Absolute price

- インディケータ

- Aleksey Ivanov

- バージョン: 2.0

- アップデート済み: 19 9月 2020

- アクティベーション: 5

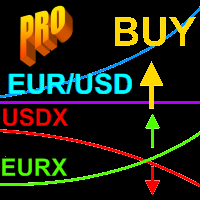

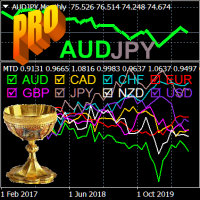

This indicator is intended for professionals assessing fundamental market trends. This indicator calculates the index of any instrument and analyzes it.

The index of the state currency shows the real purchasing power of this currency, and the dynamics of this index shows the dynamics of the economic state of the corresponding state. An analysis of the indices of both currencies included in a currency pair makes it much more reliable to identify the trend of this currency pair and assess the possibility of its continuation.

This indicator allows you to determine the index or absolute price of any currency from any currency pair, as well as the absolute price of any other instrument (metal, CFD, etc.) by correlating the quote of this instrument with the index of the dollar ( USDX) or the index of the euro ( EURX).

For instance : the Index (X) index of currency X in pairs X/USD and X/EUR is found from the ratios Index (X) = (X/USD)*USDX and Index (X) = (X/EUR)*EURX, and for pairs USD/X and EUR/X - from the ratios Index (X) = USDX/(USD/X) and Index (X) = EURX/(EUR/X).

The absolute price of a metal or CFD, the quote of which M is determined in relation to the dollar, is calculated as Index (M) = M*USDX.

The Absolute price indicator, of course, also calculates the USDX dollar index according to the standards adopted by the Intercontinental Exchange( ICE), where this index is calculated as a geometric weighted average of these currencies using the formula:

USDX= 50.14348112 * USDEUR^(0.576) * USDJPY^(0.136) * USDGBP^(0.119) * USDCAD^(0.091) * USDSEK^(0.042) * USDCHF^(0.036),

showing the value of the US dollar against a basket of six major currencies: the euro (EUR), the yen (JPY), the pound sterling (GBP), the Canadian dollar (CAD), the Swedish krona (SEK), and the Swiss franc (CHF).

A similar ratio for the euro index (adopted by the European Central Bank) is:

EURX=34.38805726*EURUSD^(0,3155)*EURGBP^(0.3056)*EURJPY^(0.1891)*EURCHF^(0.1113)*EURSEK^(0.0785).

The Absolute price indicator not only calculates the absolute prices or indices of various instruments, but also allows you to quickly analyze their behavior (tendencies and trend changes) based on a number of indicators, namely: 1) Moving Average; 2) Relative Strength Index; 3) Momentum; 4) Commodity Channel Index; 5) Bollinger Bands; 6) Envelopes.

For the indicator to work, you need to load the history (Tools / History Center) of quotes EURUSD , USDJPY, GBPUSD, USDCAD, USDSEK and USDCHF .

Using the indicator in trading.

Since the indices of currencies reflect the true economic conditions of the respective countries, the growth of the index indicates the growth of the economy, and the decline - of the fall, which expresses the true trends. Therefore, if the Index (X) of currency X in currency pair X/Y rises, and Index (Y) of currency Y falls, then this is the most reliable signal to buy X/Y. The trends of currency pairs arising from the joint growth of their constituent currencies or their joint fall are extremely unstable and subject to large and unpredictable random fluctuations. You need to identify such trends and try not to open positions on them.

After identifying a stable trend of the currency X/Y, you need to assess the possibilities of its continuation, which can be done, for example, by considering RSI (Index (X)) and RSI (Index (Y)), the possibilities of which, as well as many others, are represented by the Absolute price indicator.

Indicator settings.

- Calculate Index (absolute price). Calculate index or absolute price. Values: Index USD, Index EUR, Chart instrument index (default).

- Calculate the numerator index? Calculate the currency index in the numerator of a currency pair? Option for pairs not containing EUR or USD. Values: true (default), false (if false, the index of the currency in the denominator is calculated).

- Select the index analysis mode. Values: No (default – shows the index itself), Moving Average; Relative Strength Index; Momentum; Commodity Channel Index; Bollinger Bands; Envelopes.

- The averaging method. Values: Simple (default), Exponential, Smoothed, Linear weighted.

- The averaging period . Values: any integer (15 default).

- Deviations (STD for Bands, % for Envelopes) – deviation. Values: any real number (2.0 default).