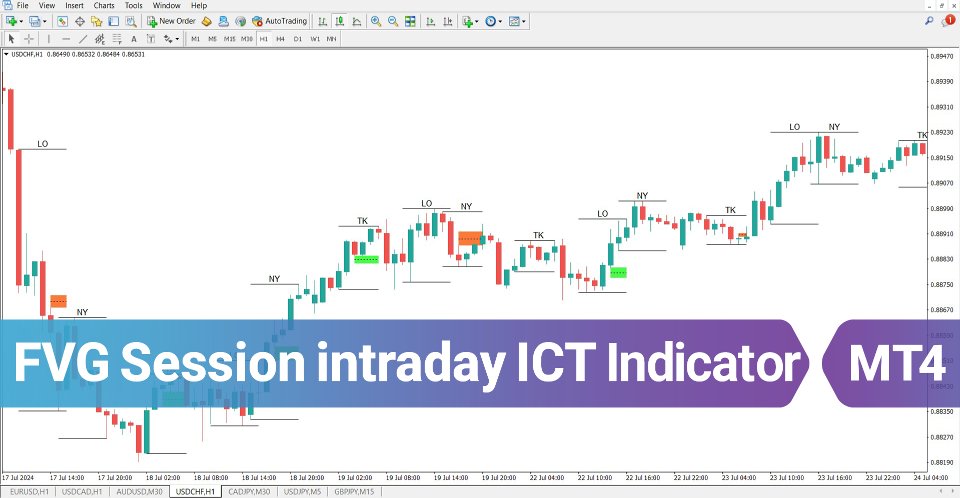

Fair Value Gap intraday Sessions ICT MT4

Intraday Fair Value Gap (FVG) Sessions Indicator for MT4

The Intraday FVG Sessions Indicator is a specialized tool designed for MetaTrader 4 (MT4) that integrates session-based price action with Fair Value Gaps (FVGs). It automatically highlights key highs and lows during New York, London, and Tokyo trading sessions, using horizontal markers to define critical price zones.

Additionally, the indicator detects the first Fair Value Gap (FVG) at the session's opening and closing times. Bullish FVGs are marked in green, while bearish FVGs appear in red, helping traders identify market inefficiencies with precision.

«Indicator Installation & User Guide»

MT4 Indicator Installation | Fair Value Gap intraday Sessions ICT MT5 | ALL Products By TradingFinderLab | Best MT4 Indicator: Refined Order Block Indicator for MT4 | Best MT4 Utility: Trade Assistant Expert TF MT4 | TP & SL Tool: Risk Reward Ratio Calculator RRR MT4 | Money Management: Easy Trade Manager MT4

Key Features

The following table summarizes the core attributes of the Intraday FVG Sessions Indicator:

| Category | ICT - Liquidity - Session |

| Platform | MetaTrader 4 |

| Skill Level | Intermediate |

| Indicator Type | Trend Continuation - Reversal |

| Time Frame | Multi-timeframe |

| Trading Style | Intraday Trading |

| Market | Forex - Cryptocurrency - Stocks - Commodities |

Indicator Overview

This indicator plays a crucial role in the ICT (Inner Circle Trader) methodology, helping traders pinpoint and analyze Fair Value Gap (FVG) zones effectively. When these gaps are breached in the opposite direction, they fade out, indicating that the level is no longer valid for trading.

