EQH-BSL, EQL-SSL - Buy Stops Liquidity on Equal Highs and Sell Stops Liquidity on Equal Lows

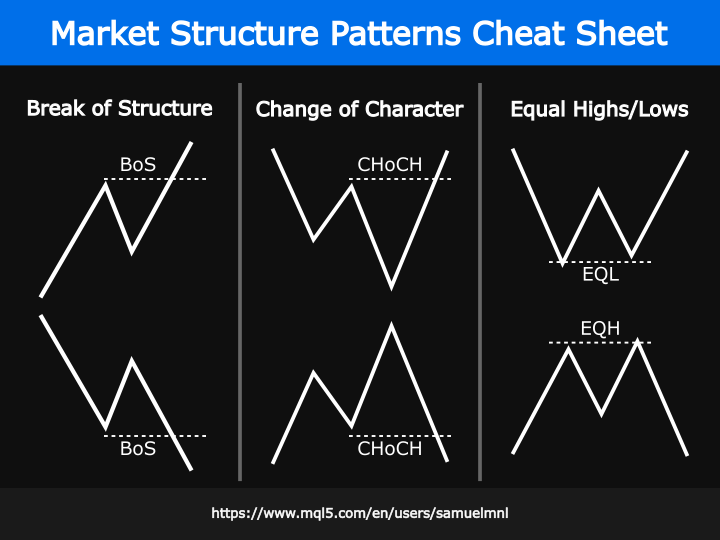

- BoS, iBoS - Break of structures and Internal Break of Structure

- CHoCH, iCHoCH - Change of character and Internal Change of Character

- OB, iOB - Order Blocks and Internal Order Blocks

- BB, iBB - Breaker Blocks and Internal Breaker Blocks

- Liquidity voids

- FVG - Fair Value Gap

- InvFVG - Inverse Fair Value Gap

- ImpFVG - Implied Fair Value Gap

- OG - New Day Opening Gap

- HoD, LoD, OoD - High of the day, Low of the day and Open of the day

- PDH, PDL, PDO, PDC - Prior day high, low, open and close

- PWH, PWL , PWO, PWC - Prior week high , low, open and close

- PMH, PML , PMO, PMC - Prior month high , low, open and close

- Sessions, Kill Zones and Silver Bullet Trading Window

Global Variables:

The access to order blocks and structure breaks values through global variables can be made using the names conventions as follow:

// The timeframe to get the data string timeframe = StringSubstr(EnumToString(_Period), StringLen("PERIOD_")); string prefix = "SMP-"+_Symbol+"("+timeframe+")", for example "SMP-EURUSD(H4)"; // For bullish order blocks (for bearish just replace 'Bullish' by 'Bearish') // Add "Bullish-IOB" for internal nullish order blocks or "Bullish-OB" for swing bullish order blocks; // Add "-Total to get the amount of order blocks on the charts;" int bullish_iob_total = GlobalVariableGet(prefix+"Bullish-IOB-Total") // use for loop to get all the values for(int i=0;i<bullish_iob_total;i++) { // Add "[index]-Top" and/or "[index]-Bot" to get the order blocks values. double iob_top = GlobalVariableGet(prefix+"Bullish-IOB["+(string)i+"]-Top"); double iob_top = GlobalVariableGet(prefix+"Bullish-IOB["+(string)i+"]-Bot"); } // For structure breaks: // Add the pattern name as displayed on the chart. For example, +iCHoCH can be accessed by "SMP-EURUSD(H4)-+iCHoCH" // For Premium/Equilibrium/Discount: // Add the pattern name followed by the desired level. For example, Premium-Top and Premium-Bot can be accessed respectively by "SMP-EURUSD(H4)-Premium-Top" and "SMP-EURUSD(H4)-Premium-Bot"

The access to the indicator data by buffers indexes was introduced in the version 3.24. The data available is mapped as follow:

| Buffer index | Data stored in the buffer |

|---|---|

| 0 | Internal Top Price |

| 1 | Internal Bottom Price |

| 2 | Internal Bull Bos |

| 3 | Internal Bear Bos |

| 4 | Internal Bull Choch |

| 5 | Internal Bear Choch |

| 6 | Internal Bull Order Block Top |

| 7 | Internal Bull Order Block Bottom |

| 8 | Internal Bear Order Block Top |

| 9 | Internal Bear Order Block Bottom |

| 10 | Internal Bull Breaker Block Top |

| 11 | Internal Bull Breaker Block Bottom |

| 12 | Internal Bear Breaker Block Top |

| 13 | Internal Bear Breaker Block Bottom |

| 14 | Swing Top Price |

| 15 | Swing Bottom Price |

| 16 | Swing Bull Bos |

| 17 | Swing Bear Bos |

| 18 | Swing Bull Choch |

| 19 | Swing Bear Choch |

| 20 | Swing Bull Order Block Top |

| 21 | Swing Bull Order Block Bottom |

| 22 | Swing Bear Order Block Top |

| 23 | Swing Bear Order Block Bottom |

| 24 | Swing Bull Breaker Block Top |

| 25 | Swing Bull Breaker Block Bottom |

| 26 | Swing Bear Breaker Block Top |

| 27 | Swing Bear Breaker Block Bottom |

| 28 | BSL Taken |

| 29 | SSL Taken |

| 30 | EQH Price1 |

| 31 | EQH Price2 |

| 32 | EQL Price1 |

| 33 | EQL Price2 |

| 34 | Premium Top |

| 35 | Premium Bottom |

| 36 | Equilibrium Top |

| 37 | Equilibrium Bottom |

| 38 | Discount Top |

| 39 | Discount Bottom |

| 40 | Strong High |

| 41 | Weak High |

| 42 | Strong Low |

| 43 | Weak Low |

| 44 | Bull FVG Top |

| 45 | Bull FVG Bottom |

| 46 | Bear FVG Top |

| 47 | Bear FVG Bottom |

| 48 | Bull Inverse FVG Top |

| 49 | Bull Inverse FVG Bottom |

| 50 | Bear Inverse FVG Top |

| 51 | Bear Inverse FVG Bottom |

| 52 | Bull Implied FVG Top |

| 53 | Bull Implied FVG Bottom |

| 54 | Bear Implied FVG Top |

| 55 | Bear Implied FVG Bottom |

| 56 | Bull Liquidity Void Top |

| 57 | Bull Liquidity Void Bottom |

| 58 | Bear Liquidity Void Top |

| 59 | Bear Liquidity Void Bottom |

As Greg Nicolas said confirmation arrow gives confidence if added... Thank you author for your dedication