KDJ Index For MT5

- インディケータ

- Kaijun Wang

- バージョン: 1.58

- アップデート済み: 10 4月 2023

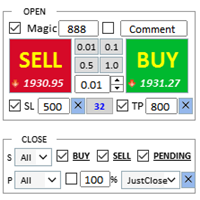

Necessary for traders: tools and indicators

| Waves automatically calculate indicators, channel trend trading | Perfect trend-wave automatic calculation channel calculation , MT4 | Perfect trend-wave automatic calculation channel calculation , MT5 |

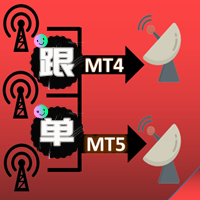

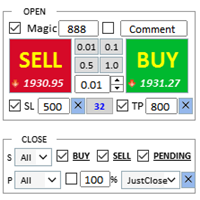

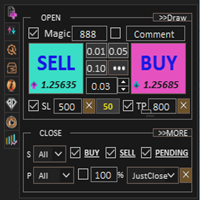

| Local Trading copying | Easy And Fast Copy , MT4 | Easy And Fast Copy , MT5 |

| Local Trading copying For DEMO | Easy And Fast Copy , MT4 DEMO | Easy And Fast Copy , MT5 DEMO |

"Cooperative QQ:556024"

"Cooperation wechat:556024"

"Cooperative email:556024@qq.com"

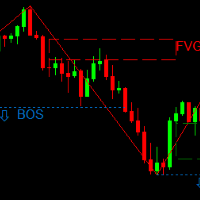

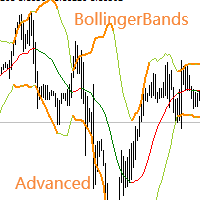

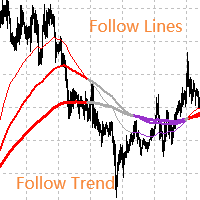

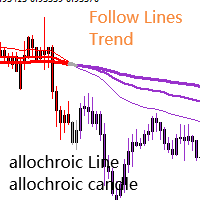

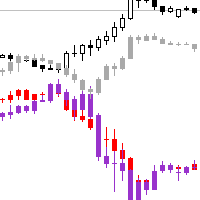

Strongly recommend trend indicators, automatic calculation of wave standard and MT5 version of automatic calculation of wave standard

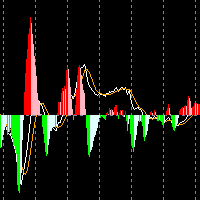

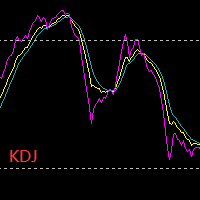

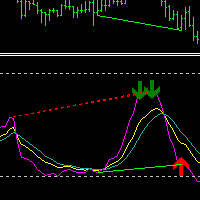

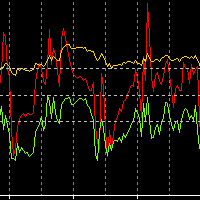

The KDJ indicator, also called the stochastic indicator, is a fairly novel and practical technical analysis indicator. It was first used in the analysis of the futures market, and then widely used in the short-term trend analysis of the stock market. It is the most commonly used in the futures and stock markets. Technical analysis tools.

The stochastic indicator KDJ is generally a statistical system used for stock analysis. According to statistical principles, it passes through the highest price, lowest price and the closing price of the last calculation period that occurred in a specific period (usually 9 days, 9 weeks, etc.) And the proportional relationship between these three to calculate the immature random value RSV of the last calculation cycle, and then calculate the K value, D value and J value according to the smooth moving average method, and draw a graph to study the stock Trend.

The stochastic indicator KDJ is calculated based on the basic data of the highest price, lowest price and closing price. The K value, D value and J value obtained are respectively formed at a point on the coordinate of the indicator, connecting countless such points, just Form a complete KDJ indicator that can reflect the trend of price fluctuations. It is mainly a technical tool that uses the true volatility of price fluctuations to reflect the strength of price movements and overbought and oversold phenomena, and sends out buying and selling signals before prices have risen or fallen. In the design process, it mainly studies the relationship between the highest price, the lowest price and the closing price. It also incorporates some of the advantages of momentum concepts, strength indicators and moving averages, so it can be quickly, quickly, and intuitively studied. Quotes. Since the KDJ line is essentially a concept of random fluctuations, it is more accurate for grasping the market trend in the short and medium term.

sir , mt4 version plz