Elarion Expert

- エキスパート

- Ruengrit Loondecha

- バージョン: 1.2

- アップデート済み: 5 8月 2024

- アクティベーション: 10

----------------------------------------------------------

@ 4.8.2024 Updated setting to Version 1.2

@ See result after Tuned in Comment

@ No set files needed,Download and putting EA to chart

----------------------------------------------------------

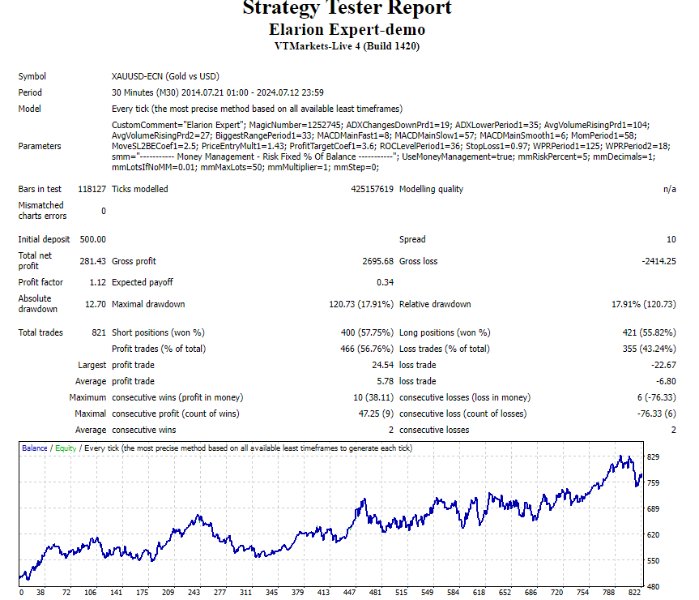

- Elarion Expert

- Working best with GOLD - M30

- Require minimal 300$ for 0.01 (AutoLot feature inside)

- Optimize update monthly. stay in Comment

- Live trade @ https://t.me/lullfrx

Indicators and Concepts

-

Rate of Change (ROC):

- ROC measures the percentage change in price over a specified period. It helps identify the speed of price movements and potential reversals. A positive ROC indicates upward momentum, while a negative ROC suggests downward momentum.

-

Williams %R:

- Williams %R is a momentum indicator that ranges from -100 to 0. It identifies overbought and oversold conditions, with values below -80 indicating oversold conditions and values above -20 indicating overbought conditions. It's useful for spotting potential market reversals.

-

Momentum:

- Momentum is a measure of the speed at which a security's price is changing. It is calculated by comparing the current price with a price from a specified number of periods ago. Positive momentum indicates a bullish trend, while negative momentum suggests a bearish trend.

-

Awesome Oscillator (AO):

- AO is a momentum indicator that measures the difference between a 34-period and a 5-period simple moving average of the median price. It helps identify market momentum and potential reversals by analyzing the strength of a trend.

-

Average Volume (AvgVolume):

- AvgVolume calculates the average trading volume over a specific period. It provides insight into market activity and liquidity, helping confirm the strength of price moves. Higher-than-average volume can indicate strong interest in a move.

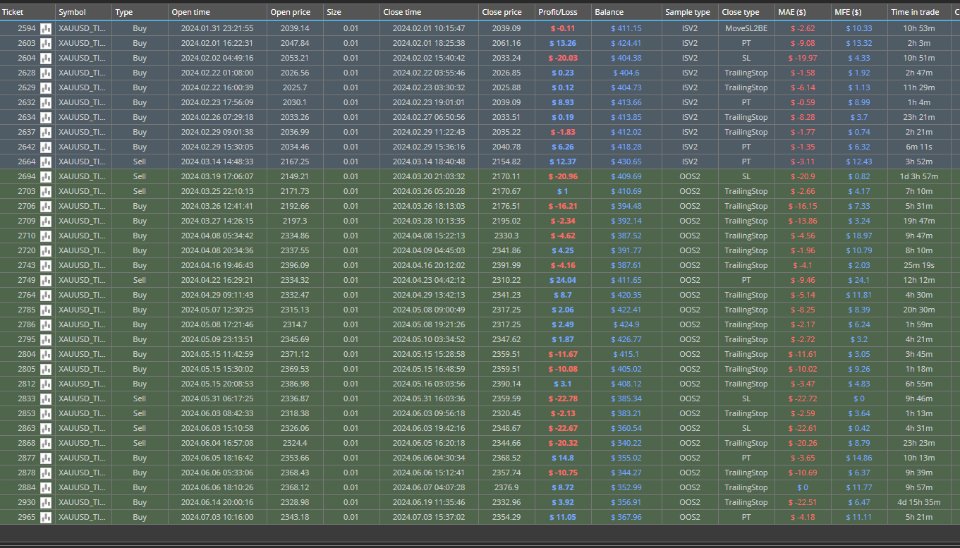

Trade Style: STOP Order

-

STOP Order by Daily Close:

- A STOP order is placed based on the closing price of the daily candle. This means the order will trigger if the price reaches a specified level relative to the daily close, allowing traders to enter the market at predetermined conditions.

-

Stop Loss (SL) by Percentage:

- The stop-loss is set as a fixed percentage away from the entry price. This method helps manage risk by limiting potential losses to a specific percentage of the trade's value.

-

Take Profit (TP) by ATR Coefficient:

- The take-profit level is determined using a multiple (coefficient) of the Average True Range (ATR). This approach sets the profit target based on market volatility, allowing for dynamic TP levels that adjust to changing market conditions.

-

Trailing Stop with Highest in Range Time:

- A trailing stop based on the highest price within a specified time range helps lock in profits as the market moves in the trader's favor. This method involves adjusting the stop-loss level to follow the highest price achieved during a particular range, allowing the trader to capitalize on continued upward movement while protecting gains.

ความคิดเห็น