AI Quant Systems

- エキスパート

- Manh Viet Tien Vu

- バージョン: 2.0

- アップデート済み: 23 2月 2025

- アクティベーション: 10

Signal: Live AI Quant

Price: The price increases based on the number of licenses sold. The starting price for this EA was $1089.

Available copies: 10

Suitable for prop firm trading

This is my most powerful EA, leveraging 10 uncorrelated entry signals. In essence, it combines the functionality of 10 EAs into one, making it exceptionally robust while minimizing drawdowns. (Drawdowns refer to the inevitable periods of losses experienced in any genuine trading strategy.)

Strategies that claim to eliminate drawdowns entirely often achieve this by taking on excessive risk—exposing themselves to tail risks or relying on dangerous money management methods such as martingale or dollar-cost averaging (DCA). These types of EAs can be wiped out by a single extreme market event.

A distinguishing feature of this type of EA is that the Equity curve is always lower than the Balance curve, indicating it is holding losing positions. This could lead to bankruptcy if an unexpected trend develops.

In contrast, most of my EAs are built on a much more sustainable foundation: employing strict stop-losses to limit losses while allowing profits to run as far as possible. By capturing significant market trends and movements while maintaining rigorous risk control, they are designed to withstand even the most extreme market events, delivering consistent and realistic performance over time rather than relying on short-term luck.

Of course, this approach inherently results in a lower win rate, but the reward-to-risk ratio is significantly higher, creating positive expectancy. Patience is, therefore, the cornerstone of generating stable profits with these ‘realistic’ systems. Cutting losses short and letting winners run is the most practical and reliable method to achieve consistent asset growth over the long term.

While many traders aspire to quick and stable profits, this is simply unrealistic. Such profits often disappear entirely during extreme market events. My MeanAI EA was specifically designed to demonstrate this point—it generates stable profits that appear consistent in the short term, proving that I can create EAs delivering quick and steady returns. However, it’s the most "unrealistic" type of EA I’ve built. Like gambling, its performance depends heavily on luck, and it would ultimately collapse under extreme market conditions.

A far better and more sustainable approach is exemplified by my AI Quant EA and other trend-following EAs I’ve developed. These systems focus on realistic profit generation by cutting losses short and maximizing gains, making them resilient to market volatility and extreme events.

The AI Quant EA is unique in its ability to trade across any type of asset, provided that trading costs, spreads, and slippage remain reasonable. I’ve meticulously developed and tested it on a diverse range of assets, a capability that sets it apart from any other EA on the market. This combination of flexibility and reliability makes it an excellent tool for achieving stable, long-term growth.

To prioritize risk management, especially against black swan events, the EA closes trades at the end of the week to avoid unexpected gaps that could lead to unfavorable outcomes, while still maintaining its ability to capture major market trends.

