Williams CCI

- エキスパート

- Sami Triki

- バージョン: 3.1

- アクティベーション: 5

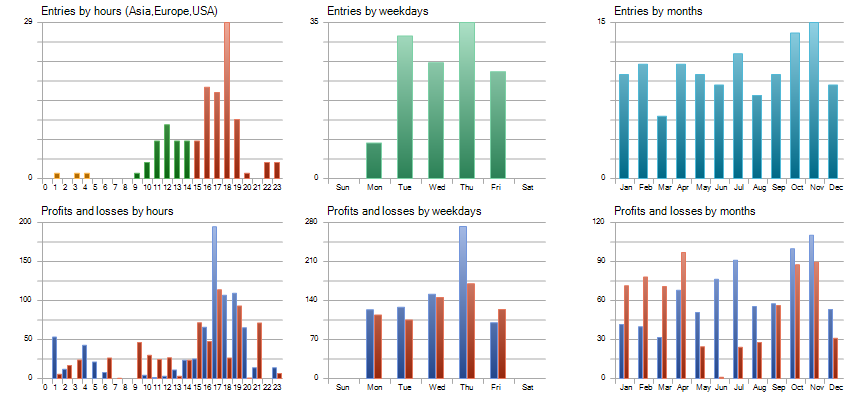

The Williams CCI trading strategy is designed to capture market momentum and trend reversals using a combination of the Commodity Channel Index (CCI) and William's Percentage Range indicators.

-

Commodity Channel Index (CCI): This indicator helps to identify cyclical trends, measuring the asset’s deviation from its statistical average. CCI detects overbought and oversold conditions, providing early signals for potential price reversals.

-

William's Percentage Range (%R): A momentum indicator that measures the closing price relative to the high-low range over a specific period, highlighting overbought and oversold zones. This serves to confirm potential entry and exit points aligned with the CCI.

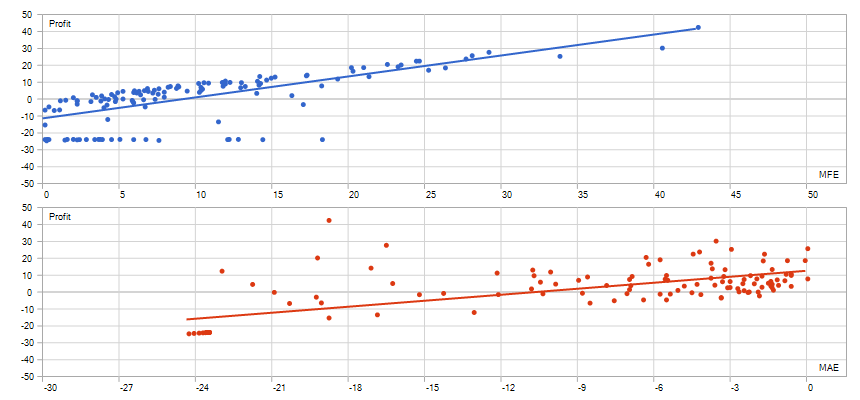

The Williams CCI strategy has a Sharpe Ratio of 2, indicating strong risk-adjusted returns. The strategy’s maximum Equity Drawdown is 21%, ensuring manageable risk, while the Profit Factor of 1.2 shows a favorable ratio of profit to risk, making it a balanced strategy for steady returns.

It works best with EUR/USD pair in H1 Timeframe.