Trades Protection v1

- エキスパート

- Cesar Daniel Sanchez Segura

- バージョン: 1.0

- アクティベーション: 5

Trades Protection v1

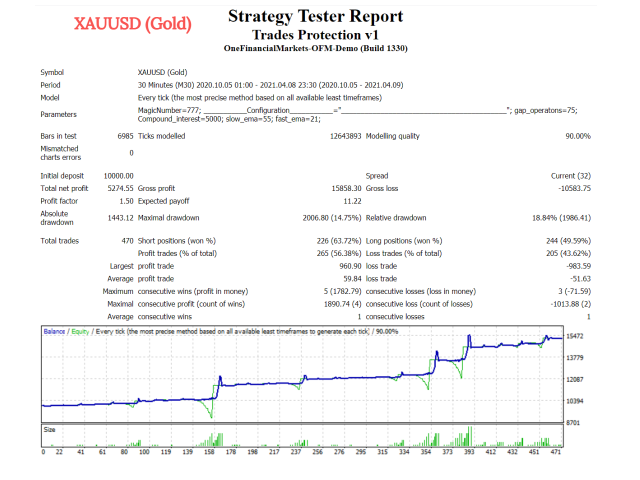

Trades Protection v1 is an Expert Advisor based on grid strategy, however it has been modified to protect trades by using hedging and closing positive versus negative trades partially. Partially closing trades allows you to profit during the cycle, realising margin and reducing the lot size of subsequent trades. It is a unique robot of its kind. We have subjected it to the big trends in 2020 on the XAUUSD pair and it can support up to 1200 pips with an aggressive setup (minimum compound interest = $5000). It really is a very safe robot. Also, take profit position to close the cycle optimally is calculated.

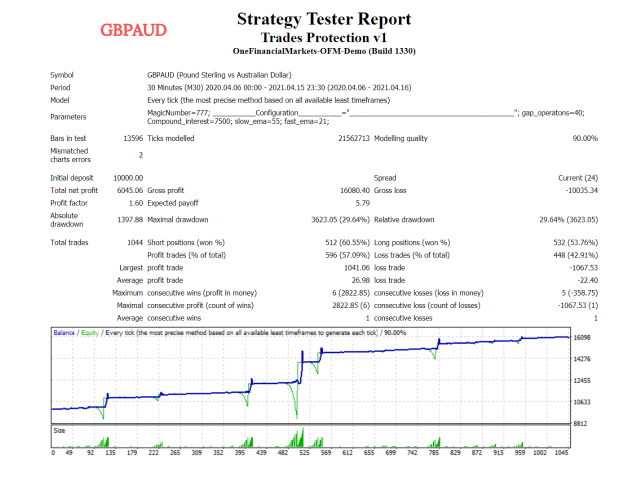

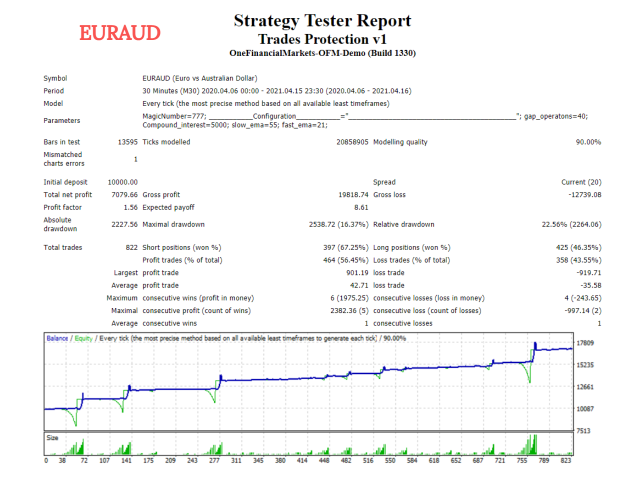

The trading entry strategy is through a crossover of configurable moving averages. It is recommended that they be low frequency to avoid being at the highs or lows of the year. So it can be implemented in any time frame, although m30 or H1 is recommended.

Another important point is that this robot increases the lot size according to the amount of money available in the account, this lot size is calculated by equity so you can have several robots in different pairs working at the same time and in the same account. It is recommended avoid repeating currency. Currently, this robot is implemented on small account of $100 USD (10,000.00 cents)(Leverage: 1:500) with high spread and still has great results. Moreover, there is no need for low latency VPS due to the strategy and the style of opening and closing trades partially.

It is very easy to use, does not need any complicated settings, just add it to a chart and it will run like clockwork for you. Before running it on real account it is better to do a backtest run backtest before running real account.

A demonstration video is shown here:

We recommend:

- 5k minimum account. Cents account can be used. However, ECN account improves performance due to low spread.

- No more than two pairs with the same currency.

Input settings description

- Gap operations [pips] -> Here you can set the distance between operations. The units of this parameter are Pips (10*points). This parameter is recommended between 30 and 50 for pairs with high volatility per day (XAU). For less volatile pairs a minimum of 10 pips is recommended. The shorter the distance between trades, the more aggressive the strategy becomes.

- Compound interest → This parameter allows you to calculate the lot size of the trade according to the equity of the trading account. For example, if this parameter is $5000.00, the lot size of the first trades will be 0.01 lots, when the account reaches $10,000, it will be set to 0.02 and when it reaches $15,000 it will be 0.03 and so on. Moderate configuration is around 7,500.00 - 10,000.00

- Slow EMA -> This is an exponential ema applied to the close. Its units are periods.

- Fast EMA → This is an exponential ema applied to the close. Its units are periods.

Never forget that past performance is no guarantee for the future.