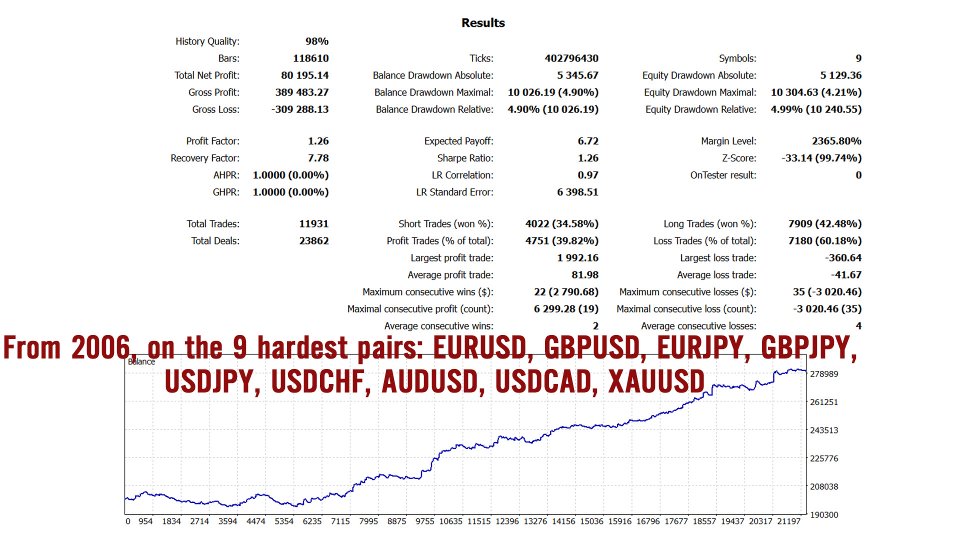

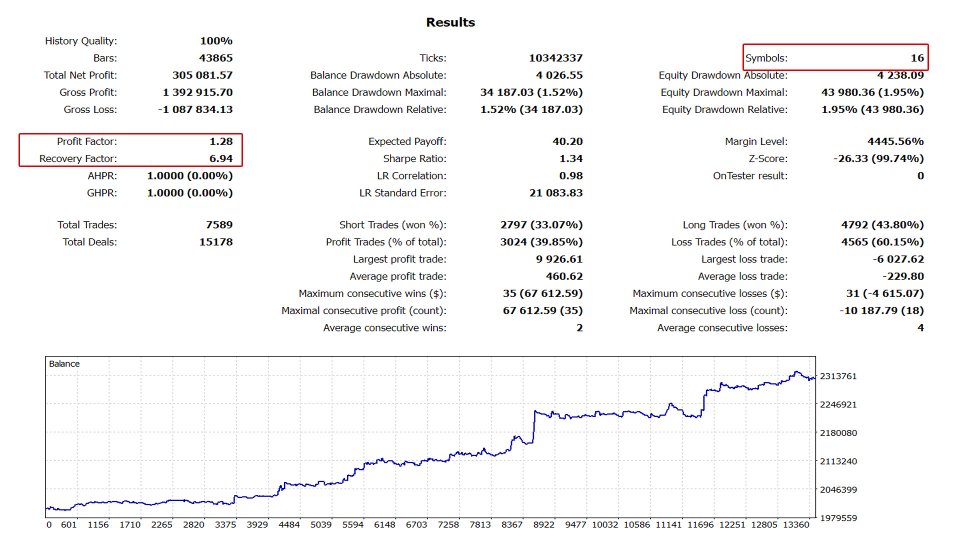

| Recommended Assets | EURUSD,GBPUSD,EURJPY,GBPJPY,USDJPY,USDCHF,AUDUSD,USDCAD,XAUUSD,BTCUSD,US30,USTEC,US500,DE30,JP225,USOIL or Any with low Cost and low Spread |

| Timeframe | H1 |

| Capital | Min $ 2000 |

| Broker | Any broker |

| Risk | 0.1-0.2% per trade or 0.01 lot / $ 2000 |

| Leverage | from 1:20 |

| Type | Weekly trading - Multi-Systems |

Important Notice:

Patience is Key

When using this EA, patience is critical. Designed with a trend-following strategy, it prioritizes a high profit-to-loss ratio over a high win rate. This means it may take time for the system to execute enough trades to fully showcase its statistical edge and long-term profitability.

Unlike many EAs on the market that rely on high-risk strategies such as grid trading, martingale, DCA, or trading without stop-losses, this EA avoids those dangerous methods. While such strategies might deliver consistent short-term profits, they come with significant risks. A single strong market trend or unexpected event can lead to devastating losses.

Trading systems with such tail risks are akin to playing Russian roulette—initially promising, but one extreme market event could erase months or even years of gains. In contrast, this EA is meticulously crafted to capitalize on market trends while protecting against extreme movements, including rare black swan events.

Robustness in Action

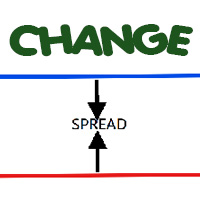

The EA’s robustness is reflected in its equity curve, which consistently remains above the balance curve. By cutting losses quickly and allowing profitable trades to run, the EA prevents extreme scenarios from escalating into account-destroying losses.

