Daily Capital Flow EA MT5

- エキスパート

- Carl Gustav Johan Ekstrom

- バージョン: 1.10

- アップデート済み: 26 12月 2024

- アクティベーション: 10

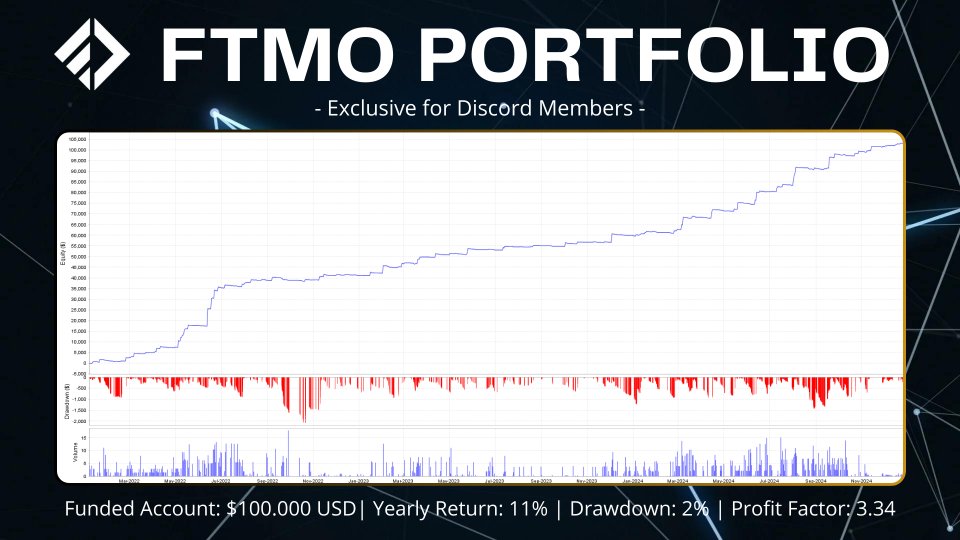

Includes a 30-day free trial to CGE Trading, a Discord community dedicated to FTMO and prop firm trading, valued at $133 USD!

