NextGen Grid

- エキスパート

- April Leann Overstreet

- バージョン: 1.9

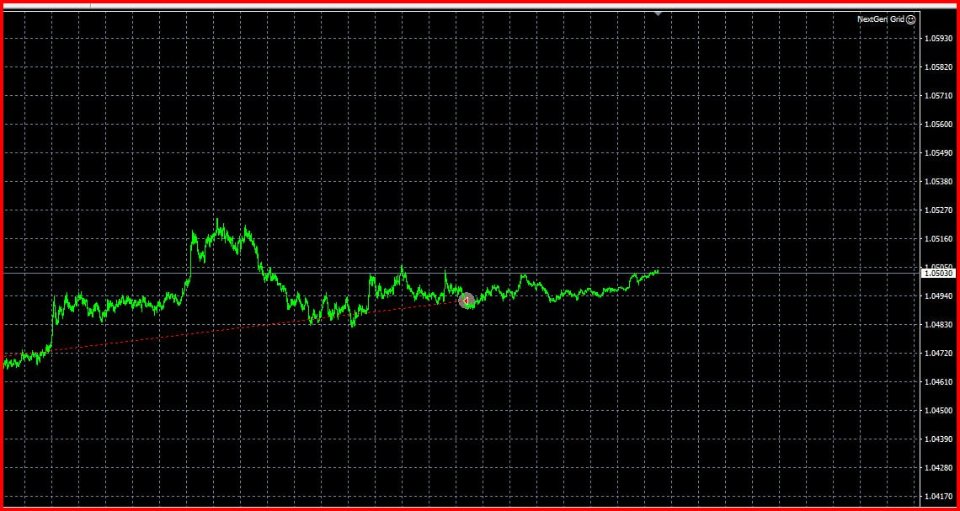

NextGen Grid is an advanced Expert Advisor (EA) designed to simplify trading and optimize profits. This bot uses a grid trading strategy, enabling it to perform consistently across different market conditions. Whether you're a beginner or an experienced trader, NextGen Grid empowers you to trade smarter and more efficiently.

Advantages of NextGen Grid

- Fully Automated Trading: Executes trades automatically based on predefined grid levels, eliminating emotional decision-making.

- Customizable Settings: Adapt the bot to fit your trading style by adjusting grid spacing, trade size, and risk limits.

- Built-In Risk Management: Protects your account with daily profit and loss limits, ensuring controlled and disciplined trading.

- Versatile Market Adaptability: Effective in ranging and trending markets with settings optimized for various currency pairs and timeframes.

- Scalable for Any Account Size: Whether you have a small or large trading account, NextGen Grid adjusts to meet your needs.

Key Features

- Grid Trading Strategy: Automatically places buy and sell orders at specified intervals above and below the market price.

- Profit and Loss Tracking: Monitors your account performance in real-time, halting trading once your daily goals are achieved.

- Martingale Option: Allows progressive lot sizing to recover from losses (optional and customizable).

- Time-Based Trade Intervals: Prevents overtrading by implementing minimum time gaps between trades.

- User-Friendly Interface: Easy setup and detailed settings explanations for seamless usage.