Many traders fail because they attempt to predict tops and bottoms or employ overly aggressive risk strategies, turning themselves into “liquidity” for disciplined traders. This EA is built on sound trading principles: a strong strategy, solid risk management, and consistent execution—providing the foundation for long-term success.

Understanding Tail Risk and the Principles of Trend-Following EAs:

The trading principle of most of my EAs is trend-following, allowing profits to run as far as possible. They achieve this by cutting losses quickly and avoiding frequent profit-taking. This approach allows them to capture significant market trends.

In the short term, trends are often weak and tend to be short-lived, which leads to a low win rate. However, when a major trend emerges, the profit potential is unlimited. Over the long term, this is the most realistic and profitable way to generate returns and grow capital. It has been statistically proven to have a positive expectancy.

Unlike strategies designed to capture consistent small profits by frequently closing trades too early and not letting profits grow, my strategies cut losses short. Many other strategies hold losing trades for too long, never cutting losses, or even doubling down (DCA). This inevitably leads to bankruptcy when a large trend (a low-frequency "black swan" event) occurs, wiping out all previous gains and possibly causing total account loss.

This is referred to as "tail risk." Because such events are infrequent in historical data, many fail to account for their impact during backtesting . Using such strategies renders all statistical expectations meaningless (a form of overfitting), as they don’t consider tail risk.

My EA MeanAI, for instance, is built with the early profit-taking style, showcasing that I can create strategies that appear very stable in terms of profitability. However, this is not the way to achieve sustainable long-term profits.

If you lack the patience and understanding of this principle, you should avoid using my trend-following EAs. You may abandon them when you see the strategy frequently cutting losses and experiencing drawdowns. These EAs are only suitable for experienced traders who genuinely wish to win in the market with patience.

Only a small group of people can achieve long-term profitability. Those who remain patient and understand how the market operates—knowing how to mitigate tail risk while leveraging it to make money—will succeed. The rest, who lack patience and seek strategies that generate quick, consistent profits but carry tail risk, are unlikely to win in the long run.

They will become a source of profit for those who are patient.

Understanding Randomness and Building Robust Strategies:

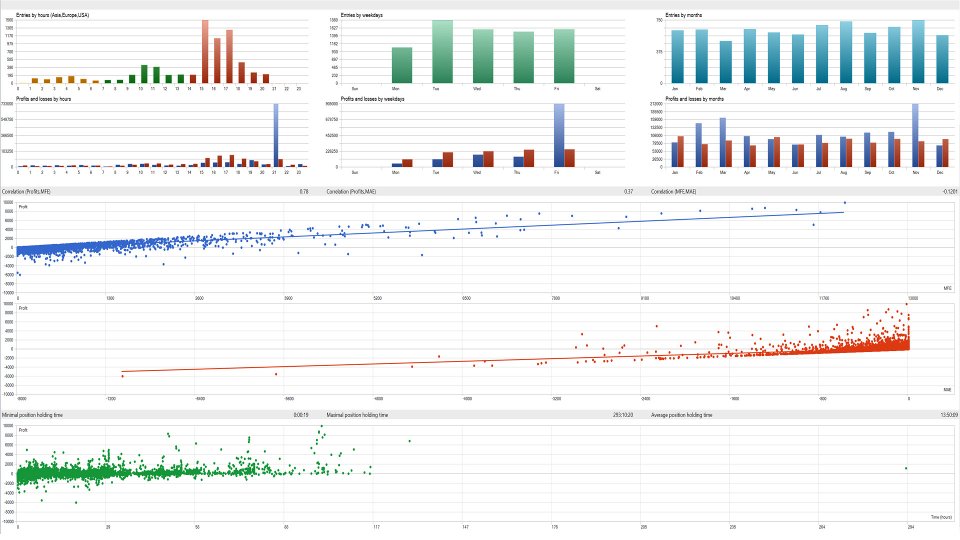

Randomness is an inherent part of the market, and understanding it is key to developing a sustainable trading mindset. In trading, randomness means that even with a well-structured strategy, individual trade outcomes are unpredictable in the short term due to market movements being influenced by countless uncontrollable factors.

