BPR and SFP indicator ICT MT4

BPR and SFP Indicator for ICT Trading on MT4

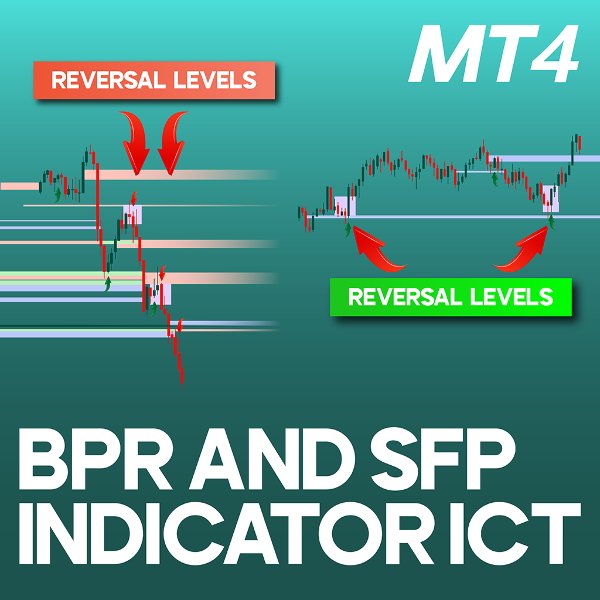

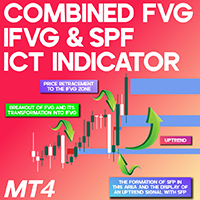

The BPR + SFP Indicator integrates two highly effective trading concepts: Breakout and Retest (BPR) and Swing Failure Pattern (SFP). This combination enables traders to assess market strength and pinpoint optimal entry opportunities with greater accuracy.

By analyzing price action and market reactions at significant levels, this indicator helps identify swing failures, breakouts, confirmations, and retracements. It offers clear visual alerts through green and red arrows, making trend reversals

and trade setups easier to recognize.

BPR + SFP Indicator Specifications

Below are the key features of the BPR + SFP Indicator:

| Category | ICT - Smart Money - Liquidity |

| Platform | MetaTrader 4 |

| Skill Level | Advanced |

| Indicator Type | Continuation - Reversal |

| Timeframe | Multi-timeframe |

| Trading Style | Day Trading |

| Market Type | All Markets |

Indicator Overview

This tool integrates SFP and BPR patterns within the ICT (Inner Circle Trader) framework, forming a strategic approach for analyzing price movements. By utilizing both patterns, traders can efficiently navigate volatile market conditions while identifying ideal entry and exit positions.

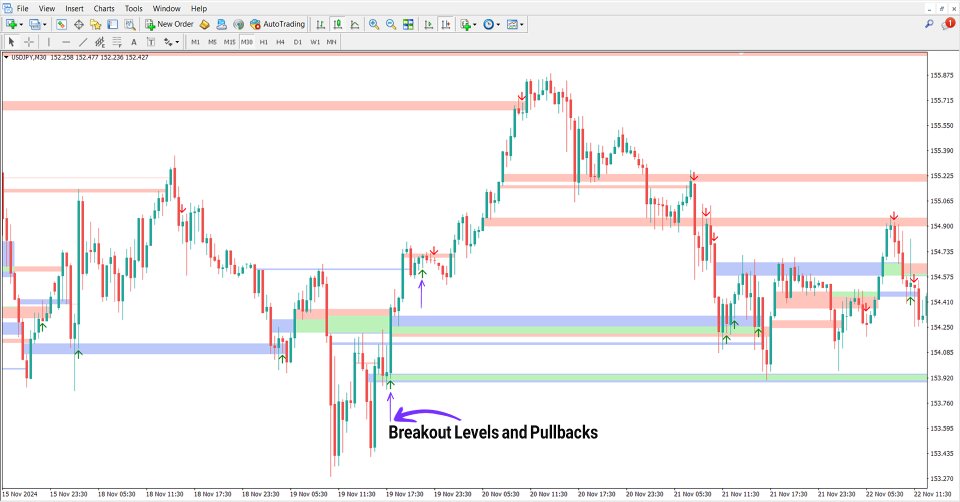

Bullish Market Conditions

On a 30-minute USD/JPY chart, green arrows appear following confirmed breakouts, highlighting potential upward trends. These signals assist traders in spotting favorable buy setups.

