Pivot classic woodie camarilla fibonacci demark

- インディケータ

- Emin Ulucanli

- バージョン: 1.10

- アップデート済み: 28 1月 2023

Pivot Classic, Woodie, Camarilla, Fibonacci and Demark

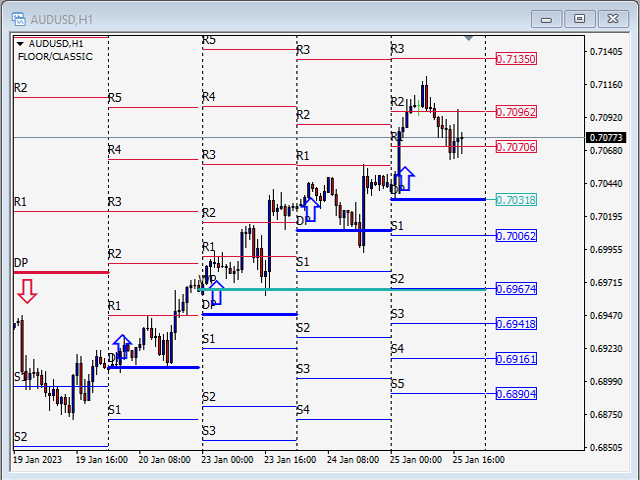

Floor/Classic

Pivot points, or simply pivots, are useful for identifying potential support/resistance levels, trading ranges, trend reversals, and market sentiment by examining an asset's high, low, and closing values. The Floor/Classic Pivot Points can be calculated as follows.

Pivot Point (P) = (High + Low + Close)/3

S1 = P * 2 - High

S2 = P - (High - Low)

S3 = Low – 2*(High - P)

R1 = P * 2 - Low

R2 = P + (High - Low)

R3 = High + 2*(P - Low)

Woodie

It differs from the standard method of calculating the pivot point. It uses the difference between the previous day's high and low, also known as range, to calculate support and resistance levels. Some traders prefer to use the Woodie formulas as they give more weight to the closing price of the previous period. The Woodie Pivot Points can be calculated as follows.

R2 = P + (H - L)

R1 = (2 * P) - LOW

P = (HIGH + LOW + (CLOSE * 2)) / 4

S1 = (2 * P) - HIGH

S2 = P - (H - L)

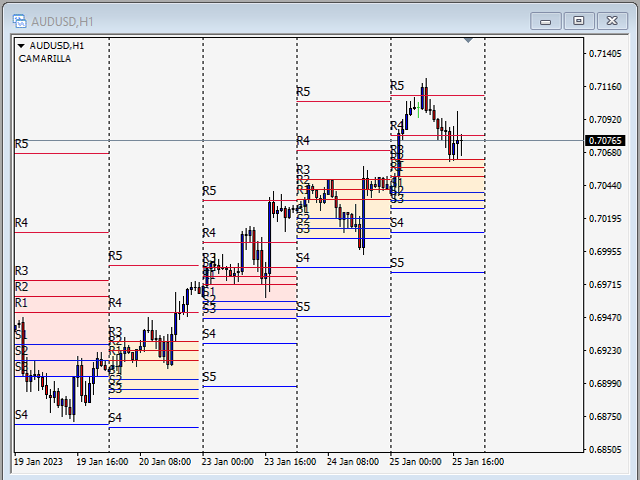

Camarilla

The Camarilla formulas are similar to the Woodie formula. Its basic idea is that price tends to revert to its average. The Camarilla levels help to target accurate stop loss and target profit orders. The most important levels are S3, S4 and R3, R4. The Camarilla Pivot Points can be calculated as follows.

R4 = ((High - Low) * 1.1) / 2 + Close

R3 = ((High - Low) * 1.1) / 4 + Close

R2 = ((High - Low) * 1.1) / 6 + Close

R1 = ((High - Low) * 1.1) / 12 + Close

S1 = Close - ((High - Low) * 1.1) / 12

S2 = Close - ((High - Low) * 1.1) / 6

S3 = Close - ((High - Low) * 1.1) / 4

S4 = Close - ((High - Low) * 1.1) / 2

Fibonacci

Fibonacci pivot point levels are determined by calculating the pivot point first, as in the standard method. Then multiply the previous day's range by the corresponding Fibonacci level. Most traders use 38.2%, 61.8% and 100% corrections in their calculations. The rationale behind this is that many traders use Fibonacci odds. The Fibonacci Pivot Points can be calculated as follows.

Pivot Point (P) = (High + Low + Close)/3

Support 1 (S1) = P - (0.382 * (High - Low))

Support 2 (S2) = P - (0.6182 * (High - Low))

Support 3 (S3) = P - (1 * (High - Low))

Resistance 1 (R1) = P + (0.382 * (High - Low))

Resistance 2 (R2) = P + (0.6182 * (High - Low))

Resistance 3 (R3) = P + (1 * (High - Low))

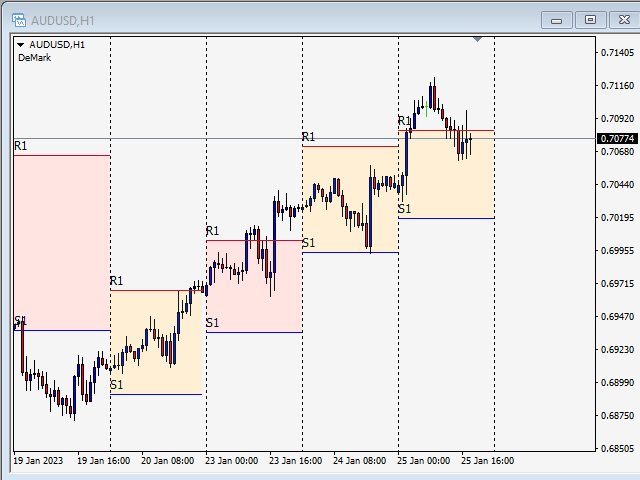

Demark

These pivot points have a conditional nature that places more emphasis on recent price movements based on the relationship between the opening price and the closing price. The Demark Pivot Points can be calculated as follows.

If Close < Open, then X = High + (2 * Low) + Close

If Close > Open, then X = (2 * High) + Low + Close

If Close = Open, then X = High + Low + (2 * Close)

Support 1 (S1) = X/2 - High

Resistance 1 (R1) = X/2 - Low

ユーザーは評価に対して何もコメントを残しませんでした