Laguerre Scrat

- インディケータ

- Davit Beridze

- バージョン: 1.6

- アップデート済み: 18 3月 2023

- アクティベーション: 5

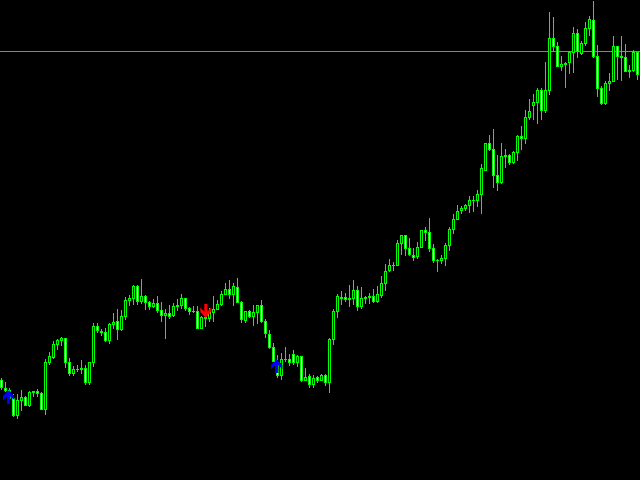

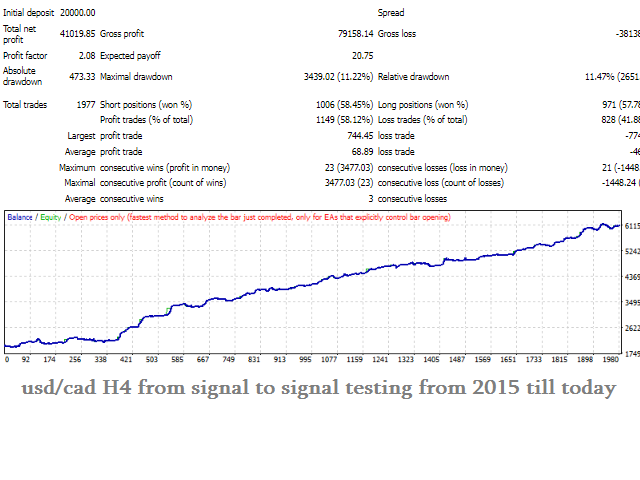

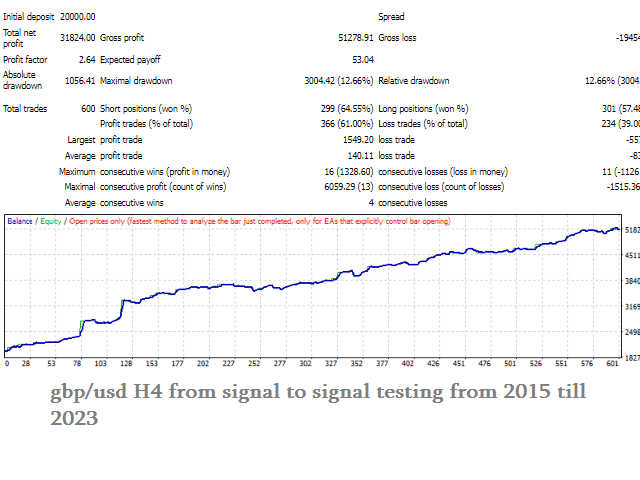

In case you get Laguerre Scrat indicator, you will get Laguerre Scrat Ea as a Gift. To get Ea and detailed manual PDF contact me PM. Default settings are for usd/cad H4

