Anchored VWAP Pro

- インディケータ

- TitanScalper

- バージョン: 1.0

- アクティベーション: 5

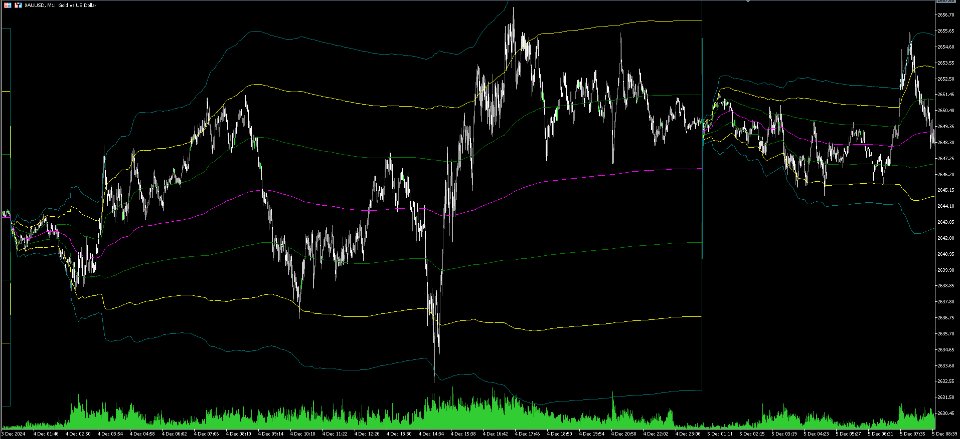

What is VWAP?

The Volume Weighted Average Price (VWAP) is a trading benchmark that reflects the average price of a security, weighted by volume, over a specific time period. It helps traders identify fair value and is used widely in intraday trading to assess price action relative to institutional trading levels.

Key Features of Anchored VWAP PRO

-

Anchored Calculation:

- Unlike traditional VWAP that resets daily, your indicator allows users to anchor VWAP to specific time frames or key points (e.g., news events, session starts).

-

VWAP Bands:

- Adds dynamic bands around VWAP using standard deviation to reflect price volatility. These bands can help identify overbought/oversold conditions and potential reversal zones.

-

Multi-Level Standard Deviation Bands:

- The bands at ±1, ±2, and ±3 standard deviations provide insights into price extremes and strength of price moves.

-

Customizable Visuals:

- Users can personalize colors for VWAP and each band to suit their charting preferences.

How Anchored VWAP PRO Works

-

VWAP Calculation: VWAP is derived by dividing the cumulative total of (price × volume) by cumulative volume:

VWAP = ∑ ( Price × Volume ) ∑ Volume \text{VWAP} = \frac{\sum{(\text{Price} \times \text{Volume})}}{\sum{\text{Volume}}} VWAP=∑Volume∑(Price×Volume) -

Bands: Bands are calculated using standard deviation:

Upper Band = VWAP + n × StdDev \text{Upper Band} = \text{VWAP} + n \times \text{StdDev} Upper Band=VWAP+n×StdDev Lower Band = VWAP − n × StdDev \text{Lower Band} = \text{VWAP} - n \times \text{StdDev} Lower Band=VWAP−n×StdDevWhere n n n is 1, 2, or 3 for different levels.

Advantages for Traders

-

Trend Identification:

- VWAP serves as a dynamic support/resistance level. When prices are above VWAP, they are considered bullish; below VWAP, they are bearish.

-

Mean Reversion Strategy:

- Traders can use the bands to identify potential mean-reversion trades when price deviates significantly from VWAP.

-

Institutional Relevance:

- Institutions often use VWAP as a benchmark for trade execution. Understanding price in relation to VWAP can provide a competitive edge.

-

Custom Anchoring:

- The ability to anchor VWAP to key points allows traders to analyze price action around significant events or time periods.

Potential Use Cases

-

Intraday Trading:

- Ideal for scalpers and day traders to gauge intraday price levels and volatility.

-

Swing Trading:

- Swing traders can anchor VWAP to weekly or monthly highs/lows to monitor price trends over time.

-

Breakout Strategies:

- Use the VWAP bands to identify breakout points and target zones.