Entropy

- エキスパート

- Segun Oladipo

- バージョン: 2.1

- アップデート済み: 6 6月 2022

- アクティベーション: 10

Entropy is an expert advisor with artificial intelligence that has the ability to self-learn and adapt to the constant chaos and disorderliness in the market. Entropy algorithm was developed in a way to ensure minimal human input or intervention to determine the in-coming market sentiment and price action that is extremely hard to pick by human eyes or manual trading.

The strategy and method in which Entropy is based on comply strictly to the core rules of trading and has an edge in its simplicity and its ability to preserve initial capital and opening position when the potential for profit far outweighs likely loss. Entropy does not usually operate when spreads widen or there is increased volatility in the market that has the potential for huge pair slippage and other adverse market events.

There are inbuilt time zone and DST adjustment engine that detects broker time and seasonal time changes. Therefore, there is no need for time change hassle and a news engine that will put the expert to sleep mode if there is any economic news with the potential for an unpredictable effect on market technicalities. We also aimed to address some major mistakes traders, developers and coders make when implementing their so-called promising strategies that only deliver amazing result in visual back-tests, but fail woefully on a demo and ultimately on a live trading account.

No toxic or margin hugging technique, like Martingale, Averaging, Gridding, Zone Recovery Strategy.

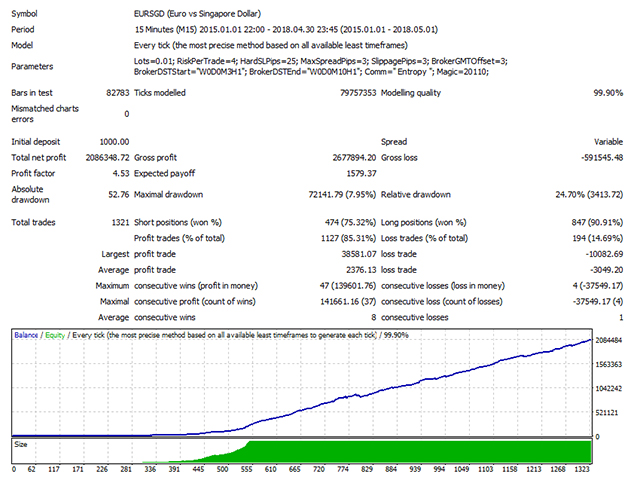

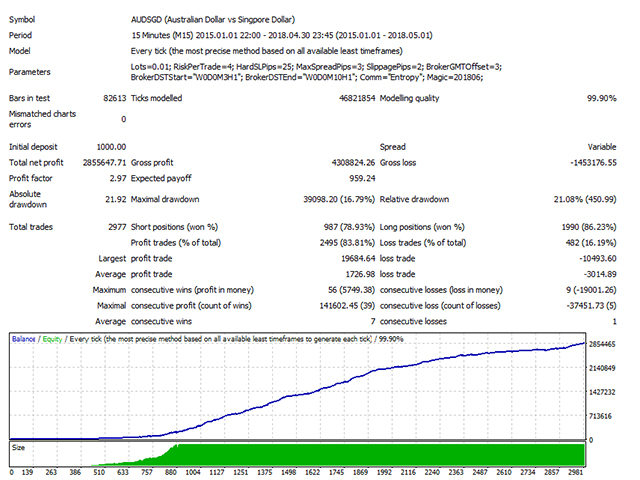

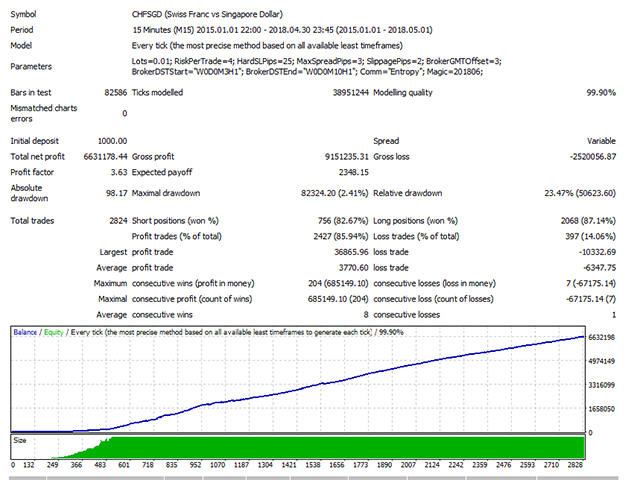

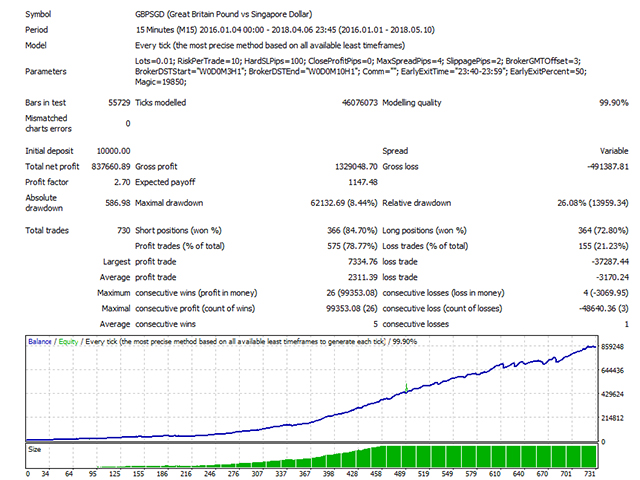

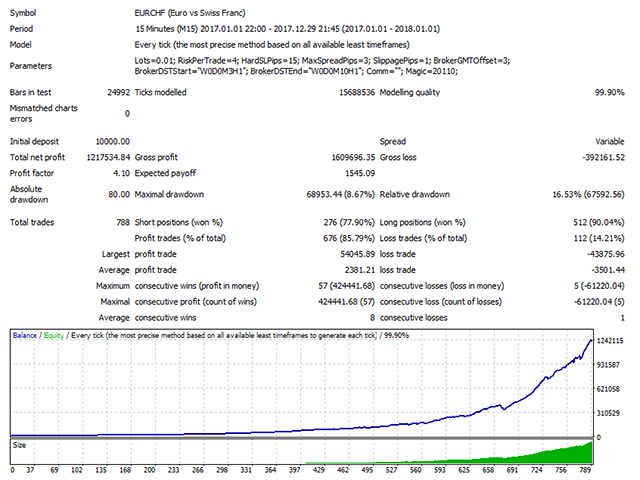

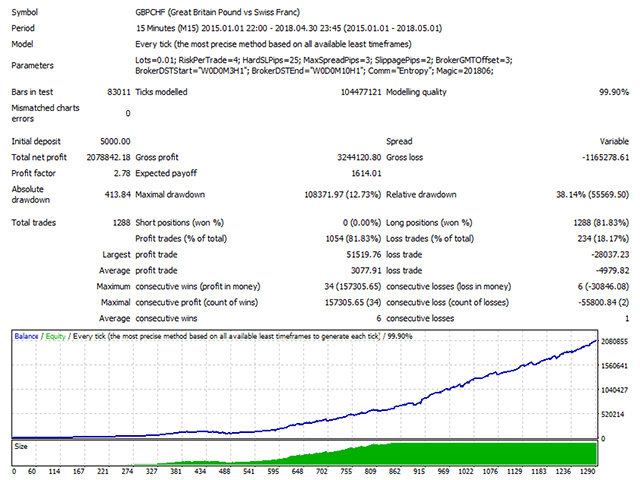

Entropy is designed to always use solid stop loss which is meant to limit risk in case of terminal crashes, server disconnects. Seasoned traders can never rule out the importance of strict money management and preserving capital to live to trade on another day. As such, risk per trade is set with all trades and most other parameter are intelligently defined by the algorithm. EA has been tested using different stress test with 99.90% tick data spanning over 10 years including Monte Carlo Robustness, worst case variable spread (with commission and slippage) and no curve fitting and It will also automatically adjust itself to 4 and 5 digit quotes.

