Gold Humster

- エキスパート

- Dmitriq Evgenoeviz Ko

- バージョン: 0.8

- アクティベーション: 5

The MT4 Gold Humster EA is an advanced trading tool developed for the MetaTrader 4 platform, specifically designed to enhance the trading experience of both new and experienced traders. Using sophisticated algorithms, it analyzes market trends and price movements to make trades that maximize profit potential while minimizing risk.

One of the key features of the Gold Humster EA is its adaptability; it can be fine-tuned to suit a variety of trading strategies, whether you prefer scalping, day trading, or swing trading. The EA works seamlessly, providing real-time signals and automated trading options that allow traders to quickly react to market opportunities without the need for constant monitoring.

What’s more, the Gold Humster EA is equipped with comprehensive risk management tools, allowing users to set stop-loss and take-profit levels according to their risk tolerance. With a user-friendly interface, traders can easily customize the parameters, making it accessible to those who may not have extensive experience in technical analysis.

In conclusion, the MT4 Gold Humster EA combines innovative technology with practical trading strategies, offering a reliable solution for financial market participants looking to improve their trading efficiency and achieve greater financial success.

How to use the Gold Humster robot:

1. Download and install. Users need to download the robot file and install it on their MetaTrader 4 platform.

2. Set the parameters. Define the trading parameters such as lot size, risk tolerance, and strategy settings.

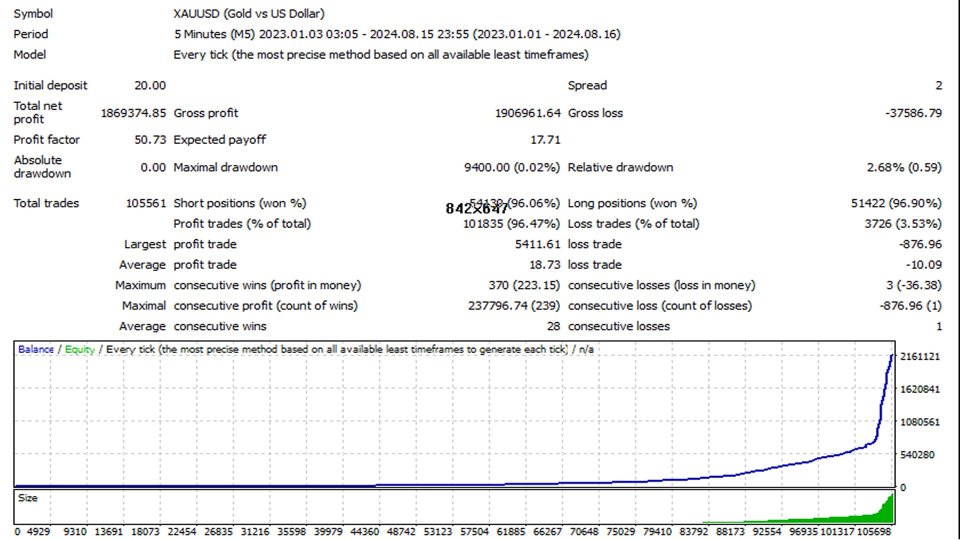

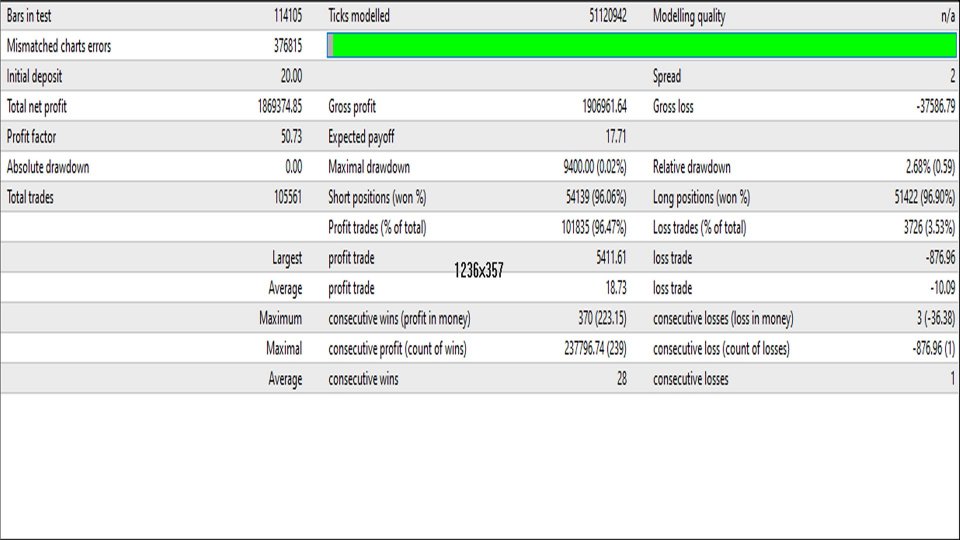

3. Backtest. Test the robot’s performance using historical data to ensure it meets your trading goals.

4. Activate the robot. If you are satisfied with the backtest results, activate the robot to start auto trading.

Recommendations:

No Grid/No Martingale/No Risky Money Management.

Currency pair: Any

Timeframe: Any

Account type: Any

Risk warning:

Before buying Gold Humster, understand the risks involved.

Past results are not a guarantee of future profitability (EA may also incur losses).

The backtests shown (e.g. in the screenshots) are highly optimized to find the best parameters, but therefore the results cannot be transferred to real trading.

This strategy will always use a stop loss, but the execution of the SL still depends on your broker.

One of the key features of the Gold Humster EA is its adaptability; it can be fine-tuned to suit a variety of trading strategies, whether you prefer scalping, day trading, or swing trading. The EA works seamlessly, providing real-time signals and automated trading options that allow traders to quickly react to market opportunities without the need for constant monitoring.

What’s more, the Gold Humster EA is equipped with comprehensive risk management tools, allowing users to set stop-loss and take-profit levels according to their risk tolerance. With a user-friendly interface, traders can easily customize the parameters, making it accessible to those who may not have extensive experience in technical analysis.

In conclusion, the MT4 Gold Humster EA combines innovative technology with practical trading strategies, offering a reliable solution for financial market participants looking to improve their trading efficiency and achieve greater financial success.

How to use the Gold Humster robot:

1. Download and install. Users need to download the robot file and install it on their MetaTrader 4 platform.

2. Set the parameters. Define the trading parameters such as lot size, risk tolerance, and strategy settings.

3. Backtest. Test the robot’s performance using historical data to ensure it meets your trading goals.

4. Activate the robot. If you are satisfied with the backtest results, activate the robot to start auto trading.

Recommendations:

No Grid/No Martingale/No Risky Money Management.

Currency pair: Any

Timeframe: Any

Account type: Any

Risk warning:

Before buying Gold Humster, understand the risks involved.

Past results are not a guarantee of future profitability (EA may also incur losses).

The backtests shown (e.g. in the screenshots) are highly optimized to find the best parameters, but therefore the results cannot be transferred to real trading.

This strategy will always use a stop loss, but the execution of the SL still depends on your broker.