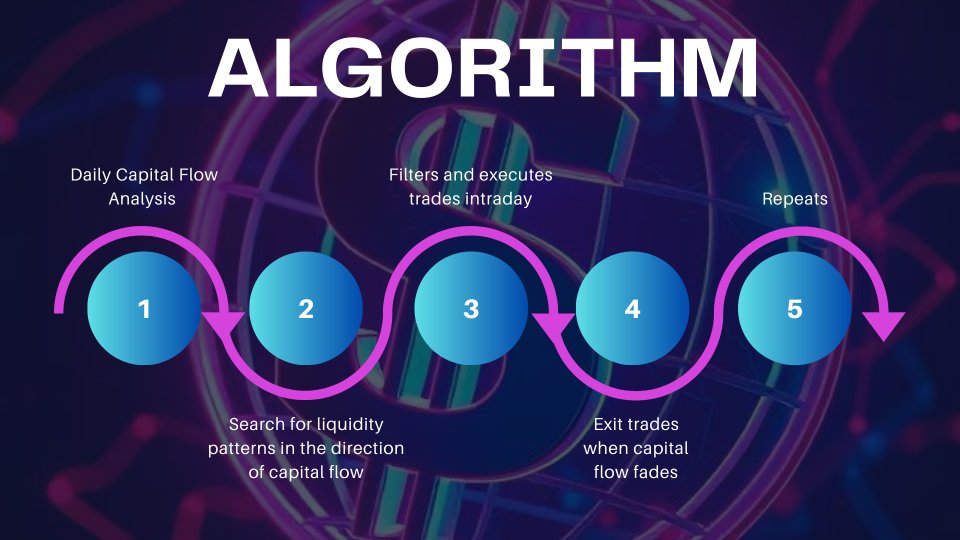

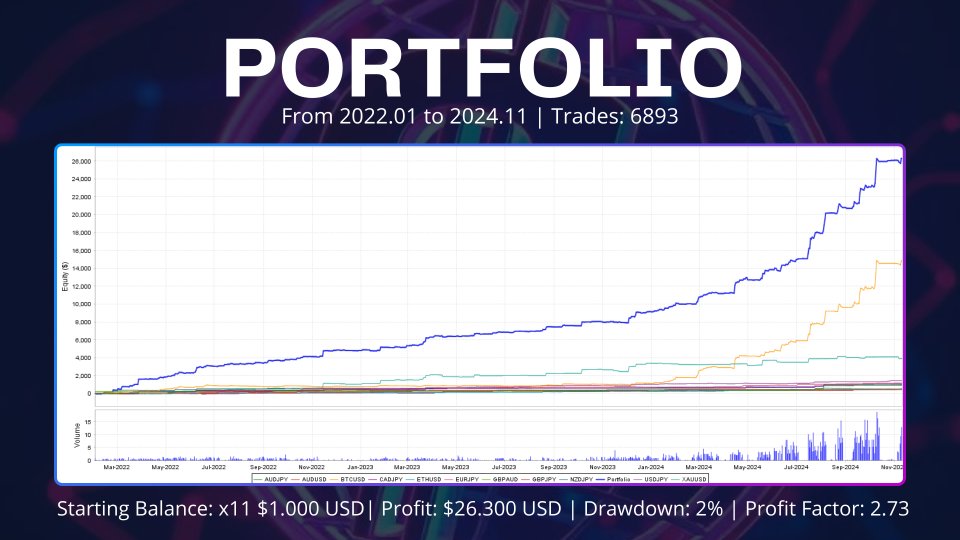

The Daily Capital Flow EA (DCF EA) is an advanced trading system designed to capitalize on intraday opportunities with precision and reliability. Ideal for investors aiming for consistent returns, this cutting-edge tool leverages Trap Plays—a proven market reversal pattern triggered by rapid liquidity shifts—while aligning seamlessly with daily capital flow dynamics. Whether you trade Crypto, Forex, or Commodities, the DCF EA provides actionable insights and exceptional performance across diverse markets.

Get Started Today!

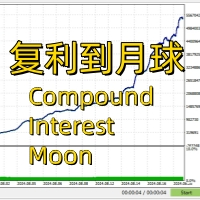

- Access Backtesting Results & Set Files: [Click here]

- Recommended Broker: IC Markets – Raw Spreads, 1:500 Leverage

- Starting Balance: $1,000 USD

Key Features

- Market Momentum Alignment: The DCF EA synchronizes trades with daily capital flows, reflecting the dominant forces driving price movements and enhancing trade accuracy.

- Exploiting Liquidity Traps: By targeting intraday liquidity traps, the EA avoids common retail trading pitfalls and transforms potential reversals into profitable opportunities.

- Proven and Reliable Strategy: The EA incorporates rigorously backtested and optimized liquidity patterns, providing a structured and dependable approach to trading.

- Versatility Across Markets: The core principles of capital flow and liquidity apply universally, enabling superior performance in Crypto, Forex, and Commodities.

- Customizable Settings: The EA offers fully adjustable parameters, allowing traders to tailor the system to fit their unique strategies and preferences.

Understanding Daily Capital Flow

Daily capital flow tracks the movement of funds during a single trading day, reflecting the net investment activity across financial markets or economies. It reveals the directional bias of institutional participants, offering traders a crucial edge in decision-making. By pairing the strongest currencies with the weakest, the EA identifies high-probability opportunities with minimal resistance. These insights are displayed on the system’s dashboard, offering traders clear and actionable information.

What is a Trap Play?

A Trap Play occurs when the price breaks a significant level (high or low), creating the illusion of trend continuation. However, the price swiftly reverses, trapping traders who entered based on the breakout. This reversal often triggers powerful counter-movements, providing lucrative opportunities for informed traders. The DCF EA excels at identifying intraday Trap Plays that align with the daily capital flow, delivering high-probability setups with enhanced success rates.

Enhance Your Portfolio

Integrating the DCF EA into your portfolio brings the benefits of strategy diversification, reducing drawdowns and promoting consistent performance. With the DCF EA, you gain access to a dependable tool that excels in volatile market conditions.