However, while individual outcomes are random, patterns can emerge over a larger sample size. This is where strategies with positive expected value come into play. By focusing on probabilities and statistical edges rather than immediate outcomes, traders can align themselves with long-term success. It’s essential to accept that randomness can lead to streaks of losses or wins and to maintain consistency and discipline through these fluctuations.

Strategies built on past performance statistics often encounter three issues:

- Tail Risk, referring to extreme, unpredictable losses that deviate from normal expectations.

- Small Sample Size, where strategies rely on too few trades or assets, leading to results that are heavily influenced by randomness and short-term luck.

- Overfitting, where strategies appear to perform well on limited data but fail in real-world applications because their success is based on excessively tailoring to past data.

A truly robust strategy must be tested across multiple pairs and on a sufficiently large sample size. While it might not perform exceptionally well on individual pairs in the short term, if it delivers consistent results over a longer period across diverse conditions, it is undeniably a strong and reliable strategy.

The Impact of Randomness on Trading Performance and EA Stability:

Different brokers have different data feeds, so OHLC levels, tick data, and Bid/Ask prices over time will vary, which may lead to orders not being identical. Even if accounts are with the same broker but of different types—such as Exness' Pro and Raw Spread accounts—orders may still differ. This is entirely acceptable as a form of randomness and minor fluctuations. The same can occur during backtesting if you use data from different providers.

This type of randomness does not significantly impact performance, as sometimes it is unfavorable, but other times it is beneficial. As long as the broker provides reasonable costs, spread, and swap rates, the strategy will still generate growth, and the equity curve will move similarly.

My EA is highly robust because it operates across a wide range of parameters, allowing it to easily adapt to minor randomness. This adaptability is demonstrated through functions like Random Entry, Stop-Loss, and Exit Levels. These functions introduce randomness in entry and exit points, causing each run to produce different trades and results. However, the outcomes remain similar, and the equity curve moves in the same manner, proving that the core principles of the EA continue to function effectively in a highly random environment.

That is also solid evidence that the EA is not overfitted to past data.

Facing Drawdowns:

When using this strategy, due to its realistic nature and low win rate, it will frequently cut losses and encounter drawdowns (periods where the account declines without growth). This is unavoidable in the short term due to market randomness. The key is to set a reasonable and low-risk level, then continue using the strategy during these phases. When major trends emerge, all temporary losses will be recovered as the strategy’s edge takes effect.

We need to remain patient and wait for the big trends to unfold.

This strategy is designed to maximize profit potential by allowing trades to run as far as possible. As a result, many small winning trades won’t be closed, and it’s normal to see trades move into profit before reversing and hitting a stop loss. This is simply part of the process.

Our ultimate goal is to capture massive, unrestricted gains—where most traders using loss-holding and averaging-down strategies will eventually face ruin. That’s where the real profits lie. In the end, those who refuse to cut their losses become the liquidity that fuels our success.

It is crucial to use the EA over a long period, as statistical values and expected returns only hold significance when the sample size is large enough. Evaluating its performance over just a few weeks or months is meaningless; a longer evaluation period is required. I recommend using it for at least 1-2 years.

Due to its low win rate, in the short term, it will experience frequent stop-losses—sometimes consecutively for 20-30 trades. This happens because the EA relies on trends to generate profits. If the market lacks a trend, it will continuously cut losses. Therefore, patience is the key to trading with these EAs. Those who lack patience will fail in the long run when using strategies that involve tail risk.

