Daily VWAP Indicator

- インディケータ

- Rafael Gazzinelli

- バージョン: 1.11

- アップデート済み: 9 11月 2024

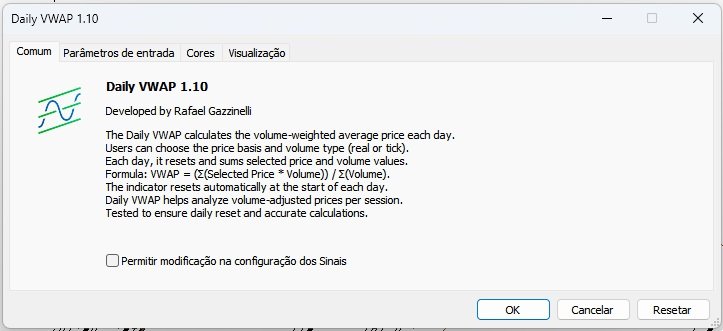

Daily VWAP Indicator (Volume Weighted Average Price)

Description

The Daily VWAP (Volume Weighted Average Price) indicator is an essential tool for traders seeking to identify the true average price of an asset throughout the day, adjusted by traded volume. Primarily used by institutional and professional traders, the daily VWAP serves as a reference point to identify the average price trend based on trading volume, making it a powerful indicator for buy and sell decisions.

How It Works

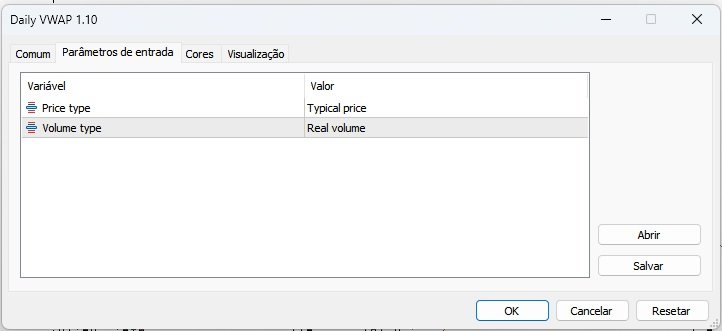

The daily VWAP calculates, for each trading session, the volume-weighted average price of an asset, where you can now customize the price calculation and volume type:

- Price Type: Allows the choice between several calculation methods, such as closing price, opening price, high, low, median, and weighted:

- Close Price: Price calculated using the closing value

- Open Price: Price calculated using the opening value

- High Price: Price calculated using the highest candle value

- Low Price: Price calculated using the lowest candle value

- Median Price: (High + Low) / 2

- Weighted Price: (High + Low + 2 x Close) / 4

- Typical Price: (High + Low + Close) / 3

- Volume Type: Option to select between Real Volume and Tick Volume to determine the type of volume considered in the calculations.

Calculation Methodology

For each candle, the indicator accumulates the value Price * Volume and divides it by the sum of the volume up to the current point to calculate the current VWAP:

VWAP = (Σ(Price * Volume)) / Σ(Volume)

At the end of each trading day, the indicator resets, starting a new calculation for the next session. This daily reset allows for a clear and independent reading for each session, ensuring that VWAP analysis is not influenced by previous days' data.

Main Advantages

- Accurate Price Analysis: The VWAP shows the volume-adjusted average price, offering a realistic view of the average price paid during the day.

- Support and Resistance Levels: The daily VWAP acts as a dynamic support or resistance line, helping traders identify market trend reversals and points of interest.

- Institutional Flow Indicator: The VWAP is often used to gauge whether an asset is trading above or below its daily average price, which can indicate buying or selling pressure, especially from large investors.

- Automatic Daily Reset: The indicator automatically resets at the start of each new session, calculating the VWAP exclusively for the current day.

Who Should Use It?

The daily VWAP is ideal for intraday traders, scalpers, and institutional investors who want to assess the volume-weighted average price performance throughout a session. It’s especially useful for those operating in high-volume markets and looking to identify short-term trends, ideal entry and exit points, and potential price reversal moments.

How to Interpret the Daily VWAP

The daily VWAP can be used in various ways in your trading strategy:

- Price Above VWAP: When an asset’s price is above the VWAP, it’s considered in a “bullish” (optimistic) position, indicating a potential buying opportunity.

- Price Below VWAP: When the price is below the VWAP, the asset is considered in a “bearish” (pessimistic) position, which may indicate a selling opportunity.

- Confluence with Other Indicators: The daily VWAP can be combined with other technical indicators, such as moving averages and Bollinger Bands, to improve the accuracy of buy and sell decisions.

Technical Specifications

The indicator is designed to provide fast and accurate readings without overloading the system. It uses optimized algorithms for continuous calculations throughout the day and resets automatically at the start of each new session, ensuring smooth real-time performance.

Conclusion

The Daily VWAP Indicator is a valuable tool for any trader seeking to understand the volume-weighted average price throughout each session. It offers important insights into market direction, buying and selling pressures, and potential support and resistance points. Add it to your arsenal to gain a strategic edge in your daily trading operations!

شكرا على جهدك الرائع مؤشر ممتاز