BuySellProf Risk Manager

- エキスパート

- Yurij Batura

- バージョン: 2.45

- アップデート済み: 20 6月 2021

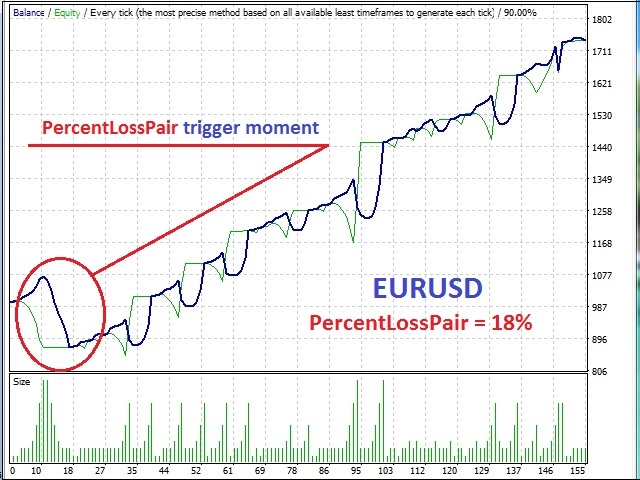

- アクティベーション: 15

Many target expert. The issue of choosing a target is solved - the direction of price movement. Locking and hedging is the main principle of this advisor. According to the law of harmonic oscillations, the price always returns to its original position sooner or later, and the forex market is no exception. Balancing simultaneously multi-directional orders, the expert captures profits at the market reversals, the more volatility, the more profit you can take on the market. But you should always remember about a reasonable ratio of drawdown and profit for a certain currency pair. The expert is very effective in conditions of high volatility (lack of certainty of the direction of price movement, news output). In the multicurrency variant, it is preferable to choose "major", liquid pairs.

Individually, at your request, the EA can trade in both mono and multicurrency options. Only in the multicurrency option, when selecting opposite currency pairs, hedging starts to work, with proper selection of pairs and input parameters, the expert does not sag more than 30% of the deposit (exceptions to force majeure market). To do this, you must attach the adviser to a new window of another currency pair with a change in the number MagicNumber and, accordingly, enter other input parameters of this currency pair.

BuySellProf Risk Manager operation signals on demo and real money can be found and examined in my profile or in MQL4 Signals.

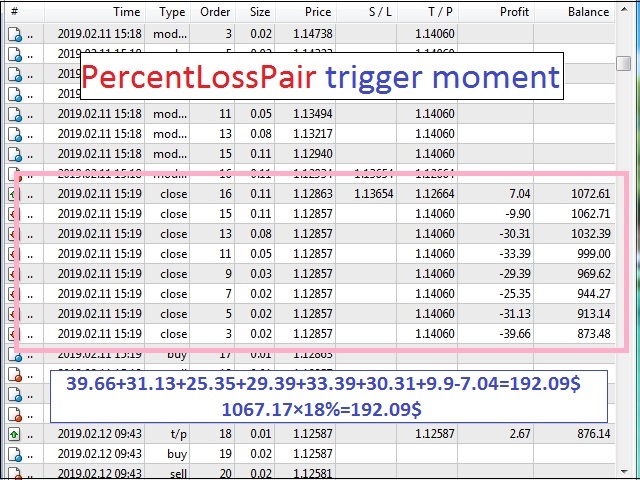

Operation description

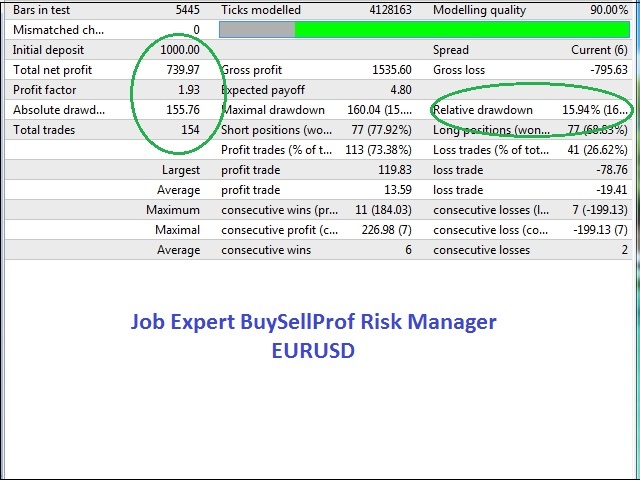

A detailed description of the principle of the expert look here. The main difference between the BuySellProf advisor and BuySellProf Risk Manager is the addition of the PercentLossPair parameter, which regulates the possible drawdown of the EA for a specific currency pair. Those. for example, for hedging, you set an expert on 10 currency pairs, but each currency pair has its own degree of volatility, an additional parameter PercentLossPair was introduced to save funds (balance) with the ability to regulate the value of a currency pair drawdown within 1 - 100%. Also, this parameter will save your funds in case of a force majeure on the forex market, when volatility can repeatedly exceed its average value in a short period of time. The results of the expert tests, see screenshots. For the convenience of working with EA, an information panel is installed in which the main parameters of the currency pair are displayed, as well as the ability to manually close profitable, unprofitable, or all orders for a currency pair. The panel also displays account balance and currency pair profit.

The expert can distinguish the type of account (real, demo or competitive). Always warn you about the possibility of trading with a robot on the server, whether you entered the login password correctly (trader password or invest password). Informs about the limits of the input parameters on this server and informs you about this through the message service Alert.

Inputs

- PercentLossPair - regulation of the drawdown of an expert for a specific currency pair(1-100%);

- TP - take profit;

- SL - stop loss;

- Use Trailing Stop - enable/disable trailing stop;

- Trailing Stop - trailing stop value;

- Lots - lot size. The trading robot allows using any lot value fractional to 0.01 or 0.1;

- Martinlot - Lots multiplier for receiving greater profit without losses; see Martingale for details (– 1 means no Martingale and increased fractionality 0.1, i.e. 1+0.1=1.1, etc.);

- MagicNumber - integer constant used to identify orders;

- MaxLots - maximum allowed lot size. In practice, that looks the following way: in case the lot size is increased from, say, 0.01 to 2 by using Martingale, all subsequent orders placed by the trading robot will have the size of 2 lots. The Martingale will work only within 0.01-2. The parameter also serves for reducing the balance drawdown during strong bullish or bearish market sentiments and volatility.