StochasticPro

- インディケータ

- Evgeniy Zhdan

- バージョン: 1.0

- アクティベーション: 10

The indicator is designed to determine the momentum of the price.

The Stochastic is recommended to be used during the lateral movement phase together with other indicators. However, some Stochastic signals have worked well in the trending market.

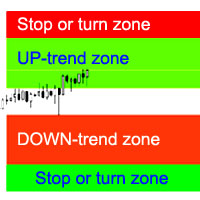

Overbought and oversold zones

Oscillator zones above 80% and below 20% are called overbought and oversold zones, respectively. When the price enters the overbought zone (that is, trades near the upper border of the range), if it bounces down, then we can expect a further fall. The signal to enter a short position is the crossing of the 80% level by the% K line from top to bottom. Similarly, a buy signal is the crossing of the 20% level by the K% line from bottom to top.

In theory, such a signal can be used sideways, but in this phase of the market it is better to combine it with other indicators. It is good to use overbought / oversold zones in a trend on your own, opening positions in the direction of the trend.