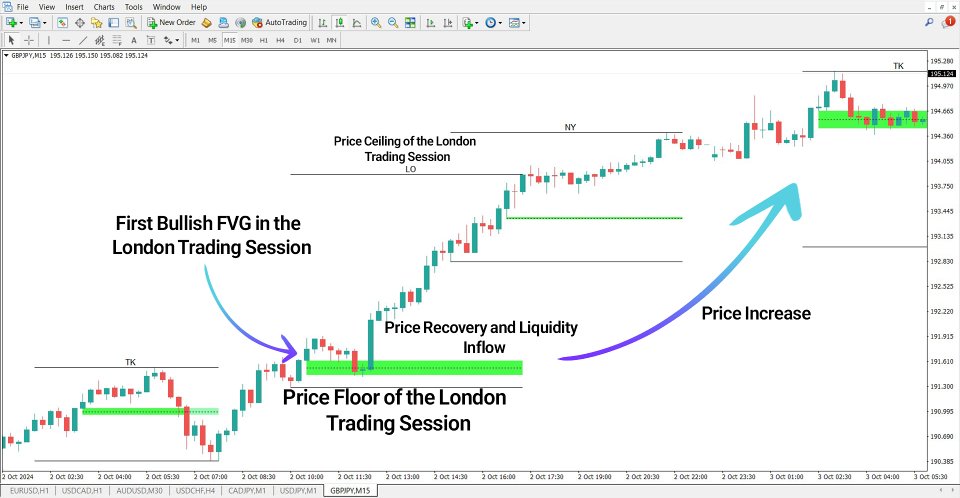

Example in an Uptrend

The chart below demonstrates a 15-minute GBP/JPY price movement during the London session, where a bullish Fair Value Gap (FVG) forms. Price later retraces to this zone, absorbing liquidity before a potential buying opportunity arises. Stop-loss orders are typically positioned just beyond these levels for risk management.

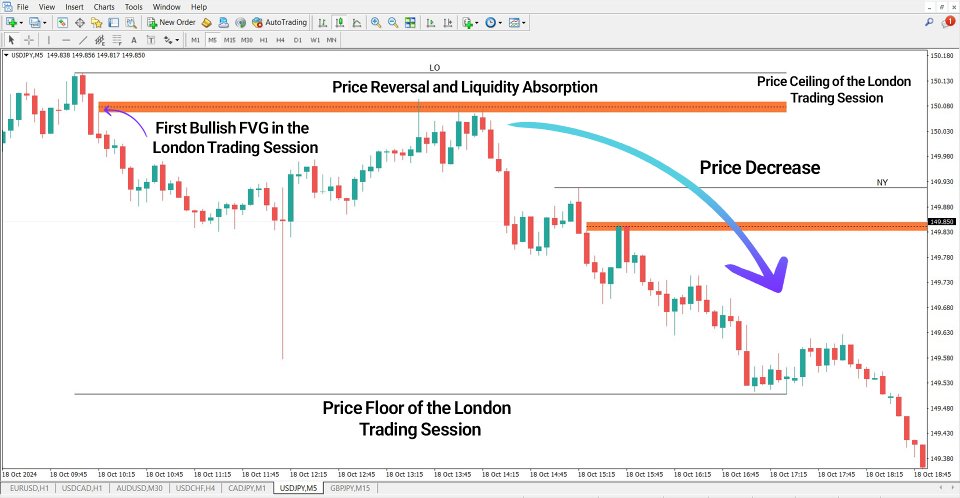

Example in a Downtrend

In a 5-minute USD/JPY chart, a bearish Fair Value Gap (FVG) develops. The price retraces to this imbalance zone, triggering pending orders and capturing liquidity before resuming its downward trajectory. This confirms a continuation of the prevailing bearish momentum.

Indicator Settings

Below are the key customization options available for the Intraday FVG Sessions Indicator:

- Tokyo session timing: Adjusts the Tokyo market hours

- London session timing: Modifies the London trading parameters

- New York session timing: Defines the New York market timeframe

- Width filter: Specifies the range width

- Minimum width value: Sets the minimum FVG zone threshold

- Server-GMT offset: Aligns session timing with the correct timezone

Conclusion

The Intraday FVG Sessions Indicator is a valuable tool for identifying high-probability price action setups by marking Fair Value Gaps (FVGs) across major trading sessions. It helps traders recognize potential entry and exit points while dynamically removing invalidated FVGs to refine trading decisions. By leveraging this indicator, traders can enhance their market structure analysis and liquidity-based trading strategies effectively.