For Stable Long term Profits

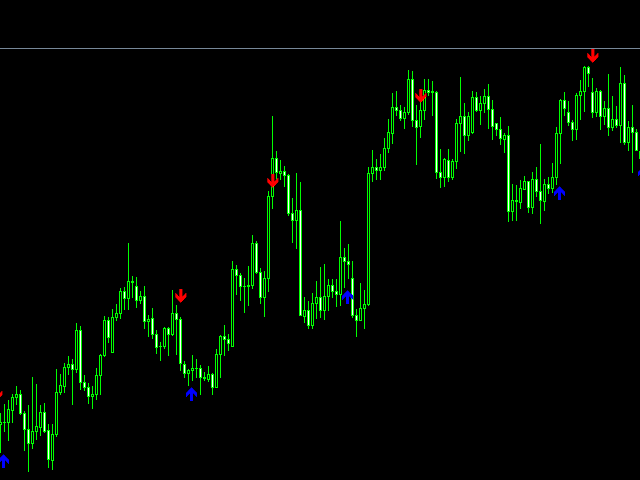

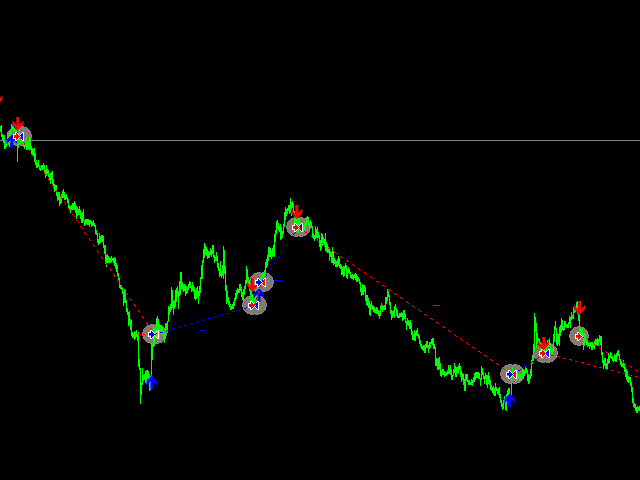

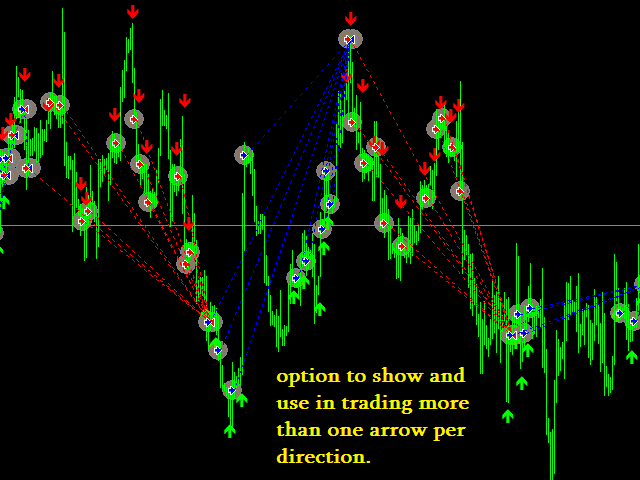

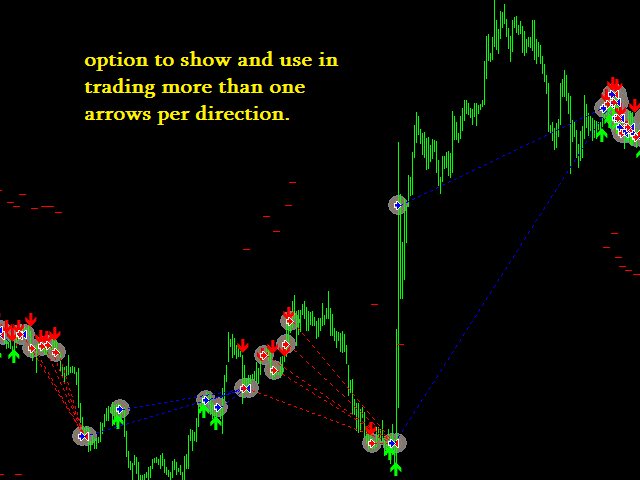

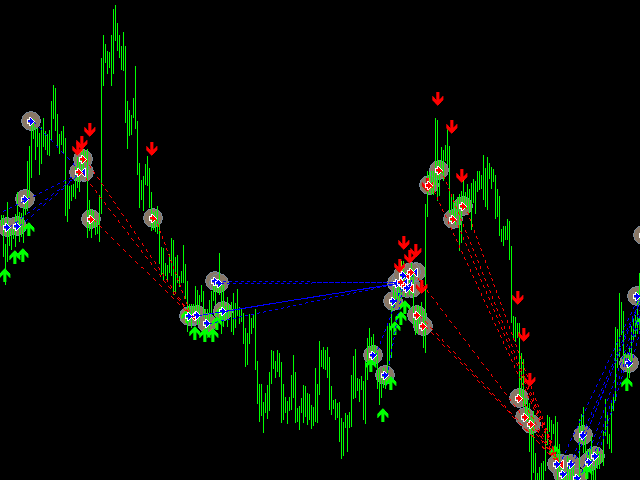

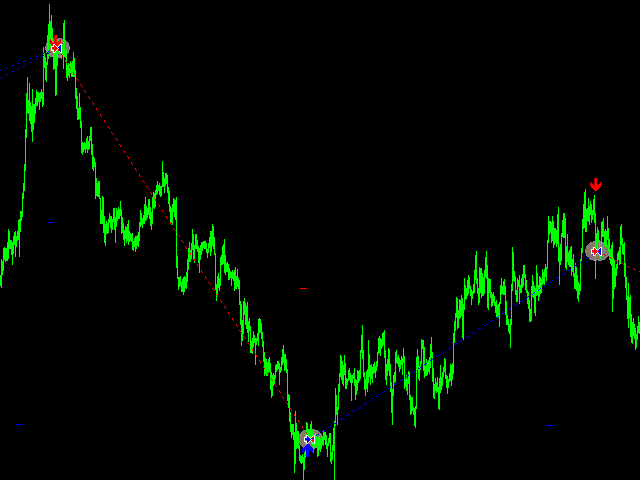

Laguerre Scrat is a trading system based on 4 indicator combinations in the shape of one indicator. Laguerre indicator (upgraded), CCI, Bollinger bands and market volatility factor. It generates arrows in the indicator window and nuts on the price chart, doubling arrows for a better view where to buy/sell. (It is possible to hide nuts from inputs).

First was upgraded Laguerre to have an automatically changeable dynamic period with help of CCI and made it possible to generate arrows on cross of few levels, after that some conditions were added with use of volatility factor and Bollinger bands factor. As a result we have a very profitable system for a very long period of history in the shape of one indicator with an easy interface and very flexible functionality!

Default settings are for all instruments just to see shape. All current profitable set files are uploaded in comments section.

Laguerre Scrat input parameters:

gurGamma – period of Laguerre

gurGammaAdd – period step to add to gurGamma (according cci level)

gurSellProof – level of laguerre to cross from down to up for proof of drawing sell arrow.

gurSellCross – level of laguere to cross from up to down after proof to draw a sell arrow.

