Setup DT Trap

- インディケータ

- Luigi Nunes Labigalini

- バージョン: 1.0

- アクティベーション: 5

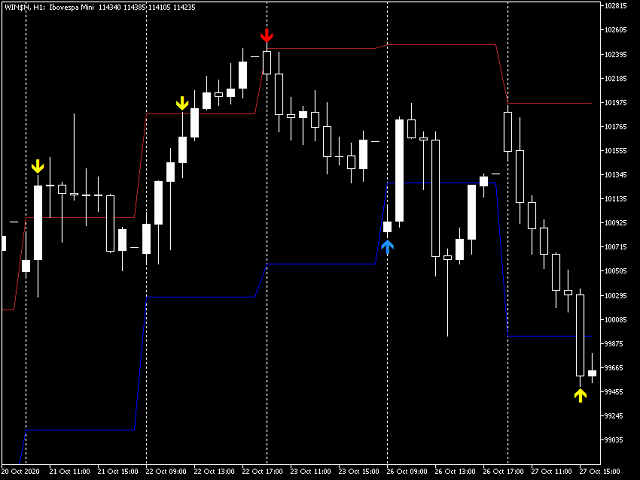

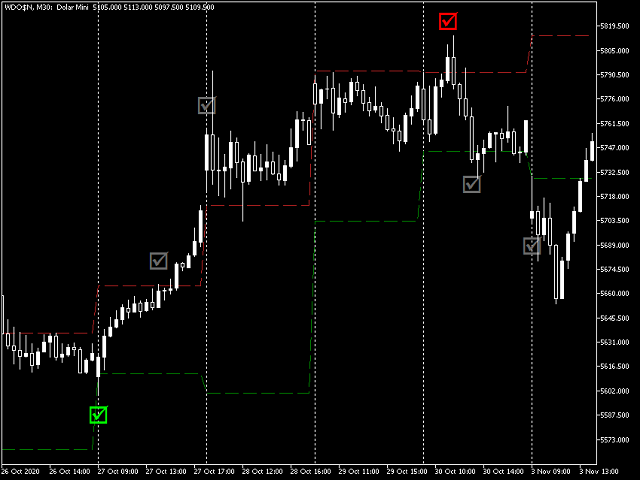

Buy and sell signals based on the Day Trade Trap Strategy for failed breakouts, popularized in Brazil by Alexandre Wolwacz (STORMER).

How does the indicator work?

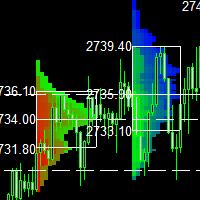

The indicator activates the buy and sell signal when their respective conditions are met.

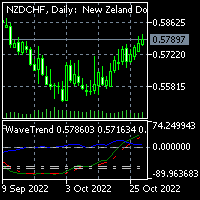

For a buy signal, we need a bar making a low lower than the previous day low. On this moment, the signal is plotted with the secondary color.

For a sell signal, we need a bar making a high higher than the previous day high. On this moment, the signal is plotted with the secondary color.

How to use it?

