Key Level Analyzer MT5

- インディケータ

- Suvashish Halder

- バージョン: 1.0

- アクティベーション: 10

Key Level Analyzer – Know Better, Trade Smarter

Key Level Analyzer is a powerful trading tool designed to provide precise market insights by identifying high-probability price zones, market turning points, and key decision areas. Unlike traditional indicators, it uses a smart algorithm to dynamically calculate support, resistance, and balance zones, helping traders make informed, data-driven decisions.

MT4 Version - https://www.mql5.com/en/market/product/132809/

With real-time updates, multi-timeframe analysis, and a customizable alert system, Key Level Analyzer ensures traders stay ahead of the market without relying on guesswork.

1. Why Key Level Analyzer is Essential for Traders

- Algorithm-Based Key Levels – Detects critical price zones where the market is most likely to reverse or continue its trend.

- No Guesswork – Provides clear entry and exit points based on structured market data.

- Works on Any Market – Effective for Forex, Stocks, Crypto, Commodities, and Indices.

2. How Key Level Analyzer Works

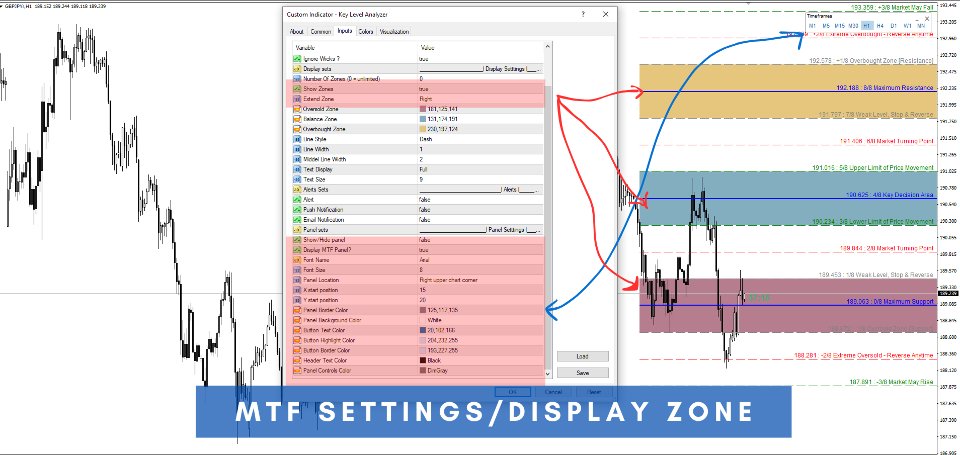

Three Market Zones for Maximum Clarity

Key Level Analyzer categorizes the market into three zones, each covered by three key levels:

-

Resistance Zone (Top Area)

- Maximum Resistance

- Overbought Conditions

- Market Turning Points

-

Balance Zone (Middle Area)

- Key Decision Area

- Upper & Lower Price Movement Limits

- Weak Levels for Stop & Reverse

-

Support Zone (Bottom Area)

- Maximum Support

- Oversold Conditions

- Extreme Reversal Points

Each of these key levels helps traders determine whether price is likely to hold, reverse, or break through, making trade decisions more structured.

3. Multi-Timeframe Support & Real-Time Alerts

- Multi-Timeframe Levels – Analyze key support and resistance zones across different timeframes (M1, M5, M15, M30, H1, H4, D1, W1).

- Crossunder Alert System – Get notified when the price crosses under a key level, allowing you to react quickly to market shifts.

- Adjustable Sensitivity – Fine-tune the indicator’s responsiveness to different market conditions.

4. Practical Trading Applications

Identify High-Probability Trades

- Use the Resistance Zone to look for selling opportunities.

- Use the Support Zone to find potential buy setups.

- The Balance Zone acts as a decision area—confirm breakouts or trend continuation.

Enhance Risk Management

- Align stop-loss and take-profit levels with precisely defined key zones.

- Avoid entering trades at weak levels with low probability of success.

Adapt to Market Conditions

- Spot trend reversals when price reaches extreme overbought or oversold conditions.

- Confirm trend continuation using the upper and lower price movement limits.

5. How to Get Started

-

Add Key Level Analyzer to Your Chart

- Drag and drop the indicator onto any Forex, Stock, or Crypto chart.

-

Customize the Indicator

- Adjust settings for sensitivity, timeframe filters, and alerts to match your trading style.

-

Follow Key Market Zones

- Use the three-zone structure to guide trade entries and exits.

- Enable alerts to track price movements in real-time.

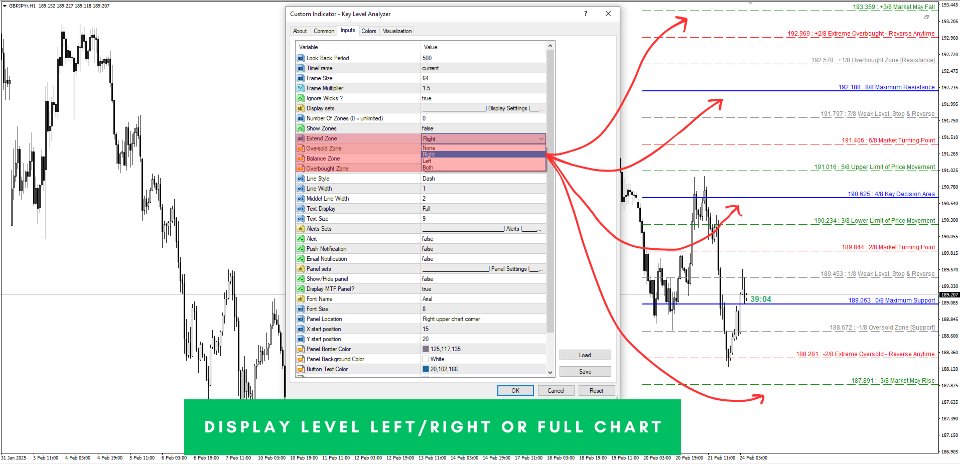

6. Key Level Analyzer Indicator Settings

- Customizable Key Levels – Modify settings for resistance, balance, and support zones.

- Multi-Timeframe Analysis – Select which timeframes to analyze simultaneously.

- Crossunder Alert System – Set notifications for key level breaches.

- Graphical Customization – Adjust colors and display options to match your trading preferences.

7. Support & Additional Resources

- Dedicated Support – Assistance is available if you need help with installation or settings.

Upgrade Your Trading Strategy Today

- Gain precise insights into key market levels.

- Trade with data-driven confidence, not emotions.

- Stay ahead with real-time alerts and multi-timeframe analysis.

Start using Key Level Analyzer now and take control of your trading decisions.