Bitcoin Prophet Scalper

- インディケータ

- Thomas Bradley Butler

- バージョン: 1.0

- アクティベーション: 5

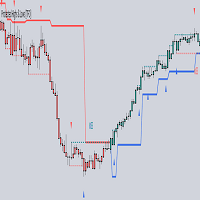

Detailed Explanation of Using the Indicator for Bitcoin Trading 1. Understanding the Indicator

The indicator uses moving averages and ATR (Average True Range) to detect trends and generate buy/sell signals. This is similar to Trade Sniper except designed for BTC

2. Setting Periods for Different Time FramesConfigure the indicator with periods suitable for each time frame. Here’s a suggested table for periods and ATR-based stoploss/take profit settings:

| Time Frame | PERIOD | Stoploss | Take Profit |

|---|---|---|---|

| 1-minute | 10 | 1x ATR | 2x ATR |

| 5-minute | 10 | 1.5x ATR | 3x ATR |

| 15-minute | 15 | 2x ATR | 4x ATR |

| 1-hour | 20 | 2.5x ATR | 5x ATR |

| 4-hour | 30 | 3x ATR | 6x ATR |

| Daily | 50 | 4x ATR | 8x ATR |

3. Implementing Settings in the Indicator

-

MA Period: Set the moving average period according to the time frame.

-

ATR Period: Adjust the ATR period for volatility measurement.

-

Stoploss and Take Profit: Use the ATR multipliers to set dynamic stoploss and take profit levels.

-

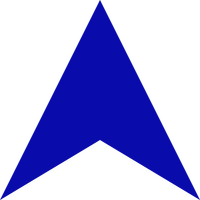

Bullish Signal: Indicates a buy signal, suggesting an uptrend.

-

Bearish Signal: Indicates a sell signal, suggesting a downtrend.

-

Risk-Reward Ratio: Ensure a favorable ratio, typically 1:2 or higher.

-

Market Analysis: Combine indicator signals with other forms of analysis (e.g., candlestick patterns, volume).

-

Volatility Consideration: Adjust ATR multipliers based on current market conditions.

-

False Signals: Volatile markets can produce false signals; use confirmation from other indicators.

-

Adaptability: Regularly review and adjust settings based on market changes.

By following these steps and considerations, you can effectively use the indicator to guide your Bitcoin trading decisions across different time frames.