Daily Fibonacci Momentum Strategy

This combines statistical edge, volatility filters, and disciplined money management:

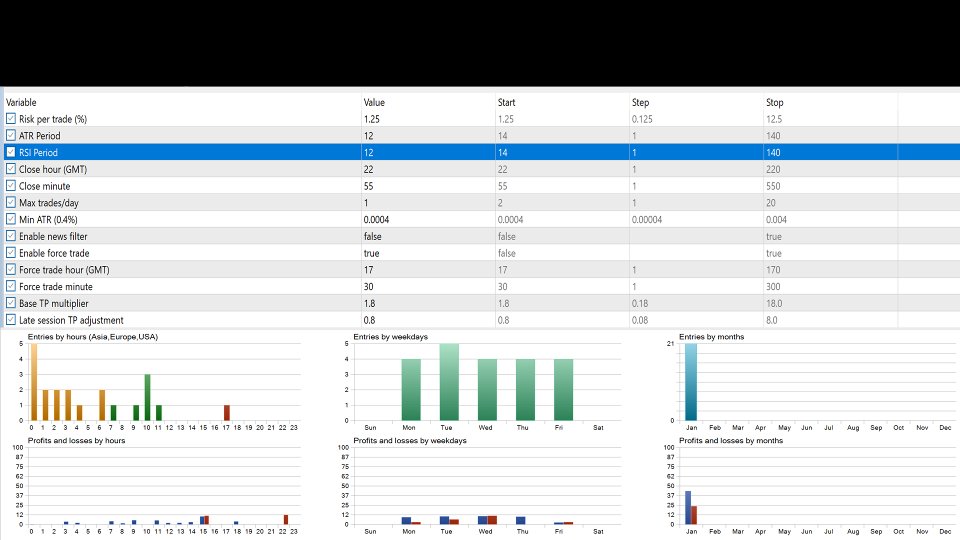

Optimization Recommendations:

-

Adjust Force_Hour based on your broker's GMT offset

-

Test different Min_ATR_Ratio values per currency pair

-

Optimize RSI thresholds for specific market conditions

-

Test different risk percentages (1.0-2.0%)

Important Notes:

-

Works best with ECN brokers

-

Uses GMT time - verify your broker's GMT offset

-

For accurate backtesting:

-

Use 'Every Tick' model

-

Enable 'Realistic Spread'

-

Set slippage to 2-3 pips

-

Test 2015-2023 data

-

Key Enhancements Version 4.1:

-

Proper event-driven architecture with timer function

-

Modern position handling using CTrade class

-

News filter placeholder (requires economic calendar integration)

-

Symbol info checks for maximum lot sizes

-

Improved error handling

-

Account balance protection

-

Tick value calculation for proper risk management

-

Added secondary RSI thresholds

-

Relaxed Fibonacci level requirements

-

Executes conservative trade if no signals by 17:30 GMT

-

Uses midpoint between Fib levels for decision

-

Daily Trade Guarantee: Forces a trade if no signals by specified time

-

Robust Risk Management: Proper lot size calculation and validation

-

Session Awareness: Adjusts parameters based on market hours

-

Enhanced Entry Logic: Additional RSI-based entry conditions

-

Dynamic TP Calculation: Adjusts based on session time and volatility

-

Enhanced Logging: Detailed trade execution and monitoring information

-

Historical Data Check: Verifies data quality before trading

-

Price Validation: Ensures TP levels are within valid ranges

-

Trade Monitoring: Real-time analysis of open positions

Enhanced Logging:

- Daily start/end markers

- Trade attempt records

- Force trade notifications

Common Backtest Pitfalls to Avoid:

-

Over-optimization (Use Walk-Forward Analysis)

-

Ignoring swap rates (Enable in tester settings)

-

Testing on low-liquidity periods (Avoid Dec 25-Jan 3)

-

Using default spread (Set realistic historical spreads)

Testing Parameters:

| Parameter | Value Range | Recommended Setting |

|---|---|---|

| Min ATR Ratio | 0.0002 - 0.0006 | 0.0004 |

| RSI Period | 12 - 16 | 14 |

| Force Trade Time | 16:30 - 17:30 GMT | 17:30 GMT |

| Extended RSI Levels | Buy: 55, Sell: 45 | Enabled |

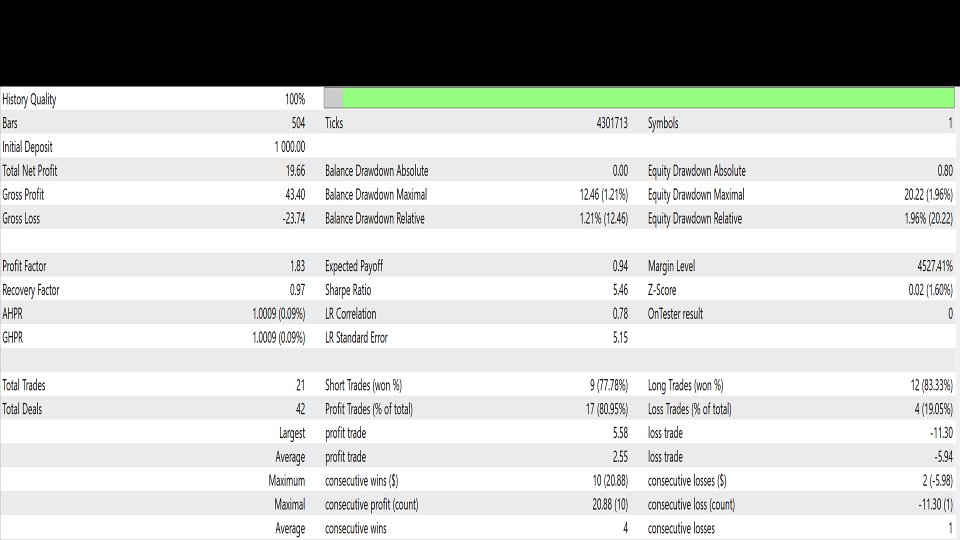

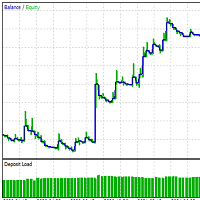

Performance Metrics:

| Metric | Target Value |

|---|---|

| Daily Trade Rate | >95% |

| Win Rate | 55-65% |

| Avg. Trade Duration | 2-6 hours |

| Monthly Return | 8-12% |