Extremum Scalper

- エキスパート

- Tetyana Shcherba

- バージョン: 1.65

- アップデート済み: 3 4月 2020

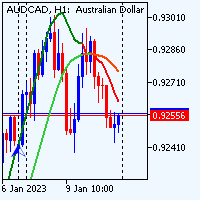

Extremum Scalper is a fully automated Expert Advisor, that uses a dynamic MM, probabilistic analysis and also strategy of breakout/rebound from the levels of daily and local extremes, and the candlestick Highs. The price Highs and the tick volume serve as the analyzed parameters.

- Works in different markets with all trade execution modes.

- Does not use martingale or hidden methods of increasing the position volume.

- The EA has 9 different extremum calculation algorithms.

- Uses a drawdown protection, slippage control, spread filter.

- Flexible settings allow you to create your own scalping strategy.

Live signal https://www.mql5.com/en/signals/341952

Full description https://c.mql5.com/6/812/ExtremumScalper_Full_Description_EN.zip

Main Settings

- Trade Direction - a selection of the trading direction Buy/Sell/Both.

- Maximum Risk 10 serial losses - the maximum risk on a losing series of 10 orders in percent.

- Fix LotSize - fixed lot, used if Maximum Risk 10 serial losses = 0.

- Maximum Daily Loss and Maximum Daily AverageSlippage – maximum allowed daily losses and slippages. If not equal to zero - when reaching the specified values, the EA will take a trading pause and go into the standby mode until the next day.

- Spread Filter – Maximum allowed spread for opening orders. Disabled if set to 0.

- Add Spread - when enabled, the current value of the spread will be added to the stop loss, take profit and parameters of trailing

- Strategy – the LocalChannel, DaysPlusChannel, GreedChannel strategies - differ in the number of simultaneously set levels. These modes are sensitive to spreads and the size of commissions on the account. The MaxPoint, MaxVolume, MaxSize, StaticSize and CandleMix modes are based on detection of the maximum values of the corresponding parameters of the current candle, the size of which is controlled by the Extremum Candle Size setting. These modes are more resistant to the size of spread, but the number of trades on them is considerably lower than in the previous modes.

- Extremum Range – the number of candles (range) to search for extremums.

- The Period of placing orders – the time period after which the EA checks the conditions for placing new pending orders.

- The Maximum Period of existence orders- the lifespan period of the pending order.

- Minimum Distance of placing orders – the minimum distance from the price to place an order. If set to zero, it will be calculated automatically.

- HighCorrection,LowCorrection – distance from extremums to place the order. It can take both a positive and negative value.

- Use Rebound orders – use the extremum level rebound strategy.

- Rebound place Mode – rebound order placement mode. Candle - the order will be placed on the High/Lowof the previous candle. Stop - the order will be placed on stop-loss level of the main order.

- Trade LOG LEVEL - logging mode, responsible for the amount of information output by the EA, which can be seen in the "Journal" and "Experts" tabs.

- Acceleration of the optimization and testing - allows to speed up optimization and testing. When enabled, the 'Maximum Daily Loss' and 'Maximum Daily AverageSlippage' parameters will not be considered during optimization and testing.

Addition

- Priority timeframe - M30.

- I recommend using pairs with an average spread of fewer than 10 points.

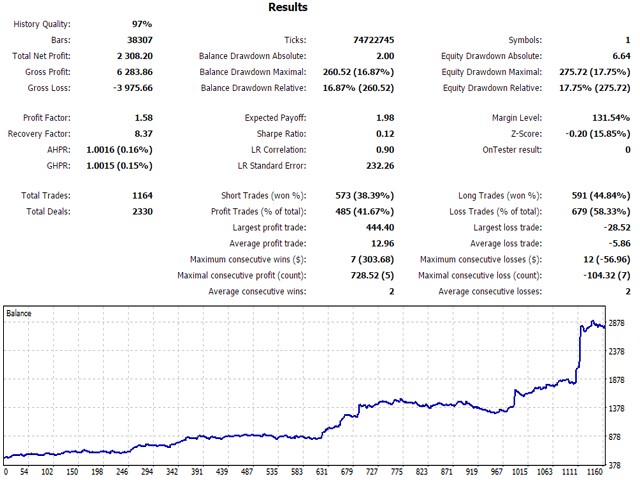

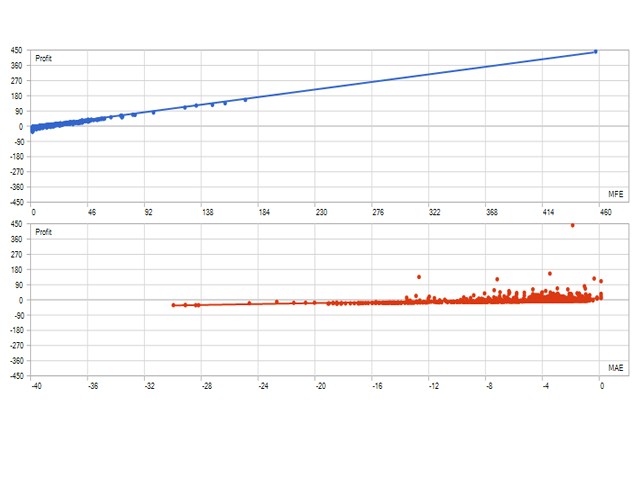

Back Tests are excellent.