Fixation Bands

- エキスパート

- Nadiya Mirosh

- バージョン: 1.2

- アクティベーション: 5

The robot is based on the correct analysis of the Bollinger Bands indicator.

About the indicator. Bollinger Bands are technical analysis of financial markets that reflects current fluctuations in the price of a stock, commodity or currency. The indicator is calculated based on the standard deviation from a simple moving average. Usually displayed on top of the price chart. The parameters for the calculation are the type of standard deviation (usually double) and the period of the moving average (depending on the preferences of the trader). The indicator helps to assess how prices are located in relation to the normal trading range. Bollinger Bands create a frame within which prices are considered normal. Bollinger bands are plotted as upper and lower boundaries around the moving average, but the band width is not static, but proportional to the standard deviation from the moving average for the analyzed period of time.

A trading signal is considered when the price exits the trading corridor - either rising above the upper line, or breaking through the lower line. If the price chart fluctuates between the lines, the indicator does not give trading signals. The bot can touch in any direction.

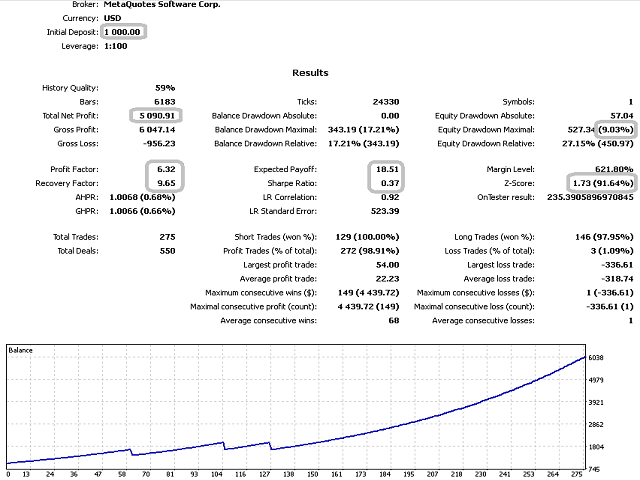

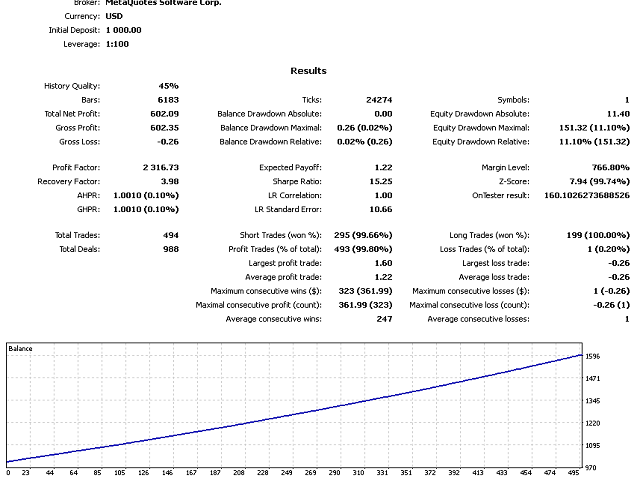

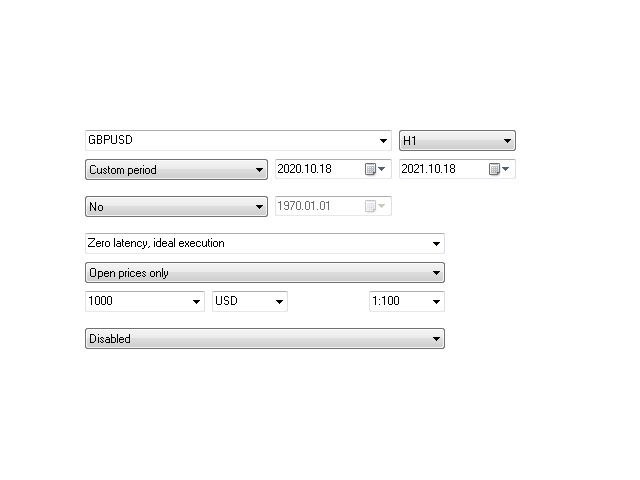

The bot has at its disposal a huge variety of instruments, several types of trailing stop, breakeven. Standard stop loss and take profit. Drawdown and profit as a percentage of the deposit. The indicator signal is also controlled by the slope of the line and its value. We trade both inside the Bollinger price channel and outside. There is a money management system. It is not necessary to delve into all the settings to work. It is enough to optimize using the file presented in the discussion and work. We work on H1 and EURUSD by default, but you can optimize on any re. When changing the optimization period, specify it explicitly in the bot settings. Optimize for "Custom"!

The parameters are mostly self-explanatory. Eksli any will not be clear, write in private messages.