ChartMaster

- インディケータ

- Javier Diaz Perete

- バージョン: 1.0

- アクティベーション: 5

Indicator Description

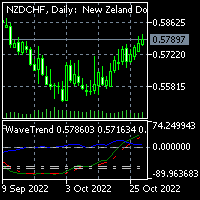

The indicator "TrendFusion" is designed for MetaTrader 5 and offers a comprehensive analysis by combining key technical indicators such as RSI, EMA, ATR, ADX, and MACD. It helps traders make informed decisions by visually representing these indicators and highlighting potential trading opportunities. This tool is especially useful for analyzing market dynamics across various assets, such as currency pairs or stocks.

Functionality

-

RSI (Relative Strength Index): Measures momentum in the market, identifying overbought and oversold conditions. The RSI value is plotted to help traders assess potential reversals or continuations of trends.

-

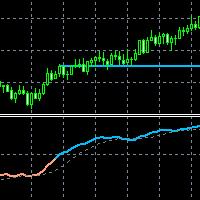

EMA (Exponential Moving Average): Tracks the average price over a set period (e.g., 20-period) to smooth out price fluctuations, showing the overall market trend. This value is displayed to offer clarity on the market’s direction.

-

ATR (Average True Range): Gauges market volatility by measuring the range of price movement over a specific period. The ATR value is displayed to help traders evaluate potential price fluctuations.

-

ADX (Average Directional Index): Determines the strength of the current trend, whether bullish or bearish. A higher ADX value indicates a stronger trend. This is particularly useful for confirming trends or identifying ranging markets.

-

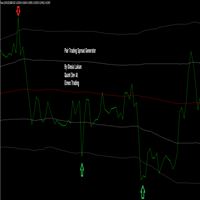

MACD (Moving Average Convergence Divergence): Tracks the relationship between two moving averages (typically 12-period and 26-period EMA) to identify momentum changes. The MACD line and signal line crossings are visually displayed, helping traders spot potential buy or sell signals.

Adjustable Parameters

TrendFusion provides flexibility through customizable input parameters, allowing traders to fine-tune the indicator to suit their trading style.

True/False Toggle Settings:

These allow you to enable or disable each of the core indicators:

-

ShowRSI (True/False): Enables or disables the RSI indicator. If set to true , the RSI values will be displayed on the chart. If set to false , the RSI will not be calculated or shown.

-

ShowEMA (True/False): Enables or disables the EMA. If set to true , the EMA is shown and its values are used in analysis. Disable it by setting this to false .

-

ShowATR (True/False): Allows you to enable or disable the ATR volatility indicator. When set to true , ATR values are calculated and displayed.

-

ShowADX (True/False): Activates or deactivates the ADX indicator. Set to true to display ADX trend strength, or false to hide it.

-

ShowMACD (True/False): Switches the MACD on or off. When true , MACD values and signals are plotted on the chart. If false , MACD will not be shown.

How to Use:

- When should you disable an indicator? If you are focusing only on specific aspects of the market (e.g., momentum or volatility), you can disable indicators that are less relevant to your strategy. For instance, if you prefer trading based on volatility, you might focus on ATR and MACD and disable RSI or ADX.

Period Settings:

Each indicator uses specific periods for its calculations, which can be customized depending on the trading timeframe and strategy:

-

RSI Period (Default: 14): Adjusts the lookback period for the RSI calculation. A shorter period (e.g., 7) makes the RSI more sensitive, showing more frequent overbought or oversold conditions. A longer period (e.g., 21) will smooth out the RSI and generate fewer signals.

-

EMA Period (Default: 20): Defines the period used for calculating the Exponential Moving Average. A smaller period (e.g., 10) will react faster to price changes, while a larger period (e.g., 50) will show a more stable trend over time.

-

ATR Period (Default: 7): Sets the number of periods used to calculate the ATR, which measures market volatility. A lower period (e.g., 5) makes the ATR more sensitive to short-term volatility, while a higher period (e.g., 14) averages out the volatility over a longer period.

-

ADX Period (Default: 14): Determines the period over which the ADX evaluates trend strength. A shorter period (e.g., 7) makes the ADX more reactive to recent changes, while a longer period (e.g., 20) provides a broader view of the trend's strength.

-

MACD Fast EMA (Default: 12) and Slow EMA (Default: 26): The MACD uses two different EMAs to identify momentum changes. Adjusting these values can make the MACD faster or slower in detecting trend changes. A shorter fast EMA and longer slow EMA increase sensitivity.

-

MACD Signal SMA (Default: 9): This is the moving average of the MACD line. A smaller value (e.g., 5) will generate faster signals, while a larger value (e.g., 12) will smooth the signal line and reduce false signals.

How to Adjust the Period Settings:

- Shorter Periods: Useful for day traders and scalpers who need more reactive signals based on recent market movements. Short periods make the indicators more sensitive to changes.

- Longer Periods: Better for swing traders or those using higher timeframes like daily or weekly charts. These periods provide a broader perspective, reducing noise and false signals.

Utility for Trading

The TrendFusion indicator is designed to provide clear insights into market sentiment, volatility, and momentum, making it a valuable tool for traders across all markets:

-

Overbought/Oversold Signals: The RSI helps to identify potential reversal points by indicating when the market is overbought (RSI above 70) or oversold (RSI below 30).

-

Trend Strength Confirmation: The ADX confirms the strength of the current trend. When combined with RSI and MACD, traders can confirm whether a trend is gaining or losing momentum.

-

Volatility Measurement: The ATR provides an easy-to-interpret visual of market volatility, helping traders adjust their strategies based on the expected range of price movements.

-

Momentum Shifts: The MACD helps traders detect shifts in market momentum, particularly useful for identifying potential entry and exit points when combined with other indicators.

Conclusion

By integrating these powerful technical indicators, TrendFusion equips traders with the tools needed to make more informed decisions and better understand market conditions. With its adjustable settings and customizable indicators, traders can fine-tune the analysis to fit their specific strategies, whether they're focusing on trend following, volatility, or momentum shifts.