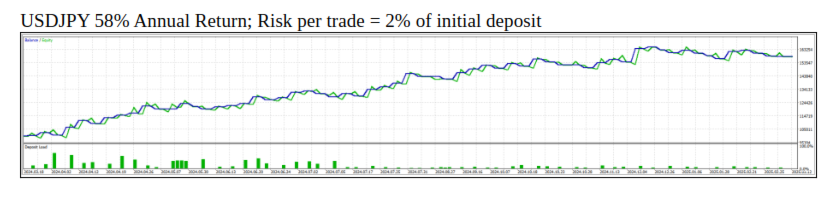

ZING an EA based on Multiple Stochastics

- エキスパート

- Better Trader Every Day

- バージョン: 1.0

INITIAL OFFER

Free downloads that will work in live accounts until April 30th 2025. Afterwards, the EA will stop trading.

On May 1st 2025, paid downloads for unlimited-use will be available for the first five downloads or 5 days, whichever is first, for just 30 US$ each.

After the first five paid downloads, or 5 days, ZING will be sold at the regular price of 249 US$.

Before running ZING, make sure that your account size matches with the initial deposit input parameter in the set file you are running.

ZING FEATURES

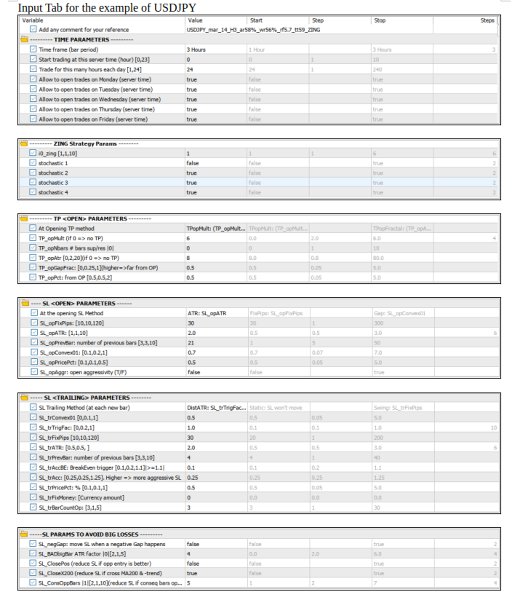

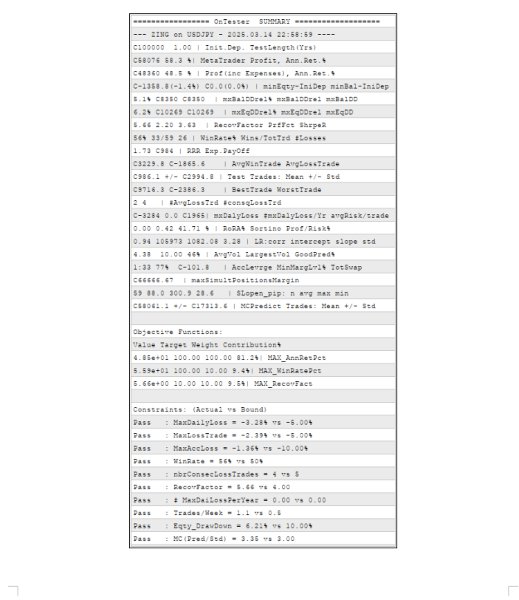

- ZING is an expert advisor that uses four stochastic indicators and two time frames to predict the price trend and trigger a trade.

