Stygian Expert MT5

- エキスパート

- Ruengrit Loondecha

- バージョン: 24.806

- アクティベーション: 10

---------------------------------------------------------

Stygian Expert MT5

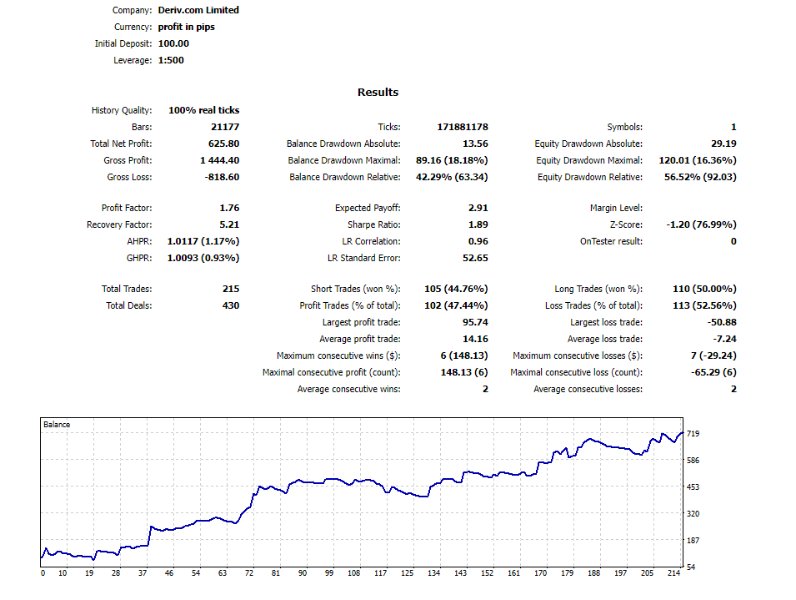

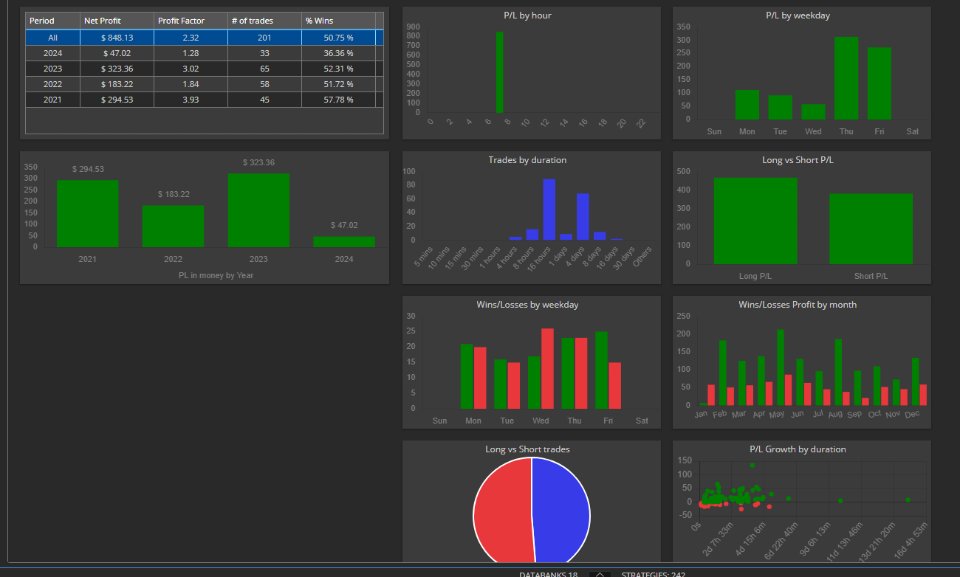

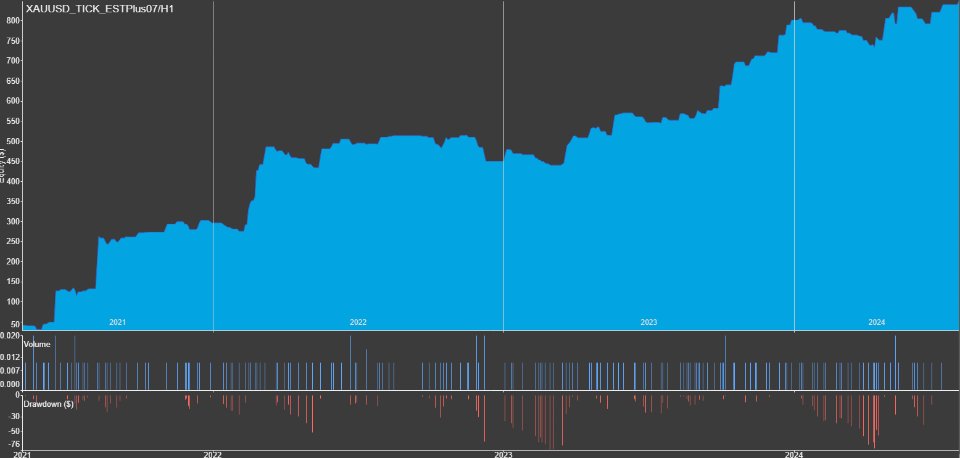

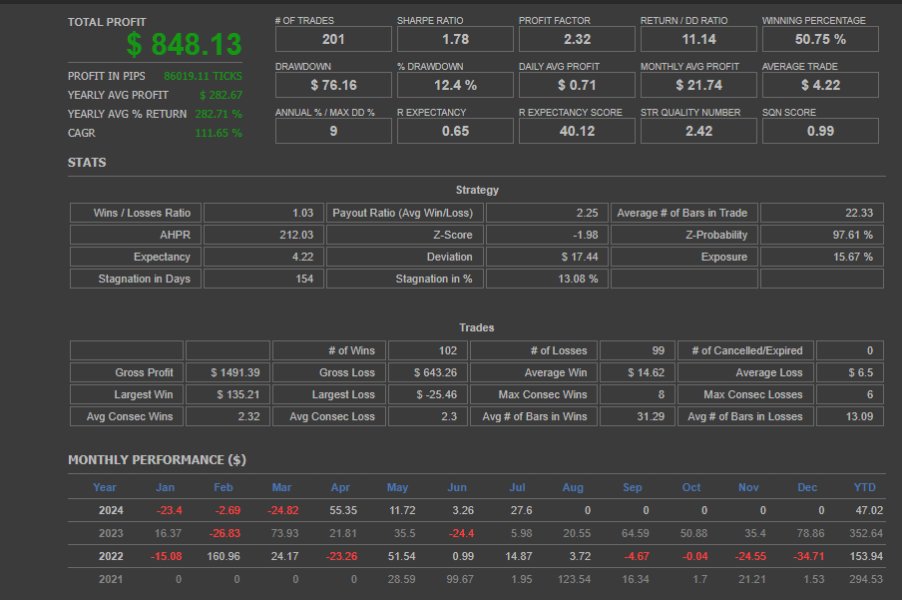

- Optimal Performance: Designed to work best with GOLD on the H1 timeframe.

- Capital Requirements: Minimum starting capital of $100-$200 for a 0.01 lot size (AutoLot feature included).

- Continuous Optimization: Monthly updates to enhance performance and adapt to market conditions.

- Stay Informed: Updates and performance reports in the comments section.

- Live Trading: Follow our live trades at https://t.me/lullfrx

Stygian Expert MT5

- Optimal Performance: Designed to work best with GOLD on the H1 timeframe.

- Capital Requirements: Minimum starting capital of $100-$200 for a 0.01 lot size (AutoLot feature included).

- Continuous Optimization: Monthly updates to enhance performance and adapt to market conditions.

- Stay Informed: Updates and performance reports in the comments section.

- Live Trading: Follow our live trades at https://t.me/lullfrx

---------------------------------------------------------

Indicators and Concepts

-

Current Hour:

- Refers to the consideration of the specific hour within the trading day. This can be important for strategies that are sensitive to intraday market movements, such as sessions with high volatility or significant economic data releases.

-

Relative Strength Index (RSI):

- RSI is a momentum oscillator that measures the speed and change of price movements. It ranges from 0 to 100, with levels above 70 considered overbought and levels below 30 considered oversold. RSI helps identify potential reversal points and the strength of a trend.

-

Quantitative Qualitative Estimation (QQE):

- QQE is an advanced version of the RSI that includes a smoothed RSI and a volatility filter. It helps provide clearer trend signals and reduce market noise, offering a more refined view of momentum and potential reversals.