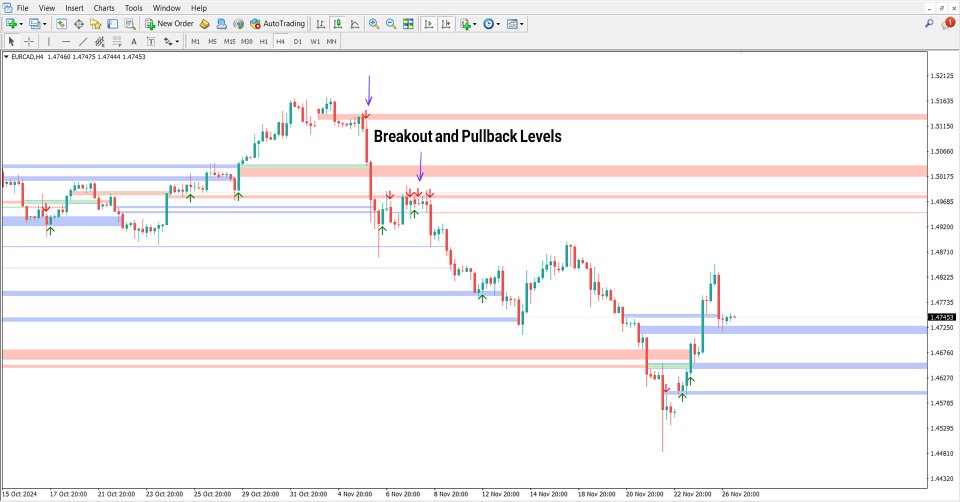

Bearish Market Conditions

A 4-hour EUR/CAD chart displays red arrows, indicating bearish trends. These signals help traders validate breakout patterns and avoid potential misinterpretations in market movements.

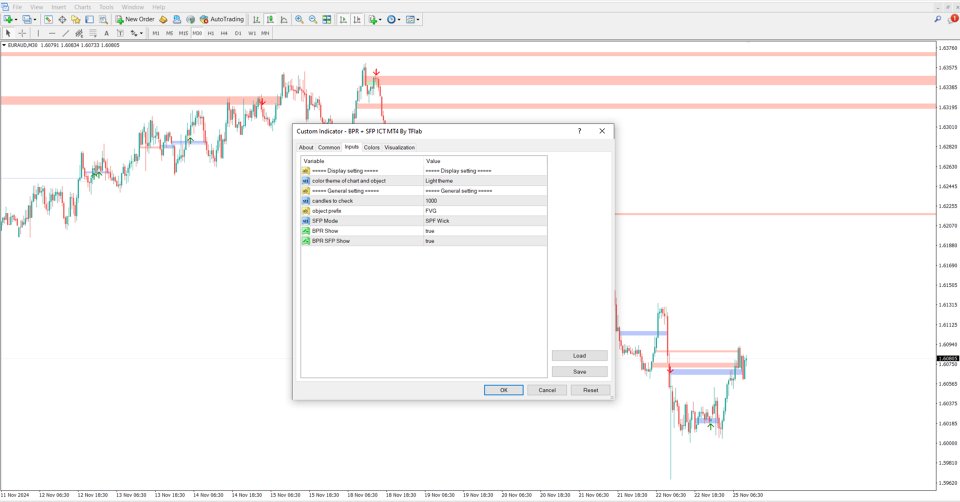

Customizable Indicator Settings

Below is an overview of the adjustable settings for the BPR + SFP Indicator on MetaTrader 4:

Display Settings

- Chart color scheme customization

General Settings

- Number of candles for analysis

- Object classification prefix

- SFP Mode activation

- BPR visibility toggle

- BPR + SFP display toggle

Conclusion

The BPR + SFP Indicator is an essential tool for detecting high-probability trade setups while reducing the likelihood of false breakouts. By filtering out weak breakout patterns, traders can execute positions with enhanced confidence and precision.