Blackpink EA 15M

- エキスパート

- Looi Guan Chek

- バージョン: 13.1

- アップデート済み: 23 12月 2020

- アクティベーション: 5

WHY USE BLACKPINK EA 15M

- Non-Scalper, back test with 10 years EURUSD 15M Chart.

- 10 years trade EURUSD 15M, total 312 trades gives a result ROI 190% with orderSize = 1.0. (Increment of orderSize can give more ROI).

- Day Trade strategy looking entry point for both uptrend and downtrend market.

- STOP LOSS value will be set on every open positions.

- BLACKPINK EA 15M is consider as a conservative short trend forex strategy that give a stable profit for long run.

Contact Email

STRATEGY EXPLANATION

The trade rule behind Blackpink EA 15M, we use our winning formula to decide the buy or sell

-

Trend

Blackpink EA 15M takes multiple combination trend indicators to decide whether the system looks for buy or sell entry points.

-

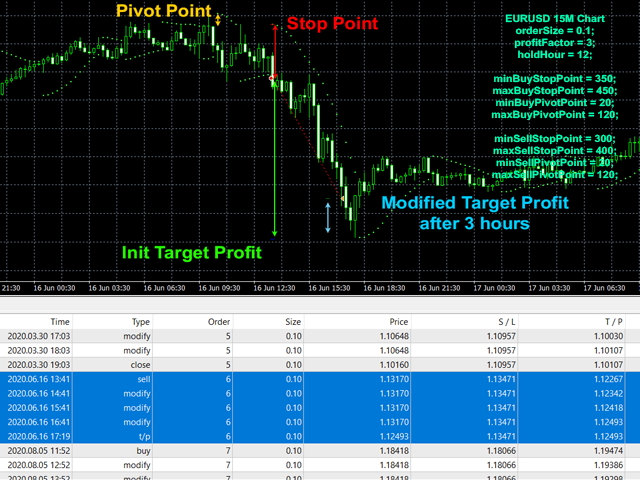

Entry Point

After the trend is decided, the system refers to Parabolic SAR as the main indicator to decide the entry point.

-

Stop Loss & Target Profit

The stop loss will be the pivot point of the Parabolic SAR and the initial target profit will be the Stop Loss Point x profitFactor. For every position open will have a fixed Stop Loss Point to keep your portfolio safe and your account will not wipe out all money in a single loss position. Blackpink EA 15M consider a relevant conservative model to look for long run profit compare to other risky model.

-

Reduction Target Profit

Target Profit will be re-adjust over time to reduce the unnecessary loss or take profit when the market is less strength to continue the trends. holdHour is the maximum period hold for the open position. For every hour passed, the profit factor will be revised and new target profit will be set. After the max holdHour Blackpink EA will execute a close order for the open position opened.

IMPORTANT NOTICE

1. BLACKPINK EA DO NOT TRADE ON FRIDAY.

2. LATEST STABLE VERSION: V12.3

3. DOWNLOAD THESE VARIABLE INPUTS TO USE BLACKPINK EA. [ https://c.mql5.com/31/543/blackpink_ea_15m_300_400.set ]

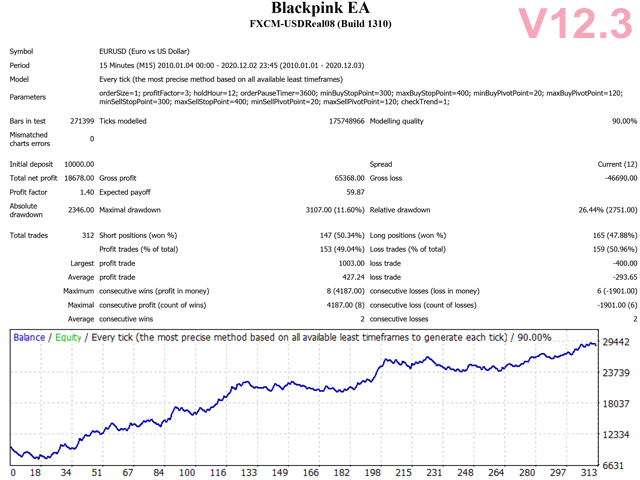

BACKTEST RESULT

This strategy is backtest with EURUSD 15m chart from 2010 to 2020 with these parameters:

orderSize=1; profitFactor=3; holdHour=12; orderPauseTimer=3600; minBuyStopPoint=300; maxBuyStopPoint=400; minBuyPivotPoint=20; maxBuyPivotPoint=120; minSellStopPoint=300; maxSellStopPoint=400; minSellPivotPoint=20; maxSellPivotPoint=120; checkTrend=1;