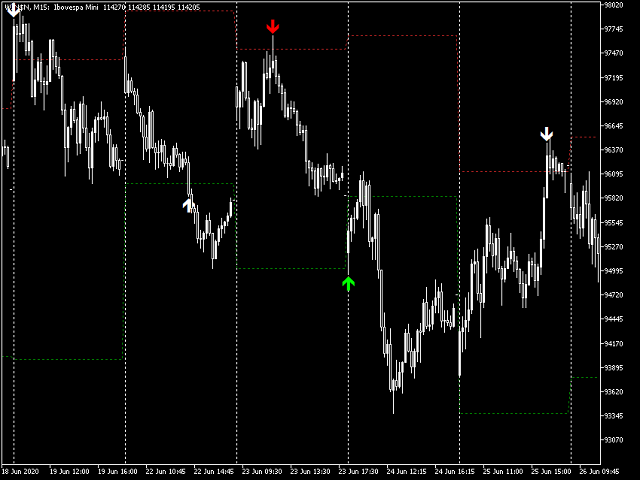

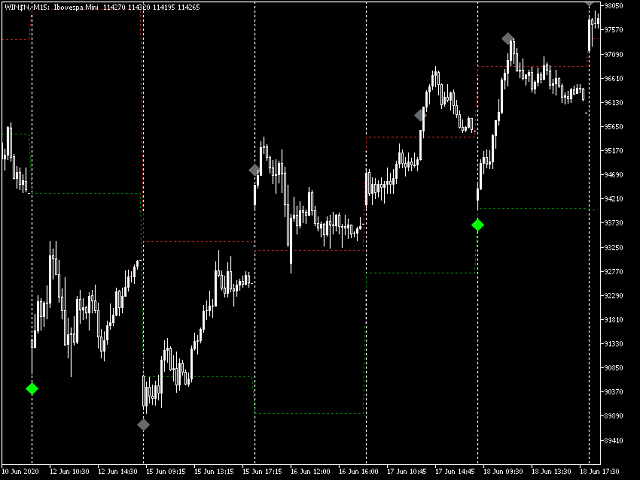

For a buy, we need the following bar to make a high higher than the previous bar with the signal. On this moment, the signal changes to the primary color. The entry is one tick above the high of the signaled bar. If the entry is not activated on the following bar, it should be cancelled.

The stop loss is one tick below the low of the signaled bar. The target is twice the size of the signaled bar, from it's high.

For a sell, we need the following bar to make a low lower than the previous bar with the signal. On this moment, the signal changes to the primary color. The entry is one tick below the low of the signaled bar. If the entry is not activated on the following bar, it should be cancelled.

The stop loss is one tick above the high of the signaled bar. The target is twice the size of the signaled bar, from it's low.

Tips:

- It works on all timeframes lower than the Daily.

- Take in consideration how much time is left until the end of the day and if it's probable that it will reach the target until then.

- The signal is great when the bar is a reversal one (hammer/shooting star) or immediatelly followed by a reversal pattern (engulfing pattern/dark cloud cover/piercing pattern).

- The higher the volume of the signaled bar, the stronger the movement tends to be.

- If the symbol is Daily oversold, the buy signal is better. And if it's Daily overbought, the sell signal is better.

- The indicator filters the first touch of the previous day high/low, not plotting signals on the next touches.

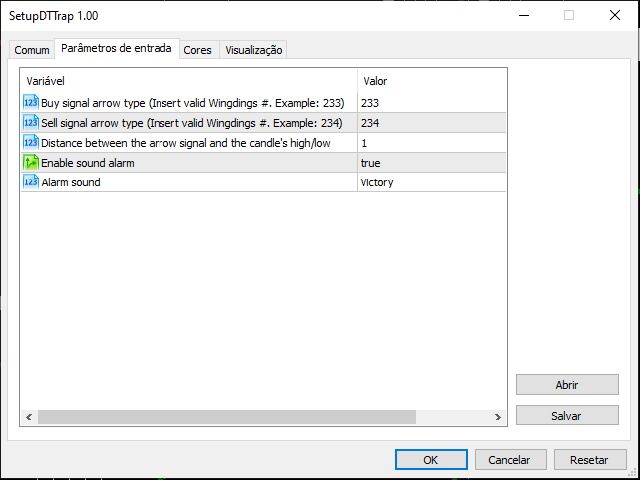

Features you can edit to your preference:

- Type of the Buy and Sell signal arrows, based on the Wingdings font.

- Six options of distance between the arrow signals and the candle's high/low, that auto adjust itself for different symbols and timeframes.

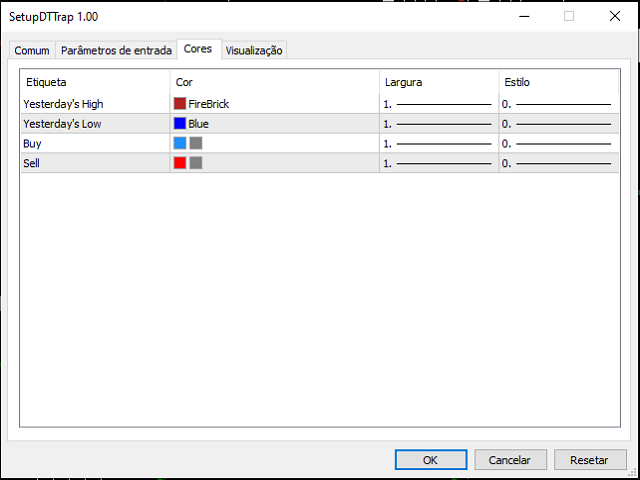

- Color and size of the nonactivated Buy and Sell signal arrows.

- Color of the activated Buy and Sell signal arrows.

- Color, thickness and style of the previous day's high and low.

- Enable/disable the sound alarm.

- Sound of the alarm.