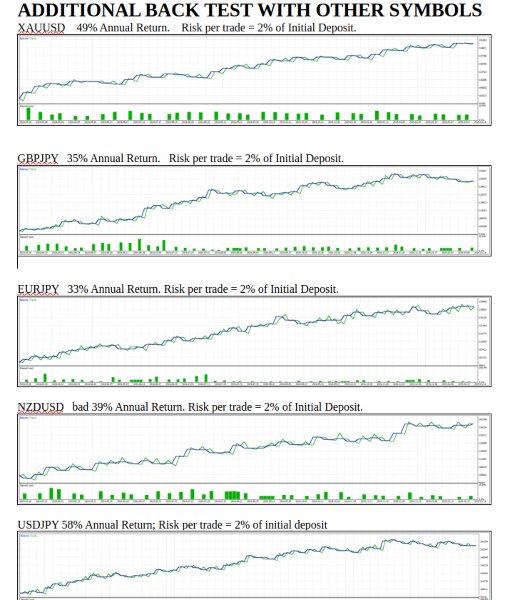

- It trades ANY Forex symbol, ANY metal symbol. We recommend major ones: combinations of USD, GBP, JPY, EUR, AUD, CAD, XAU.

- User may run any number of symbols in parallel by running an instance of this robot on each symbol.

- It does not use grid, martingale, or hedging strategies. Don’t be fooled by other EAs that show exponential growth in back testing.

- Account type: Netting or Hedging. It always use Netting rules.

- Initial Balance, lot size and leverage are subject to your broker's limits.

- User level required: from beginner to expert traders. It requires user to know the MetaTrader 5 Optimization tools as we recommend to optimize parameters before running live.

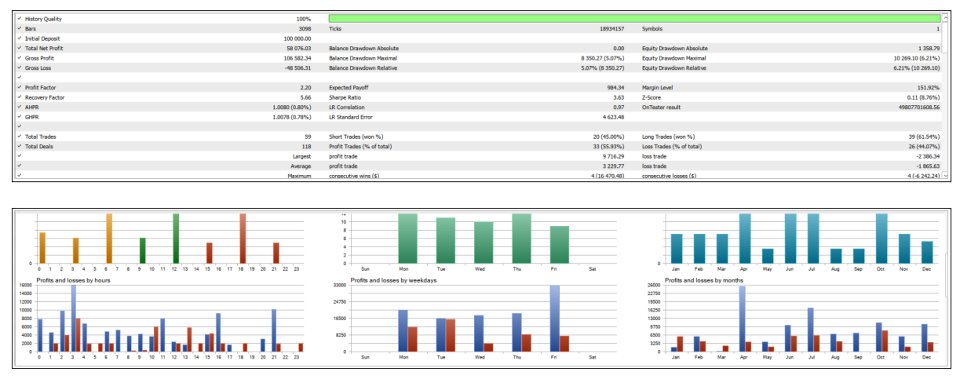

- Users can optimize variables to get strategies with high annual return, low risk, high win rate, high expected payoff, high probability of success, and more, based on the training data.

- All time frames are available.

- All trades are opened with a Stop Loss automatically. Never lose more of what you risk in a given trade.

- User may select which days of the week to trade.

- User may select a time window for trades (start/end hours).

- There are multiple methods for opening Take Profit (TP) calculation.

- There are multiple methods for the opening and trailing Stop Loss (SL) calculation.

- There are multiple methods to handle large changes in price (positive or negative).