As a caveat, we do not make promises or guarantee profit with this algorithm and like every other system out there, there will be a stagnation period that will span for days maybe weeks or month. Overall, the Entropy algorithm will weather the stagnation and the positive movement will eventually outweigh the stagnation time. You are encouraged to perform your due diligence by backtesting and demo-trading with your broker to see what potential it has in a live environment with your desired broker first.

Expert Recommendations

- Server: Low latency VPS

- Symbol: EURSGD, AUDSGD, CHFSGD, GBPSGD, EURCHF, GBPCHF, GBPAUD

- Time Frame: Default expert setting optimized for M15, it can be re-optimized for M30

- Broker: Low spread with commission

- Deposit: Greater than $200

- Leverage: Greater than 1:200

- It is important to note that backtesting Entropy in MT4 Strategy tester does not take account of the prevailing news. Therefore, the backtest and live trading results may vary. For faster backtesting select false for "Avoid trade on news"

Input Parameters

- OpenDirection: Long only, short only or long and shorts positions

- DynamicLots: False for fixed lot or true for automatic lot calculation

- Lots: If false in DynamicLots fixed lots will be used

- RiskPerTrade: Percent of equity to risk per trade (Risk more than 4% not recommended)

- HardSLPips: Solid stop loss

- MaxSpreadPips: Maximum spread allowed in pips

- SlippagePips: Maximum slippage allowed in pips

- BrokerGMTOffset: Broker standard GMT offset hours - GMT+2/+3(EET)

- BrokerDSTStart: Transition to DST

- BrokerDSTEnd: Transition from DST

- Comment: comment

- Magic: Identifying trades from different expert advisors and when trading platform restarts

- DisplayOnChart: Display spread, swap, balance and win rate on chart

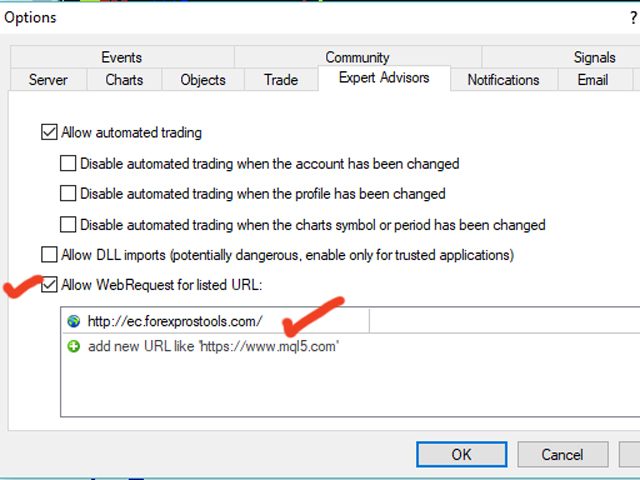

- Avoid trade on news: Enables the use of news filter engine

PS: Entropy has been designed to work for many instruments including metals, indices, and energy. However, for the sake of safety, it is not recommended to use this EA outside the recommended pair, risk, and time-frame described above. Please message me if you have any question or clarification.

I am 17% up since I got Entropy Ea. Following his advice it works well with Singarpore dollar my broker does not give me best deal with SGD.

I wish it also works with pairs like with euro dollars.