EA Corrector for loss

- エキスパート

- Sergey Demin

- バージョン: 1.20

- アクティベーション: 10

Semi-automatic advisor. Any timeframe, any trading instrument.

The advisor works as:

- a classic advisor with stop-loss;

- a classic advisor with stop-loss and Martingale;

- a grid advisor (with averaging orders and no stop-loss);

- a grid advisor + Martingale (with averaging orders with increasing lot size and no stop-loss).

Be sure to enable "TradePanel" = true in the settings.

I use the Advisor as a trend grid, which requires the User to perform preliminary market analysis and make their own decision.

After the User has analyzed the market, decided on the direction and entry zone, the User launches the semi-automatic advisor by pressing one of the buttons "Buy" or "Sell".

Attention: The Advisor is well tested in the MT4 Strategy Tester. To do this, enable the setting "TradePanel" = true.

When trading, the setting "TradePanel" = true too.

I use this advisor ONLY in cases of compensation of losses of my Big Portfolio.

How does it happen?

Most of the tactics in my advisors contain the principle of "Impulse breakouts of levels".

Such transactions are more often closed in profit.

But in those cases when the advisor gets a loss, it means that the "Script was broken" and the trading instrument went into a strong correction. After the correction, the market almost always goes flat and the script is resumed.

In this case, I conduct my own market analysis and decide whether to compensate for the loss or not.

If I see during my analysis that yes, it is possible to compensate for the loss, I use this advisor as a semi-automatic grid.

After the User launches the advisor by pressing the button on the chart ("Buy" or "Sell"), the advisor will not start trading immediately - it will wait for the appearance of two Elliott waves, after which the advisor will start opening orders with the aim of the appearance of the third Elliott wave. As a result, the advisor will receive a profit and close.

The advisor processes ONLY ONE market entry, one cycle, after which it will turn off and wait for new user launches.

Recommended for manual traders who know how to conduct their own market analysis, understand themselves - in which direction to enter and from which zone to enter.

The advisor is good in combination with the Fractal Sniper Levels MT4 indicator.

Buyers who purchased my portfolio advisors can get this semi-automatic advisor and the Fractal Sniper Levels MT4 indicator completely free of charge.

Advisor trading principle:

1. The advisor waits for the "Buy" or "Sell" button to be pressed;

2. The advisor starts and waits for two Elliott waves to appear only in the direction specified by the User.

3. When a signal appears, the advisor places two pending orders buy-limit or sell-limit (sometimes buy-stop/sellstop or market entries as needed).

4. When orders are triggered:

4.1 When a pre-set profit in dollars is received (the User specifies it in the settings in advance), the Advisor switches off and waits for the next button press;

4.2 When the price goes into minus, the Advisor carefully completes the dynamic grid of orders in the same direction (according to its strategy). The range between subsequent orders specified by the User is taken into account. It is recommended to make the specified range dynamic: the further the price moves away from the future profit, the wider the range between orders in the grid will be.

User settings:

TradePanel - enable/disable the trading panel on the chart (true - display buttons on the chart). When testing in the Strategy Tester and in real trading, it is MANDATORY to enable.

Trading parameters:

- MagicNumber (2808) - magic number for order identification

- Lot1 (0.1) - volume of the first order;

- Lot2 (0.1) - volume of the second order;

- TP (100) - take profit in USD for the initial two lots;

- SOL stop loss type:

- USD - in dollars (if the grid is not used. The EA is in the stop loss trading mode);

- pips - in points (if the grid is not used. The EA is in the stop loss trading mode);

- Averaging - averaging without stop loss (the grid is used);

- SL (-200) - stop loss in selected units (USD or points) - if the grid is not used.

Trailing stop settings:

- Trall (true) - enable trailing stop for the first two orders;

- Trailing Stop size in points (500) - trailing stop size in points for the first two orders;

- TrailingStep (300) - trailing stop step in points for the first two orders.

Averaging parameters:

- Increase position volume at losses/ valid at Stoplosses koef (1) - volume increase coefficient at losses, if the grid is not used (the advisor is in the stop-loss trading mode). In other words - Martingale is enabled at values of 2 and higher.

- Grid width, pips - steps (220) - grid width in points (will work if the averaging mode is enabled);

- Grid expansion, pips delta (80) - grid expansion;

- koefic (1) - averaging coefficient when using the grid;

- USD. We must close the loss with averaging orders - required profit in USD to close the averaging orders

- USD. Start of trailing averaging - USD to start trailing averaging

- USD. Trailing averaging compression (10) - USD to compress trailing averaging

Additional parameters:

- Reducing profit with averaging -USD (-10) - profit reduction with averaging in USD

- From which averaging order does the decrease in the averaging Profit (3) - from which averaging order does the profit reduction begin

Important:

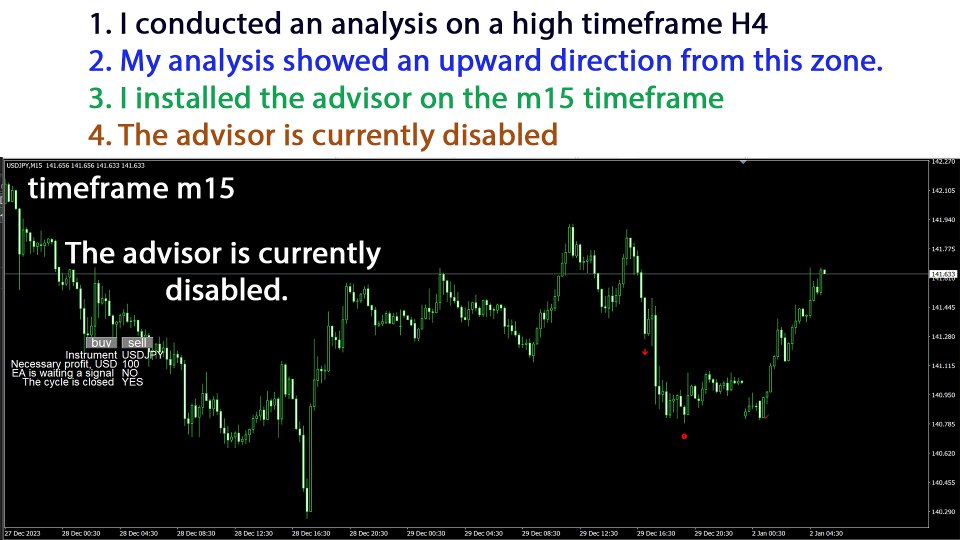

I analyze the market well on high timeframes (H4/D1/W1) and know where to enter trades on small timeframes (m5/m15). But I don't want to sit for hours at the monitor. Therefore, AFTER the analysis, I turn on my reliable tool on the m15 timeframe.

This advisor will do the rest: it will open a trade at the right moment, receive a profit and turn off, waiting for my further instructions.

Attention:

profit in past transactions does not guarantee profit in future transactions!