FutureTrade

- インディケータ

- Andrey Spiridonov

- バージョン: 1.0

- アクティベーション: 20

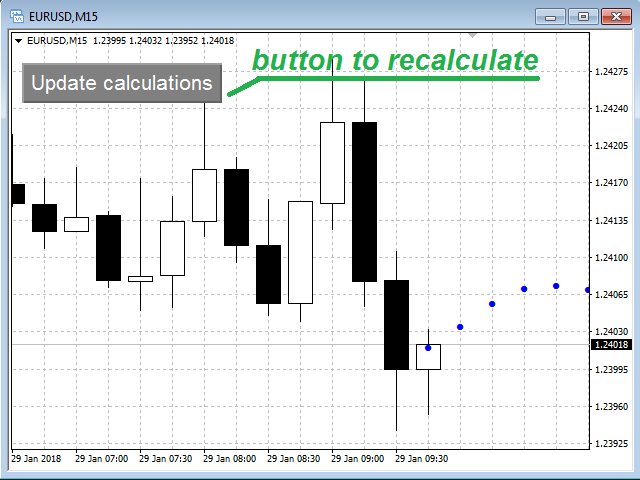

FutureTrade is one of the few indicators that predicts the price right on the price chart. The indicator calculation algorithm is based on the fast Fourier transform. Given the oscillatory behavior of the price, the Fourier function predicts its future behavior. The indicator should be attached in the usual way to a chart with the trading instrument specified symbol and with the M15 timeframe. This timeframe is the most optimal for working with any symbols. Once started, the indicator calculates the price forecast and displays it on the chart in the form of blue dots. They serve as a guide for the trader. Even if the price starts deviating from the predicted values, it is most likely to return to these values. The "Update calculations" button is located at the top left corner of the chart. It recalculates the price forecast. Instructions on when and how to use this button are provided below. The timeframe cannot be changed, the indicator automatically sets M15.

Advantages of the indicator

- The indicator works with any trading symbols

- It is possible to recalculate the indicator values at any moment by using the "Update calculations" button

- The indicator is suitable for scalping, short-term binary option trading, medium-term trading

Parameters

- K=200 - the number of bars to calculate the indicator, this affects the accuracy and speed of calculation (the default value is recommended)

- symbol="EURUSD" - trading symbol for the indicator

Trading recommendations

- Do not trade during the releases of high-impact news and when passing from one trade session to another.

- Press the "Update calculations" button to recalculate the indicator values.

- Open a trade position in the price direction predicted by the indicator (blue dots).

- Set take profit within the limits of the predicted price. A minimal take profit is recommended (see the screenshot).

- After that, wait for take profit to trigger. If the current price deviates from the forecast with time (2-3 candles after the position was opened), recalculate the indicator values by pressing the "Update calculations" button. If the new forecast is made within the opened deal, the price is most likely to return to the predicted value - wait for take profit to trigger; otherwise, close the position with a loss.

- It is recommended to use a fixed stop loss depending on the market situation.

WORTH MILLIONS$ THE BEST EVER! FRIENDLY SUPPORT!