This is the type of risk mentioned above, which exists in strategies that generate stable profits with a very high win rate—such as my MeanAI EA. If you do not understand this concept and lack patience, you will struggle to achieve long-term success. You may continue following the same old path of using profit-seeking strategies that provide short-term stability but carry significant tail risk—which is bound to fail in the long run.

If you need consistent and stable profits, use my MeanAI EA—it is proof that I can develop EAs focused on steady returns, just like any other top-tier developer. However, as I’ve mentioned, this EA is not a long-term way to make money—a fact that few traders acknowledge or discuss in their products.

However, it’s important to understand that past performance does not guarantee future results. When we engage in trading, we are essentially betting that a certain strategy, which had a positive expected value in the past, will continue to achieve similar results in the future.

While we cannot be absolutely certain, through statistical analysis and testing on a sufficiently large sample size, we gain an edge and a much higher probability of success compared to the majority of traders.

Diversifying Systems and EAs to Minimize Drawdowns

Combining multiple systems and EAs is an excellent way to reduce drawdowns. While they all follow the same core principle of letting winning trades run, each system has different entry and exit rules. This variation allows them to perform well in different market conditions.

At times, EA 1 may perform well while EA 2 struggles, and in other periods, EA 2 may excel while EA 1 underperforms. By running these systems together, drawdowns and drawdown duration are minimized, leading to improved overall performance.

Even though these systems are not correlated, risk management is still essential when using multiple strategies simultaneously. For example, if you are running all of my EAs together, ensure that you reduce the risk to half of the recommended amount when running them individually—starting at 0.1% of total capital per trade—to maintain a balanced approach.

Key Features:

- User-Friendly Design: Simple to use and quick to set up, with customizable risk settings to match your preferences. Choose from percentage risk, fixed dollar amounts, or fixed lot sizes.

- Optimized for H1 Timeframe: The EA is most effective on the H1 timeframe, ensuring smooth and efficient performance.

- Multi-Pair Trading & Backtesting: Manage multiple trading pairs from a single chart. Just match the input settings to your broker’s symbol format and add the symbols to your market watch list. Attach the EA to an H1 chart for BTCUSD or EURUSD to activate this feature. Multi-pair backtesting is fully supported for streamlined optimization.

- The EA can trade for prop firms by generating random entry and exit points within a reasonable range. This is possible because the EA is highly robust, and its signals operate across a wide parameter range, ensuring that performance does not degrade significantly even with slight randomness in entry points. Since prop firms do not allow trade copying, using this EA across multiple accounts requires different entry and exit points for each user. By utilizing MQL5’s randomization functions, the EA can generate more than 10^22 unique combinations, making the probability of identical trades for different users impossible.

- Gradual Price Adjustments: To preserve its value and protect existing users, the EA’s price will gradually increase as more traders adopt it.

Since brokers provide leverage, you never need to deposit your entire capital into the account. It’s best to use the MODE_RISKMONEY mode to calculate risk. Simply enter the amount you’re willing to risk per trade, and the EA will automatically calculate the appropriate lot size.

For example, if you have total capital of $10,000, you only need to deposit $500–$2,000 into your account. If you want to risk 0.1% of your capital, which means risking $10 per trade, just input $10 into the Fixed Money field. The EA will calculate the lot size so that each trade risks approximately $10. This calculation is based on your actual capital rather than the amount currently in the trading account.

This EA represents a disciplined, robust, and highly effective approach to trading, making it a standout tool for serious traders.

EA User Guide:

To start, add the EA to the chart by opening your trading platform (MT5) and dragging the EA from the Expert Advisors folder onto the chart of your desired trading pair.

Next, configure the parameters and choose the appropriate risk management mode: if you select MODE_RISKMONEY, input a fixed amount in the Fixed Money field; if you choose MODE_PERCENTACCOUNT, input the risk percentage in the % Risk On Current Balance field; or if you opt for MODE_FIXLOT, input a fixed lot size in the Fixed Lots field. Then, enter a unique Magic Number to differentiate this EA's trades from those of other EAs.

