Cross MAs Trend Entry

- インディケータ

- Georgi Gaydarov

- バージョン: 1.1

- アップデート済み: 20 10月 2020

- アクティベーション: 10

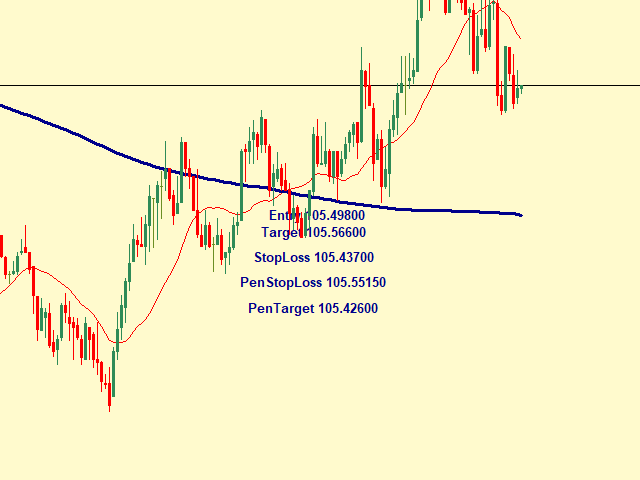

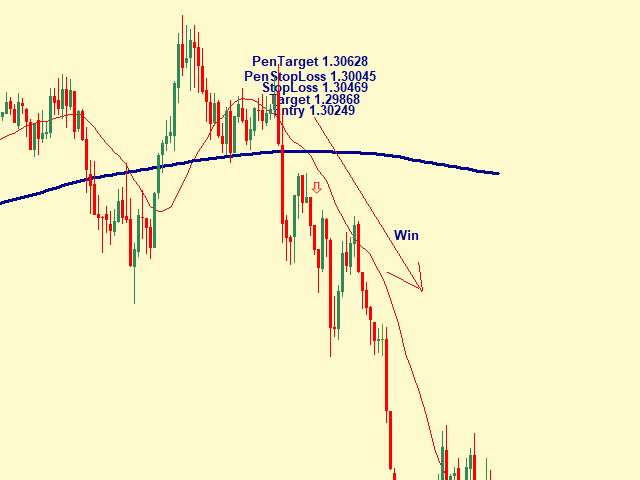

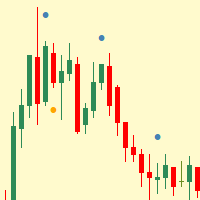

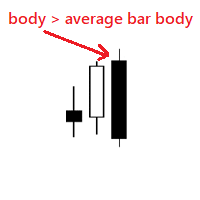

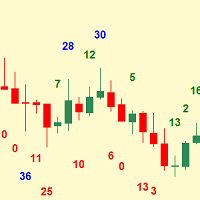

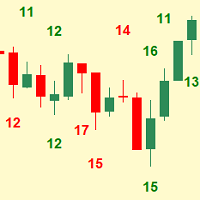

This cross MA and trend line indicator defines entries based on fast and slow MA and on the previous bot or top. The entry is displayed together with indicative prices for target and stoploss. It also gives a indicative pending sl and tp in case you set a reverse stop order.

The prices are based on tops and bots from my strategy which I use in my other indicator - https://www.mql5.com/en/market/product/56045.

The entry shows you if a correction is strong and will become reverse trend or if the correction is weak and the trend will continue. Based on that, I prefer to open straight order on the trend direction and to set pending order (on the stoploss price) in the opposite direction. This way you will profit no matter in which direction the price will go. Set the pending lots at least to cover your loss from the straight position.

! Before using the indicator please optimize it in the strategy tester for your symbols. For some symbols slow MA 400 may work, for another slow MA 300 will work, etc.

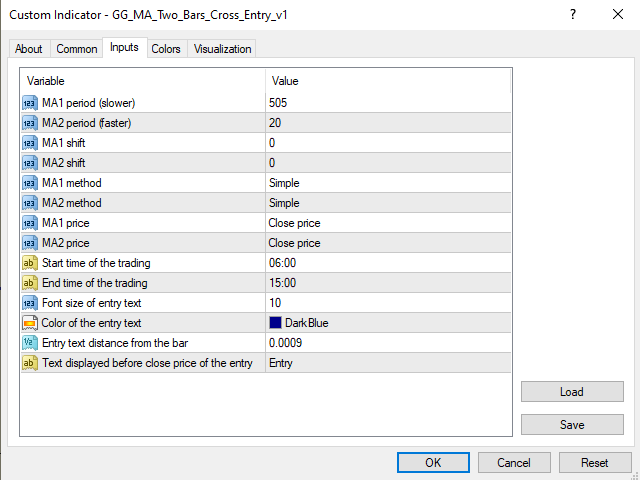

Input parameters:

- MA1 period (Slower)

- MA2 period (Faster)

- MA1 shift

- MA2 shift

- MA1 method

- MA2 method

- MA1 price

- MA2 price

- Start time of trading - from what time to start looking for entry

- End time of trading - when to stop looking for entry

- Font size of the texts

- Color of the texts

- Distance from the bar

- Text displayed for the entry

Notes:

- the indicator does not draw the MAs (to keep the chart clean). But you can always add them manually

- the indicator does not draw my tops and bots (if you want to use them for your strategies, you can check my other indicator)

- If sell order should be open the Entry is displayed above the closed bear bar

- If buy order should be open the Entry is displayed below the closed bull bar

- It works on the timeframe on which is the symbol currently

- It displays all your previous entries on initialization

- There is no strategy that works constantly, so optimize the parameters often