LondonBreakout

- エキスパート

- SAMUEL EURFYL DAVIES

- バージョン: 1.1

- アップデート済み: 10 7月 2020

- アクティベーション: 5

The EA shows great potential in all three major market breakouts - Asian(Tokyo), European(London), and North American(NewYork). This EA is a sophisticated adaption of the widely used Breakout strategy and has numerous parameters for you to fine tune if you wish, or you can simply run the EA with its default values to begin with. Both back testing and live testing have concluded positively, so I am proud to be able to share this EA with you after a number of month's hard work.

The EA has been tested and optimised to take advantage of the 3 overlapping markets:

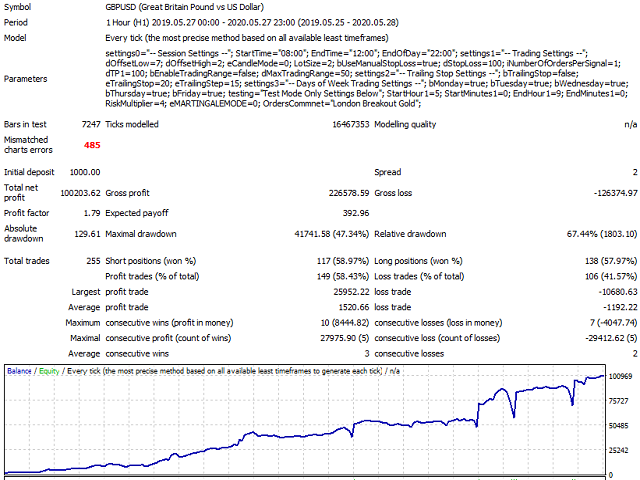

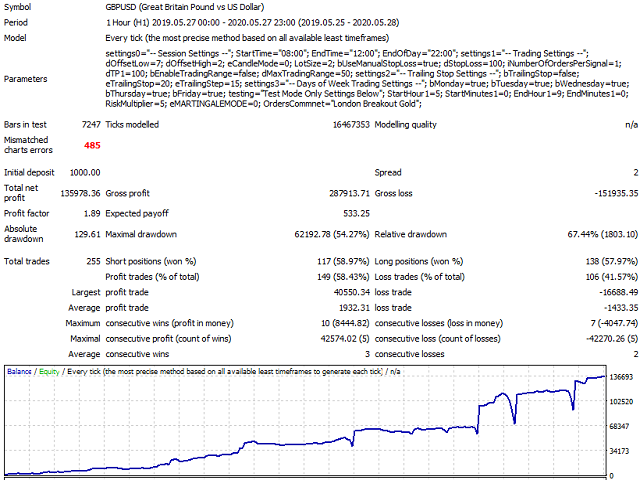

New York and London (USDGBP): between 8:00 am — 12:00 noon EST (EDT)

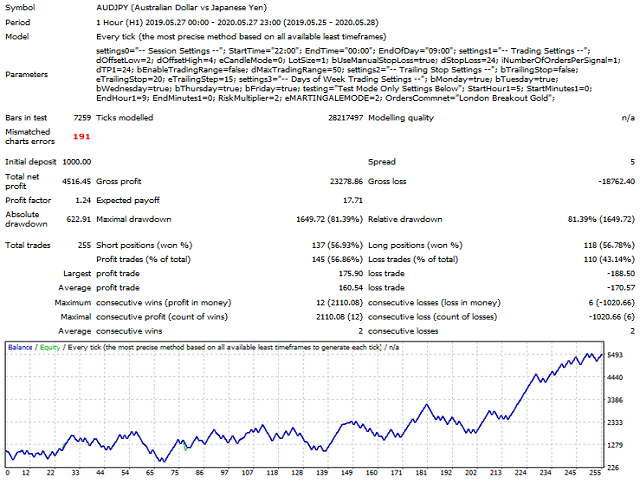

Sydney and Tokyo (AUDJPY): between 7:00 pm — 2:00 am EST (EDT)

London and Tokyo (GBPJPY): between 3:00 am — 4:00 am EST (EDT)

(from: https://www.forexmarkethours.com/)

See my uploaded images for settings and times I run on for the UK timezone. You need to set the Start time and End time depending on the currency pair you use, and note the MT4 platform is your broker time. The broker I used was ICMarkets.

This breakout strategy could be optimised for other pairs in these markets but the default settings serve an example for GBPJPY, which works especially well when coupled with Martingale. USDGBP seems to be the best performing pair so far and the potential profits are included in the images!

One significant additional feature of this EA is that it includes an exiting option to accelerate profitability, if you have the ability to manage potentially higher risk. I have integrated a Martingale feature that can be manually switched on and off and again this has shown very positive results (see images for parameter settings and profits!). Couple the Martingale with this London Breakout strategy you are left with a much stronger opportunity to implement a powerful EA strategy to suit your own risk management. This EA also defaults to automatically close off any trades that are still running by the end of the evening if it is set to include Martingale mode. This is a feature designed to protect against too many consecutive losses, which is most important when running Martingale.

Independent EA verification included the scrutinising of trade management, such as ensuring sufficient funds and volume of trades etc. You, however, need to manage appropriate Lot sizing which is very important, of course. There is a trade off between profit and risk, of course. I set the default Lot size to 0.1 with the assumption of a £1,000 starting investment, or the equivalent of which ever currency you operate in. Always remember that you need to have a good risk management approach that relates chosen Lot size to current account balance, ensuring a manageable margin and drawdown. I have attached a screenshot of what works for me and I am running this live with good results. I would not let you invest your money into something I don't personally invest in myself. I have so far ran this EA for several weeks and have not seen the GBPJPY lose more than three times consecutively on this strategy. On that basis, and being conservative, you might want to consider what would happen if you had for example an extremely rare 5 consecutive losses.

With appropriate margin, you are able to run Martingale with more than one currency pair so long as you calculate to protect against the occasion that both currency pairs suffer consecutive losses simultaneously. This, of course, is a strategic decision that you have to make based on your funds and personal approach to the risk/reward ratio.

This EA works on price action and does not rely on indicators such as moving averages and so the install is very simple. I recommend the hourly chart for best visualisation of the EA in operation. Attached screen shots contain examples of both with and without Martingale. Please contact me if you have any queries.

ユーザーは評価に対して何もコメントを残しませんでした