Channel Arg Control

- インディケータ

- Vitalii Zakharuk

- バージョン: 1.0

- アクティベーション: 5

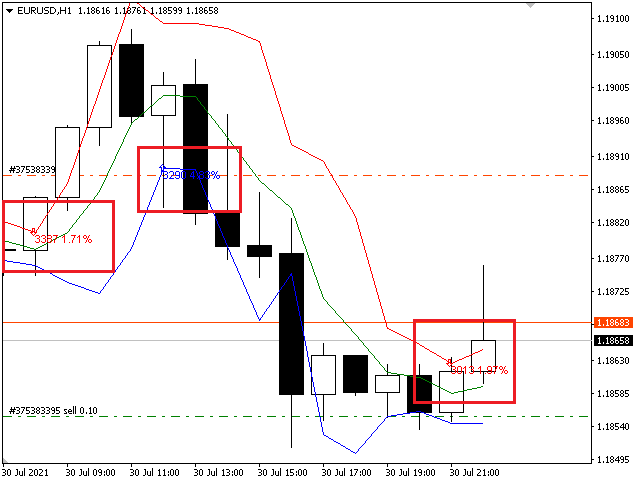

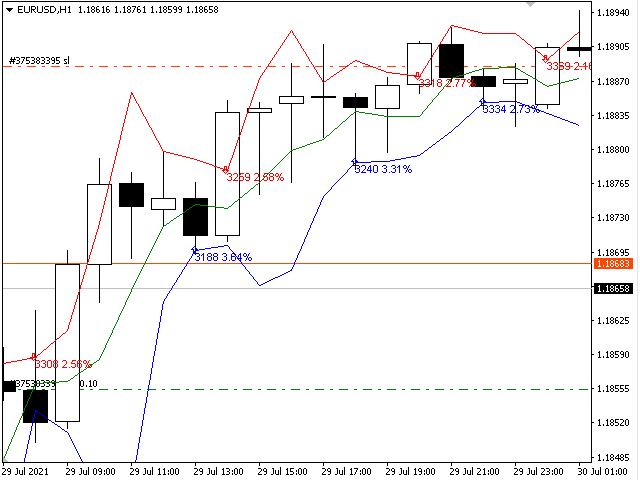

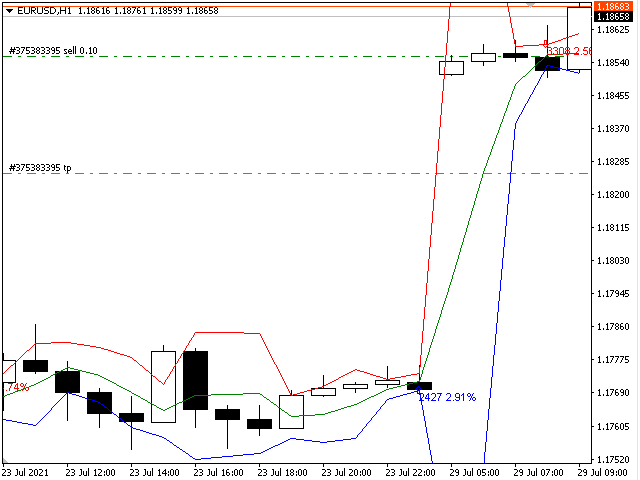

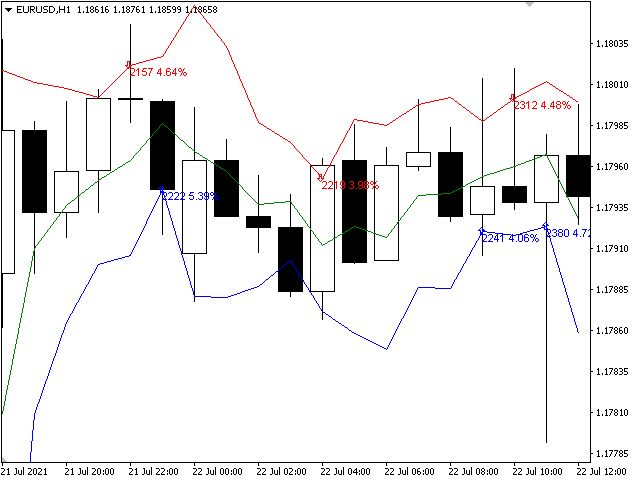

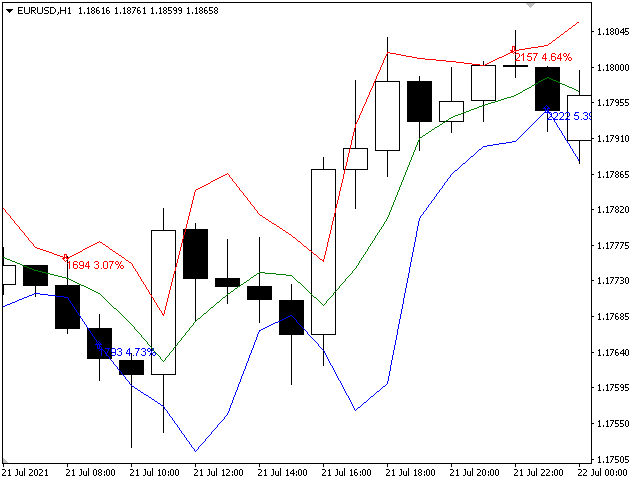

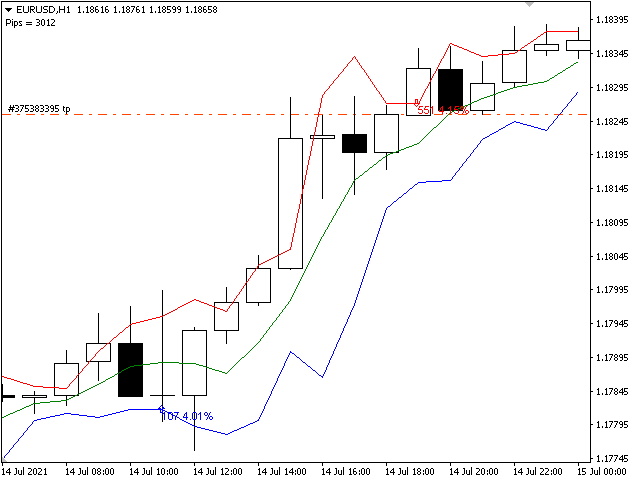

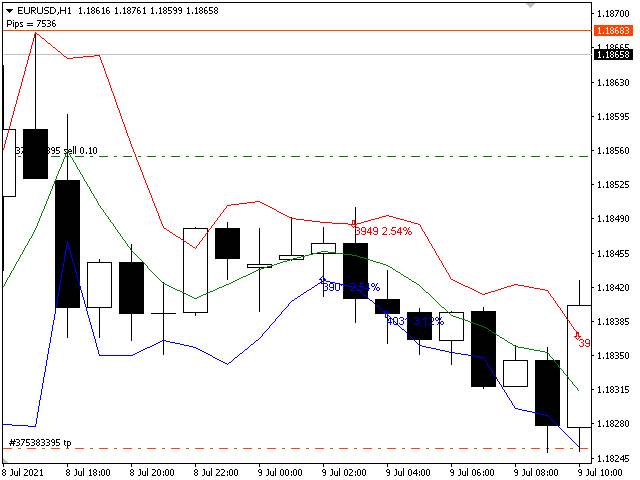

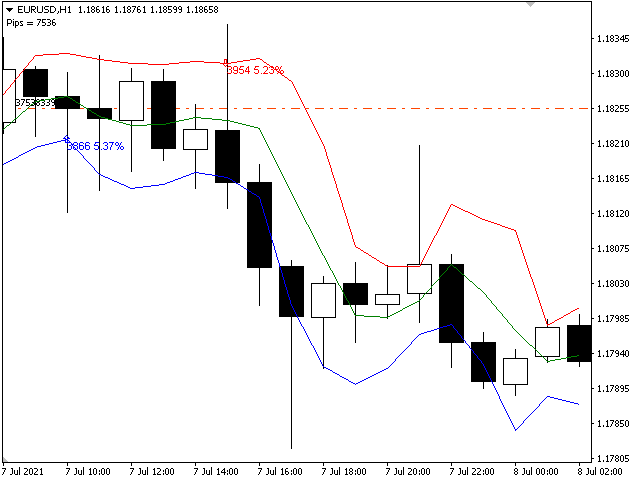

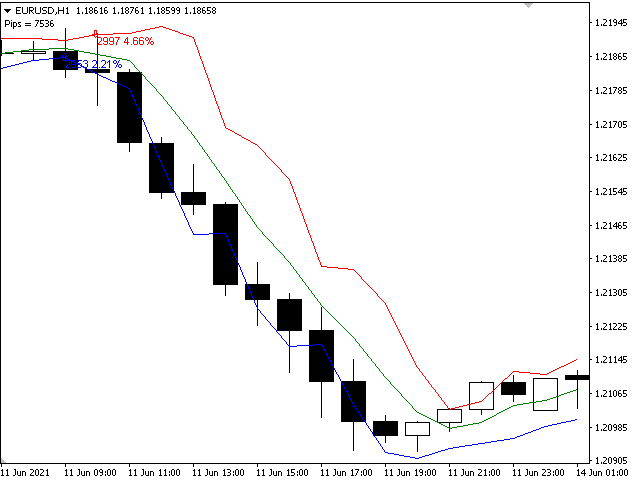

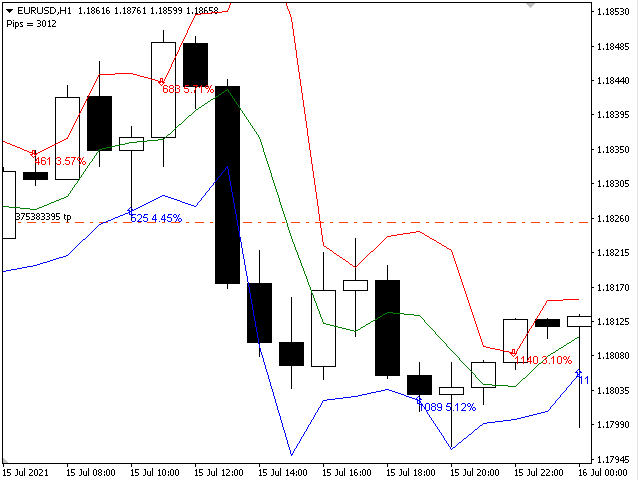

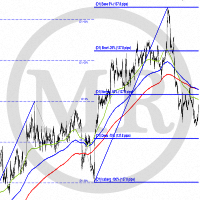

The Channel Arg Control indicator, in addition to lines, reflects entry signals in the form of arrows. But how to do that? At first glance, this is not an easy task. But not for the Channel Arg Control indicator, this indicator