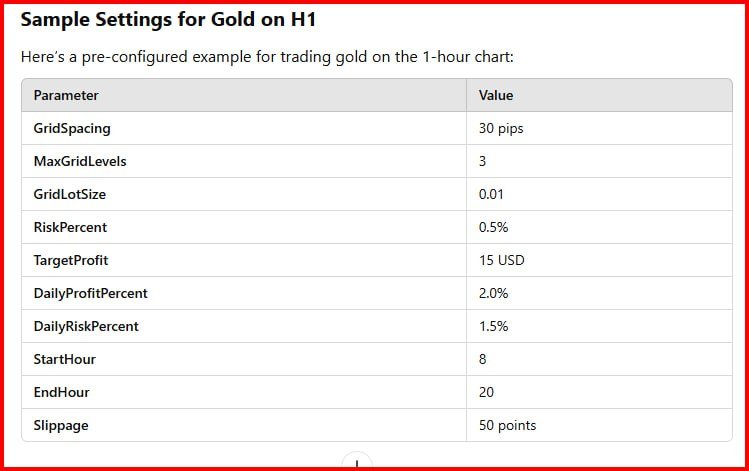

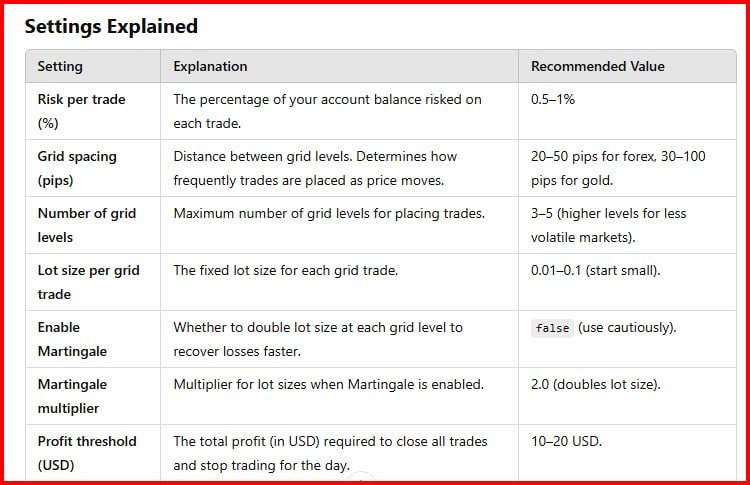

Inputs (Parameters)

Below are the customizable settings for NextGen Grid:

-

Grid Spacing:

- Distance between trades (in pips).

- Example: 10-30 pips depending on market volatility.

-

Max Grid Levels:

- Maximum number of active trades at a time.

- Example: 3-10 trades for small to medium accounts.

-

Lot Size:

- Trade size based on your account balance.

- Example: 0.01 lots per $1,000 for conservative risk.

-

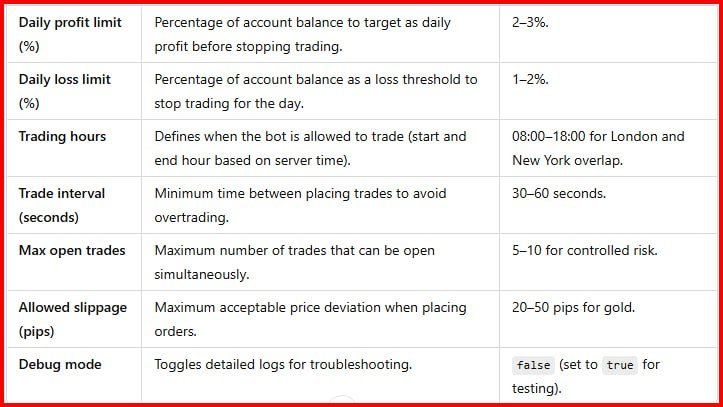

Daily Profit Limit:

- Percentage of account balance to achieve before trading stops.

- Example: 2%-5%.

-

Daily Risk Limit:

- Percentage of account balance to risk before trading stops.

- Example: 1%-3%.

-

Trade Interval:

- Minimum time between trades to prevent overtrading.

- Example: 30 seconds to 5 minutes.

-

Martingale Multiplier (Optional):

- Increase trade size progressively to recover losses.

- Example: 1.5x or 2x.

Who Should Use NextGen Grid?

- New Traders: Simplifies trading with automated processes and easy setup.

- Experienced Traders: Offers advanced customization for enhanced strategies.

- Investors: Ideal for passive trading with built-in safeguards to protect capital.

Take Control of Your Trading

With NextGen Grid, you can trade confidently and efficiently. Experience the power of automation and optimize your trading performance today!