gurBuyCross – level of laguerre to cross from down to up after proof to draw a buy arrow.

gurBuyProof – level of laguerre to cross from up to down for proof to draw a buy arrow.

GurSigShift – on what distance from candle to draw arrow.

Volatile – Higher/Lower/not use level of Volatility higher or lower to use for proof of arrow.

VolTF -timeframe of Volatile indicator to use for determining Volatility.

VolPeriod – period of Volatility indicator

volLevel – level of Volatile indicator to higher or lower of what level to use in trading for arrow proof.

Use CCI -true/false use cci or not to grant dynamism to Laguerre Period (gurGamma + gurGammaAdd)

cciTF – what timeframe use cci on.

cciPeriod – what period of CCI to use.

cciPrice – what type of cci use (open price, close price, weighted price etc)

cciLevel – what level of cci to use. 75.0 means range 75 (-75) above 75 below -75. (That’s example)

UseBB – true/false for sell arrow confirmation price should be lower in the up line of bollinger bands. For Buy arrow confirmation price should be higher on the lower line of Bollinger bands.

bbTF – timeframe of bollinger bands to use.

bbPeriod – period of bollinger bands to use.

bbDeviat – deviation of Bollinger bands to use.

bbPrice – what type of Bollinger bands to use (close price, open price etc)

alertsOn – true/false use alerts or no.

I use it to assist my entries in combination with differnet TI so far, author is honest and helpful