Rubdfx Supply Demand

- インディケータ

- Namu Makwembo

- バージョン: 3.5

- アップデート済み: 26 12月 2024

- アクティベーション: 5

Holiday Sales

Zones Indicator

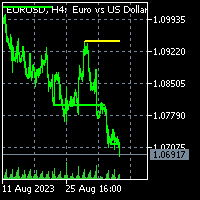

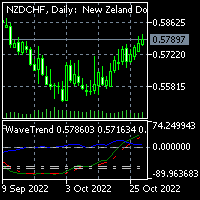

The Zones Indicator is your everyday Trading tool that leverages advanced algorithms, including ICT institutional concepts like order blocks, engulfing candle patterns, and Level interactions, to identify critical levels of supply and demand (Resistance & Support). Visual signals are generated and clearly marked on the chart, providing a straightforward guide for traders to spot key opportunities.

Key Features

-

Advanced Algorithmic Analysis:

- Identifies supply and demand zones using order blocks, engulfing candle patterns, and other ICT-inspired techniques.

- Zones dynamically update as market conditions change, providing real-time precision.

-

Multi-Confirmation Tools:

- Adds additional confluence to your strategy by integrating reversal patternsand support/resistance interactions.

-

Multi-Asset Compatibility:

- Supports all tradable instruments, including Forex, synthetic indices, metals, cryptocurrencies, indices (e.g., NASDAQ), and more.

-

Adaptable Trading Styles:

- Ideal for scalping, swing trading, or as a supplementary tool for confirmation near significant market levels.

-

Multi Channel Alert System:

- Stay informed with instant alerts via computer, mobile, and sound notifications when price enters a supply or demand level.

-

Customizable Settings:

- Flexible parameters allow you to tailor sensitivity and other aspects to match your trading approach.

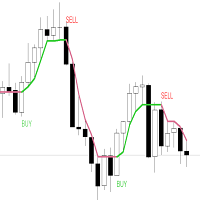

Preparation for Buying

-

Identify the Demand Zone:

- Wait for the price to approach a bullish order block or demand level.

-

Confirm Entry:

- Look for candlestick patterns such as bullish engulfing, bullish cross, or piercing patterns.

-

Enter the Trade:

- Place your buy order after confirmation.

- Set a stop-loss just a few pips below the zone for protection.

-

Exit Strategy:

- Close your trade when opposing signals appear, or secure profits after a significant price move away from the entry point.

Preparation for Selling

-

Identify the Supply Zone:

- Wait for the price to approach a bearish order block or supply level.

-

Confirm Entry:

- Look for candlestick patterns such as bearish engulfing, shooting stars, or bearish crosses.

-

Enter the Trade:

- Place your sell order after confirmation.

- Set a stop-loss just a few pips above the zone.

-

Exit Strategy:

- Close your trade when opposing signals appear, or secure profits after a significant price move away from the entry point.

This indicator is continuously refined to meet the evolving needs of traders. Stay updated with the latest improvements and features by regularly checking for updates, ensuring you always have the most effective tools at your fingertips for precise market analysis.

This indicator is continuously refined to meet the evolving needs of traders. Stay updated with the latest improvements and features by regularly checking for updates, ensuring you always have the most effective tools at your fingertips for precise market analysis.

Understanding ICT Order Blocks

Order blocks are institutional levels used by smart money to initiate trades. These levels act as key supply or demand zones and are critical in anticipating market reversals or continuations.

-

Bullish Order Block:

- Represents the last bearish candle before a price increase.

- Wait for the price to return to this zone and confirm with a bullish signal before entering a buy position.

-

Bearish Order Block:

- Represents the last bullish candle before a price decline.

- Wait for the price to return to this zone and confirm with a bearish signal before entering a sell position.

Key Steps for Trading Order Blocks:

- Identify the order block (bullish or bearish) on the chart.

- Wait for the price to return to the zone.

- Confirm the trade with candlestick patterns or other tools.

- Use institutional levels or opposing order blocks for take-profit zones.

Why Choose Version 3.4?

- Non-Repainting Zones: Provides reliable levels without recalculations or misleading signals.

- Real-Time Alerts: Instant notifications to ensure you never miss key trading opportunities.

- Multi-Asset Flexibility: Works across various markets, making it suitable for traders in Forex, indices, metals, and crypto.

- ICT-Inspired Logic: Incorporates institutional trading techniques for precise market insights.