PipSense CBS

- エキスパート

- Joel Protusada

- バージョン: 1.1

- アクティベーション: 5

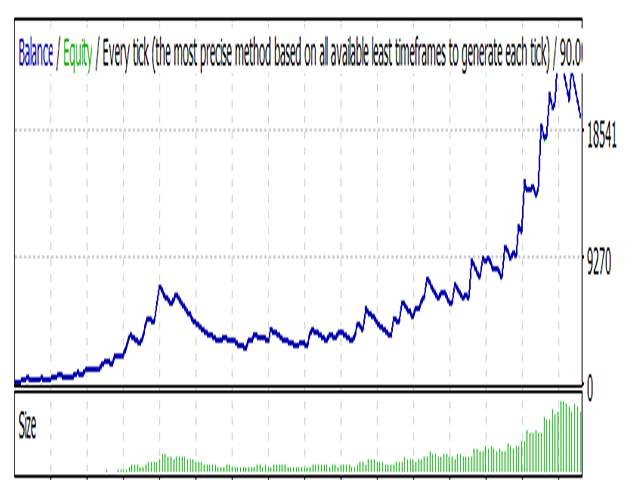

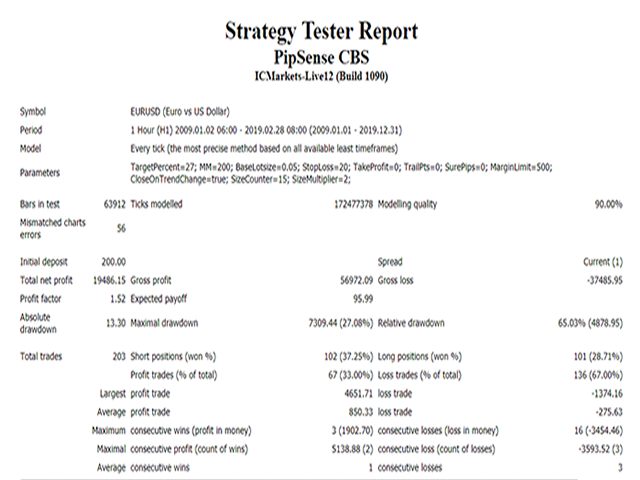

PipSense CBS (Candlestick Breakout System) is a fully automated trend following strategy with stop-loss that you can use to backtest a 10-year of data with modelling quality of at least 90%. It uses only an entry analysis based on the proprietary candlestick breakout system to detect price breakout movement. The success secrets of the Expert Advisor if backtested correctly are the combination of the entry method with the Money Management and multiple exit strategies. Once opportunity level is determined, it will open trades right away.

Correlation Secret Technique

One particular technique that only few traders have known is about correlation cut-loss. The cut-loss method can be achieved by calculating an overall equity target, which is the TargetPecent parameter. If the equity is greater than the balance plus the target percentage, all open trades will be closed including a pair with floating loss. It cut-loss negative floating loss with an overall positive profit. This method can be achieved by loading the EA to 3 currency pairs EURUSD, USDJPY, EURJPY

Psychology

Trend Following is a long-term strategy. It is not for the faint-hearted and impatient traders. Using a real trend following strategy will make you experience days, weeks, months or even a year with negative profit. But if you are patient enough to wait and once the jackpot breakout is triggered all loses will be recovered with overall positive result. After setting your final parameters, observe the visual backtest for you to see what I've been saying here. If you start the EA at the right moment, you may also experience immediate positve result but not always.

Recommendation

You should optimize the Expert Advisor to any pair you wish to use it using 90% Modelling Data for best performance. The default parameter settings are tested with EURUSD.

Features

- A Trend Following Expert Advisor that works best in H1.

- It takes advantage of the trending price movement of the market.

- Accuracy is on the trade entry when there's a price breakout.

- Uses two money management parameters only but calculates already the best lotsize.

- Stop-loss and Take-profit are used but optional. With or without SL & TP, there are good opportunities when the currency pair is optimized/backtested properly. Modelling data of 90% is ideal.

- Trail Stop is used with an option for an assured pips by setting the "Sure Profit on Trail Stop in Pips" parameter.

- Margin Level Percentage monitoring.

- Easy to set up.

Requirements

- Symbols: use only in 3 currency pairs EURUSD, USDJPY, EURJPY. You can run only one pair for conservative setup. For aggressive and moderately risky setup, you can run the 3 pairs simultaneously.

- Timeframe: H1.

- Maximum Leverage 1:500. Should be backtested properly on each pair.

- Minimum Leverage 1:200. Should be backtested properly on each pair.

- Fund deposit: Below $200 is risky. $600 or more is ideal fund to start.

- Account type: non-ECN and ECN-ready.

- Account currency: USD.

- The EA should run 24/5. For stable server and internet, you need a VPS.

Money Management Formula

Please see Parameters

Lots = (Account Balance / MM) * Baselotsize

Parameters

- TargetPercent - This is a group target if more than 1 pair is used.

- MM - Money Management, this is used to divide the Account Balance then multiplies to BaseLotsize.

- BaseLotsize - the lotsize multiplier after calculating the MM parameter.

- Stop Loss in Pips - You can protect your trade by setting this, but optional. Set to zero if you don't want a stop-loss.

- Take Profit in Pips - You can set this for a specific target profit in pips. This is optional. Set to zero if you don't want a take-profit.

- Trail Stop Loss in Pips - This a trail stop to protect positive profit. Set zero to disable.

- Sure Profit on Trail Stop in Pips - If trail stop is enabled, set a value here if you want an assured positve profit.

- Margin Level % Limit - if you use an aggressive MM/lotsizing and trading multi-pairs, set this to monitor the margin level % to avoid over trading.

- Close Trade on Trend Change - If set to TRUE, it will close the open trade once the trend has changed against the trade.

- Number of Bars to Calculate - A parameter for a proprietary analysis formula to detect price breakout.

- Breakout Level - A parameter for a proprietary analysis formula to detect price breakout.