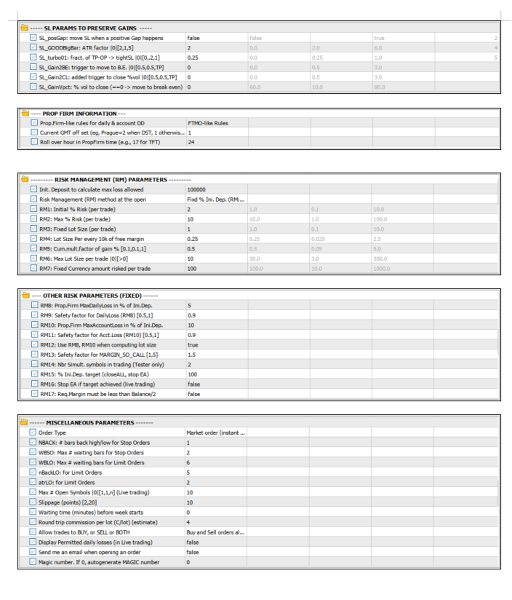

RISK MANAGEMENT

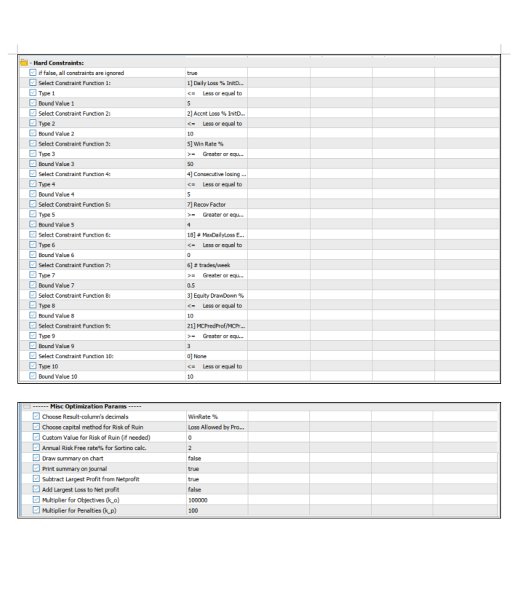

- There are multiple options to calculate money at risk and lot sizes that the user can chose from.

- ZING is Proprietary Firm friendly: at every tick, it checks max daily loss and max account loss limits.

- It closes positions and suspends trading until next day if daily loss limit is approaching.

- It closes positions and stops trading if account loss limit is approaching.

- It stops trading and closes positions when Prop. Firm target is achieved (optional).

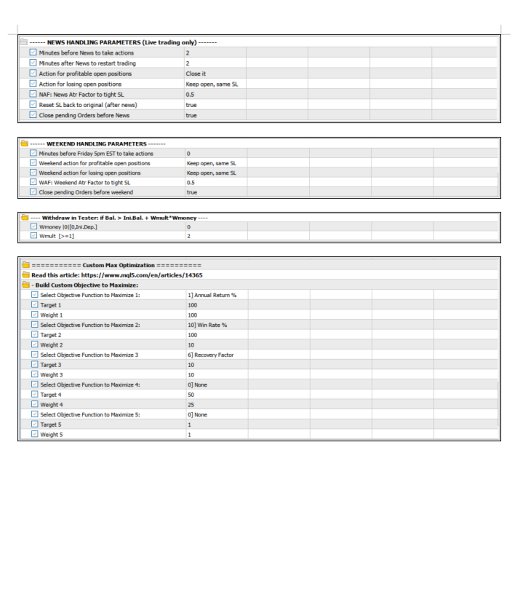

NEWS and WEEKEND HANDLING

- It handles high importance news (it ignores low and medium priority news).

- It handles open positions and pending orders before and after the news.

- It handles open positions and pending orders before weekend starts.

OPTIMIZATION

- We recommend to run the MT5 optimization tool every one or two weeks on the symbol of your interest. This solves the problem with many EAs which become unprofitable after few weeks.

- We recommend to optimize with the Generic Optimization Formulation (GOF) explained in this article: https://www.mql5.com/en/articles/14365

- Users can optimize variables to get strategies with high annual return, low risk, high win rate, high expected payoff, high probability of success, and more, based on the training data.

YOUR COMMITMENT IS REQUIRED

The more time you spend learning this EA, and the more often you optimize parameters, then the more likely the EA will perform well. ZING has lots of parameters, each with multiple levels, hence the need to optimize them. In one hand, this feature may seem a disadvantage compared to other simpler EAs, on the other hand, you have in your hands the power to improve the EA as weeks and months pass. Other simpler EAs (some of them that only work for one symbol and cannot be optimized) will work well for a while, but eventually will under perform due to changing market conditions. ZING can be optimized as the market changes. We recommend to optimize parameters weekly or bi-weekly, but you can do it less or more often.

RISKS

-

Before purchasing this (or any!) EA, be aware of risks involved.

-

Past performance is not a guarantee of future profitability (EA could also incur losses).

-

Back-tests shown are optimized for the training data, and the performance cannot be directly applied to live trading in the future.

-

There is a probability (although small) when using any EA that you may lose money in all your trades.

-

Hence, risk the amount of money you are comfortable losing.