will tell you whether you have configured the indicator correctly, while you can specify the history interval in the bars that interests you. And yet, how does the indicator tell you? Look at the numbers on the chart near the arrows! This is exactly what you thought, these are profit pips from a series of entries on the indicator. Profit pips are calculated for the specified interval, the interval for calculation is set in the indicator, as a rule, 1000 bars are enough for this.

double iBuy = iCustom (0, 0, ":: Indicators \ Channel Agr Control.ex4", FullReCalc, LimitCalcHistory, Spread, Length, Deviation, VolatilityAVG, Volatility, VolatilityPercentageLimit, 3, 0);

double iSell = iCustom (0, 0, ":: Indicators \ Channel Agr Control.ex4", FullReCalc, LimitCalcHistory, Spread, Length, Deviation, VolatilityAVG, Volatility, VolatilityPercentageLimit, 4, 0);

if (iBuy> 0)

{

...

}

if (iSell> 0)

{

...

}

- FullReCalc - forces the pips of profit to be recalculated on each bar (a specified amount of LimitCalcHistory).

- LimitCalcHistory - Limits the amount of history to recalculate the profit chin.

- Spread - Specify the spread that is lost on each bar when calculating the pro-fit.

- Length - The length of the channel.

- Deviation - Channel width.

- VolatilityAVG - The number of bars for calculating the momentary volatility.

- Volatility - The number of bars to calculate the total volatility.

- VolatilityPercentageLimit - The limit of volatility, here you need to choose a good one, it greatly affects profitability.