Multi Symbol Comet EA

- エキスパート

- Ahmed Mohamed Ahmed Elaroussi

- バージョン: 25.2

- アクティベーション: 5

In addition to all Comet EA Support Resistance Entries Exits features, this version can trade, back test and optimize multiple symbols simultaneously.

It's a great advantage to back test, observe and analyze the account behavior/performance while trading multiple symbols simultaneously, which is the real-life case.

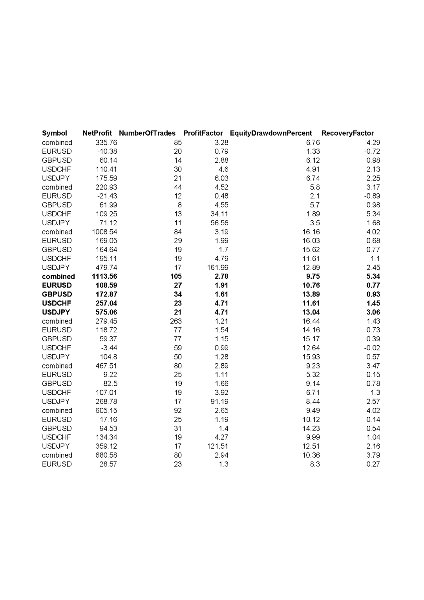

Furthermore, after optimization, a detailed OptimizationResults csv-file will be generated in the \MQL5\Files folder, which contains the main performance metrics for each optimization pass. The file contains the metrics for all symbols combined, and also the metrics for each individual symbol within the optimization pass.

Common features in single-symbol and multi-symbol versions:

- Works on netting and hedging accounts.

- Designed with the possibility of "M1 OHLC" back testing and optimization to save time and resources. Results are highly accurate and reliable for live trading.

- Ideal drawdown (below 10%-15%) if properly optimized (recommended over a period of two years, then to be re-optimized monthly, or just if performance decreases).

- Trade entries according to support and resistance levels and their strength.

- Five options for trade exits to choose from and combine.

- Optional identifying of support and resistance levels at a higher timeframe.

- Optional controllable grid trading (enable/disable, interval, volume, max. number), with which no risk to destroy balance.

Screenshots:

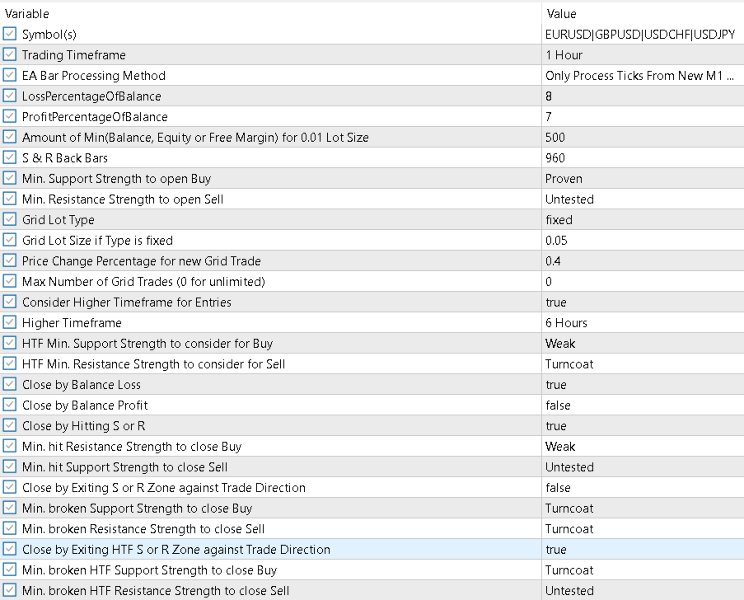

- Inputs of multi-symbol version.

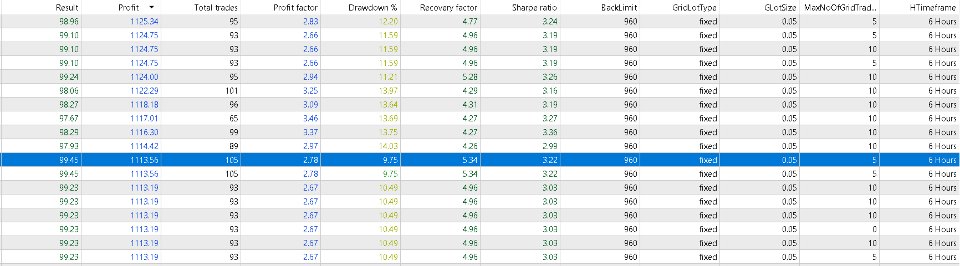

- Optimization Results sample, and a selected pass.

- Identifying the pass in the generated OptimizationResults file, and checking the performance metrics for each symbol within the pass.

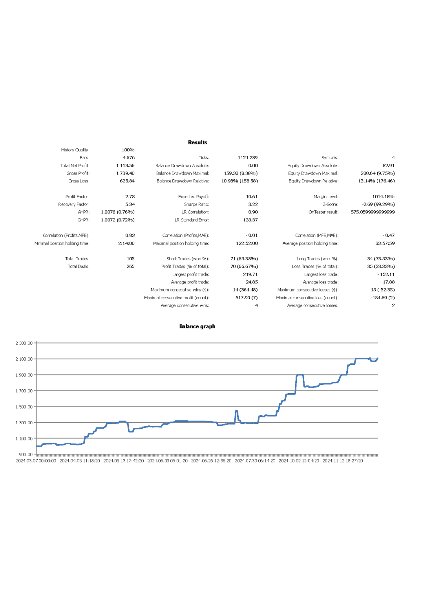

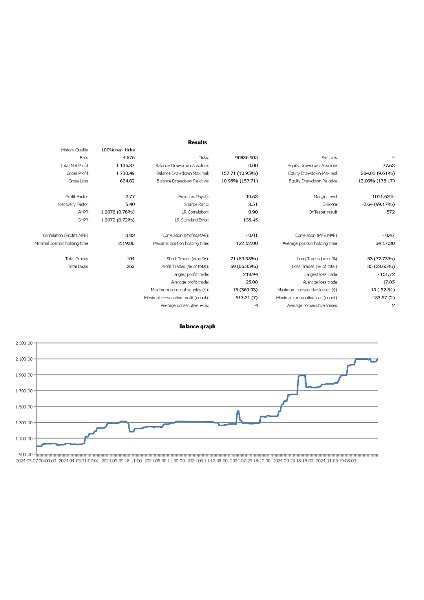

- Back test result using "M1 OHLC" modelling.

- Back test result using "Every tick based on real ticks" modelling.