-

SR Percent Rank (SRPercentRank):

- SRPercentRank ranks the current price within a specified range (e.g., recent highs and lows). It is a measure of how the current price compares to the historical price range, indicating whether the price is near historical highs, lows, or somewhere in between.

-

Hull Moving Average (HMA):

- HMA is a weighted moving average that reduces lag and increases smoothness. It helps identify the current trend direction and potential reversals with greater responsiveness compared to traditional moving averages.

Trade Style

-

Entry Order:

- An entry order involves placing an order to enter a trade based on specific criteria or signals. This can be a market order, which executes immediately at the current price, or a limit/stop order that triggers at a specific price level.

-

Take Profit (TP) and Stop Loss (SL) with EnterReverseAtMarket%:

- The Take Profit (TP) and Stop Loss (SL) levels are set based on a percentage from the entry price, defined as the EnterReverseAtMarket%. This method calculates the distance from the entry price to the TP and SL levels as a percentage, allowing for dynamic risk and reward management.

-

Move SL to Break Even (MoveSL2BE) ATR * EnterReverseAtMarket%:

- The stop-loss is moved to the break-even point (the entry price) once the market moves in the trader's favor by a distance calculated as ATR (Average True Range) multiplied by EnterReverseAtMarket%. This strategy ensures that initial risk is eliminated once the market moves favorably, locking in the initial capital.

-

Trailing Stop by Bid-Ask:

- The trailing stop is adjusted based on changes in the bid and ask prices. This approach involves setting the trailing stop level relative to the bid price (for sell positions) or the ask price (for buy positions). It allows the stop-loss to follow the price more closely, adapting to the market's current buying and selling activity.