[ https://c.mql5.com/31/542/blackpink-ea-15m-screen-9708.png ]

| Symbol | EURUSD (Euro vs US Dollar) | ||||

| Period | 15 Minutes (M15) 2010.01.04 00:00 - 2020.12.02 23:45 (2010.01.01 - 2020.12.03) | ||||

| Model | Every tick (the most precise method based on all available least timeframes) | ||||

| Parameters | orderSize=1; profitFactor=3; holdHour=12; orderPauseTimer=3600; minBuyStopPoint=300; maxBuyStopPoint=400; minBuyPivotPoint=20; maxBuyPivotPoint=120; minSellStopPoint=300; maxSellStopPoint=400; minSellPivotPoint=20; maxSellPivotPoint=120; checkTrend=1; | ||||

| Bars in test | 271399 | Ticks modelled | 175748966 | Modelling quality | 90.00% |

| Mismatched charts errors | 0 | ||||

| Initial deposit | 10000.00 | Spread | Current (12) | ||

| Total net profit | 18678.00 | Gross profit | 65368.00 | Gross loss | -46690.00 |

| Profit factor | 1.40 | Expected payoff | 59.87 | ||

| Absolute drawdown | 2346.00 | Maximal drawdown | 3107.00 (11.60%) | Relative drawdown | 26.44% (2751.00) |

| Total trades | 312 | Short positions (won %) | 147 (50.34%) | Long positions (won %) | 165 (47.88%) |

| Profit trades (% of total) | 153 (49.04%) | Loss trades (% of total) | 159 (50.96%) | ||

| Largest | profit trade | 1003.00 | loss trade | -400.00 | |

| Average | profit trade | 427.24 | loss trade | -293.65 | |

| Maximum | consecutive wins (profit in money) | 8 (4187.00) | consecutive losses (loss in money) | 6 (-1901.00) | |

| Maximal | consecutive profit (count of wins) | 4187.00 (8) | consecutive loss (count of losses) | -1901.00 (6) | |

| Average | consecutive wins | 2 | consecutive losses | 2 | |

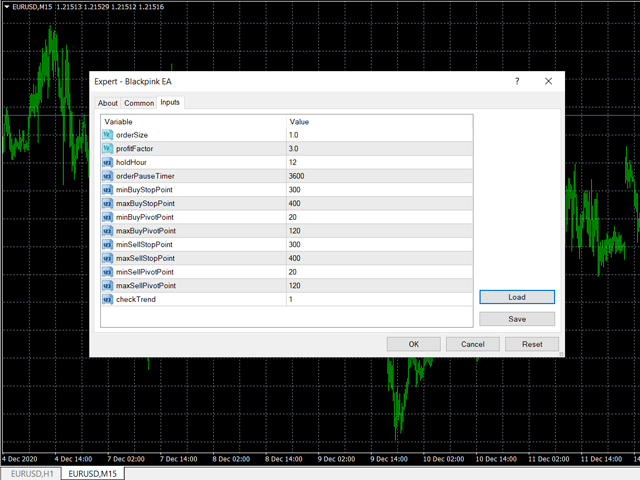

INPUT VARIABLE SUGGESTED (11/2020)

EURUSD 15M Chart

orderSize = 1;

profitFactor = 3;

holdHour = 12;

orderPauseTimer = 3600;

minBuyStopPoint = 350;

maxBuyStopPoint = 450;

minBuyPivotPoint = 20;

maxBuyPivotPoint = 120;

minSellStopPoint = 300;

maxSellStopPoint = 400;

minSellPivotPoint = 20;

maxSellPivotPoint = 120;

checkTrend = 1;