If you want the EA to trade across multiple symbols, set Trade On Multi Symbol? to True and input the list of symbols into the Map Of Symbol field. Ensure the symbols are accurate (case-sensitive), separated by commas, and added to Market Watch. Otherwise, set this option to False to limit trading to the current chart. During backtesting, input the broker server's GMT time in the GMT Hour field.

For live trading, the EA automatically adjusts the time, so no manual input is needed. To activate the EA, make sure the AutoTrading button on your platform is enabled.

The Random Entry, Stop-Loss, and Exit Levels function will generate different entry and exit points for the EA when executing trades, ensuring variation in trades across accounts. This feature helps support prop firm trading by preventing identical trading patterns among different accounts.

The Auto Shutdown function will automatically stop the EA from trading once the daily loss limit is reached or when the profit target for the evaluation phases (filled in below) has been achieved.

The news trading management function should only be used for prop firms that restrict this type of trading, as major market movements usually occur after the news release.

To use this function, copy the following link: https://www.forexfactory.com/ then paste it into the Allow WebRequest for listed URL section under Tools -> Options -> Expert Advisors. After that, check the Allow WebRequest for listed URL box.

As for important notes, the EA provides three risk management modes: MODE_RISKMONEY, MODE_PERCENTACCOUNT, and MODE_FIXLOT.

If you select MODE_RISKMONEY, the EA calculates risk based on the exact amount entered in the Fixed Money field, ignoring % Risk On Current Balance and Fixed Lots. Similarly, if you select MODE_PERCENTACCOUNT, the EA calculates risk as a percentage of the current account balance based on the value in the % Risk On Current Balance field, while disregarding the other fields. If you select MODE_FIXLOT, the EA executes trades with the lot size specified in the Fixed Lots field, ignoring the other two fields.

When using multi-symbol mode (Trade On Multi Symbol? = True), ensure that the symbol names exactly match the broker's naming convention, are separated by commas, and are added to Market Watch to avoid errors. If multi-symbol mode is not enabled (Trade On Multi Symbol? = False), the Map Of Symbol field will not be used.

Importance: Check the Experts tab in the Toolbox to ensure the EA is running without errors; otherwise, it will not function properly. One common issue in multi-symbol mode is error 4302, which occurs if the required symbols are not added to the Market Watch. To fix this: Restart the terminal, right-click in the Market Watch, select Show All Symbols, and reattach the EA.

For time conversion, the EA automatically handles this during live trading. However, when backtesting, you must manually input the broker’s GMT time.

The manual trade direction setting feature allows you to define the trading direction of the EA based on your own market outlook. For instance, if you believe the market is in an uptrend and want the EA to only execute buy trades, you can select the "Trade_OnlyLong" mode in the Trade Mode field. Conversely, if you want the EA to only execute sell trades, you can choose the "Trade_OnlyShort" mode.

This feature should be used when the EA is set to trade on the current chart only, meaning the "TradeOnMultiSymbol" function is not enabled. Otherwise, the EA will trade in the specified direction across all pairs in the MapOfSymbol.

It is advisable not to use this feature if you lack experience. A better approach is to let the EA trade in all directions, as it has already demonstrated long-term edge.

Although the EA does not manage trades based on Magic Numbers, entering one is essential to prevent conflicts with other EAs. This ensures that no other EA mistakenly interacts with the trades managed by this EA.

Since my EA manages orders based on comments, it’s best to keep the input comment set to the default. If you want to change it, make sure it’s distinct from the comments of other EAs. Additionally, if you’re upgrading the EA version or adding the EA back to the chart, ensure you input the exact same comment as before.

To monitor trades, check the Trade tab, and verify the Magic Number in the Account History tab to ensure the EA's trades are not confused with others.

If any issues arise, check that the symbol names in the Map Of Symbol field are accurate, ensure there are no Magic Number conflicts, and verify that all necessary symbols are added to Market Watch.

Good luck and happy trading!