Trend Following Pro

- エキスパート

- Yeoh Kia Gee

- バージョン: 1.80

- アクティベーション: 5

TREND FOLLOWING PRO EA

1. OVERVIEW

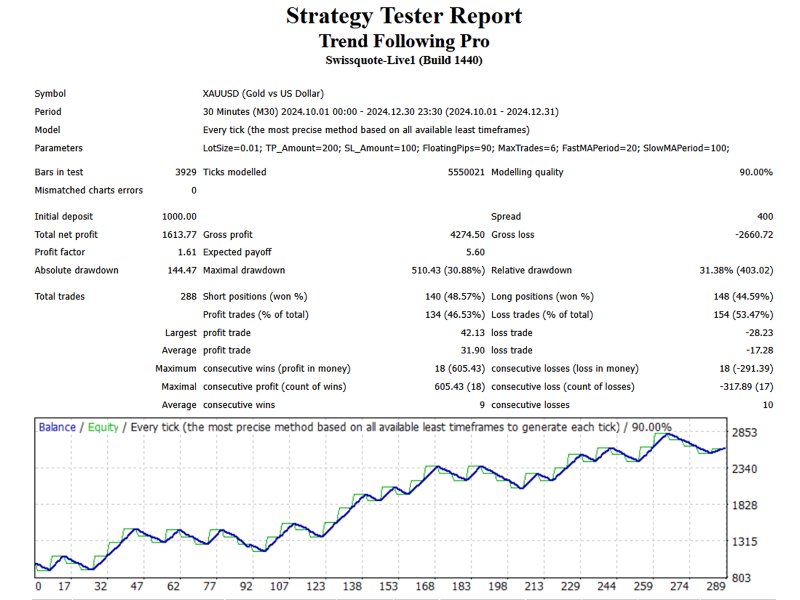

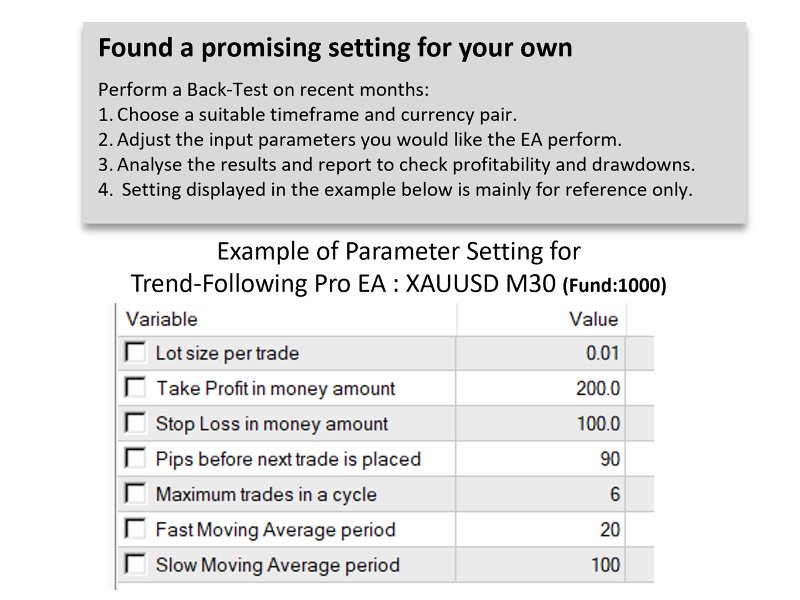

The Trend-Following EA is an automated trading system designed to capitalize on market trends using moving averages. By analyzing price momentum, this EA identifies optimal trade entries and exits, ensuring effective trend-based trading. It is suitable for traders who prefer a systematic approach to following market movements without manual intervention.

2. Trading Strategy

- The EA identifies trend direction based on the crossover of Fast and Slow Moving Averages.

- A BUY trade is executed when the Fast MA crosses above the Slow MA.

- A SELL trade is executed when the Fast MA crosses below the Slow MA.

- Subsequent trades are opened if the price retraces by FloatingPips not favour of the trend.

- Trades are closed when total floating profit reaches TP_Amount or total floating loss reaches SL_Amount (absolute value without – sign).

3. Best Timeframes for Trend-following EA

- H1 (1-Hour) – Best for swing trading with moderate trade frequency.

- H4 (4-Hour) – Suitable for catching medium-term trends with reduced market noise.

- D1 (Daily) – Ideal for long-term trend following, minimizing false signals.

- Lower timeframes (M1, M5, M15) can generate too many signals, leading to false breakouts and overtrading.

4. Risk Management

- The EA ensures controlled exposure by limiting the number of trades.

- Trades are only executed within predefined TP and SL limits.

- Position sizing can be adjusted through LotSize for better risk management.

- FloatingPips prevents excessive trade stacking by spacing out additional trades.

- Recommended to use on trending markets such as major forex pairs and XAUUSD. Suitable for M30, H1 and H4 timeframes for optimal trend-following.